Answered step by step

Verified Expert Solution

Question

1 Approved Answer

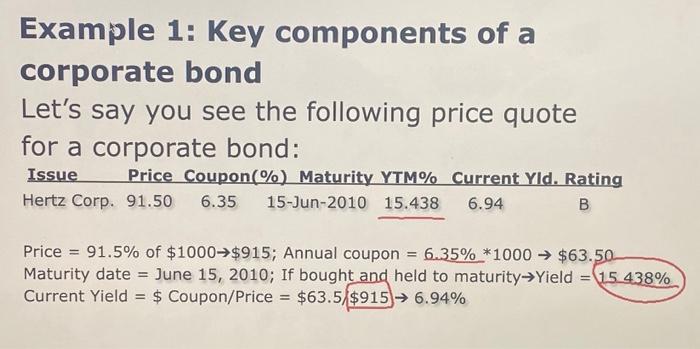

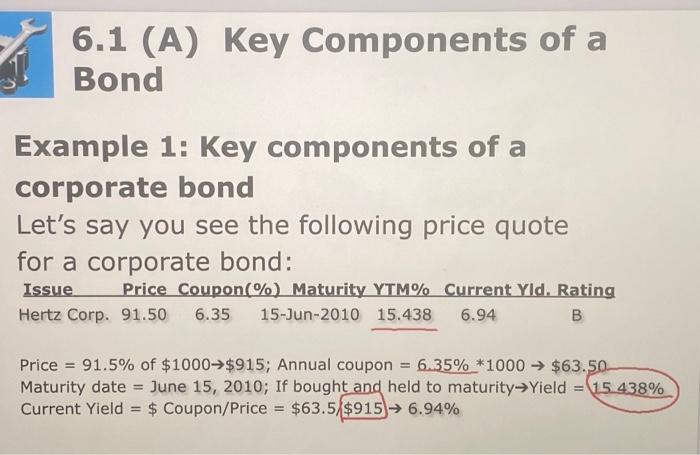

can you solve it and explain it if cr >r - p>fv preimiu if cr ifcr=r - p=fv par Example 1: Key components of a

can you solve it and explain it

if cr >r - p>fv preimiu

if cr

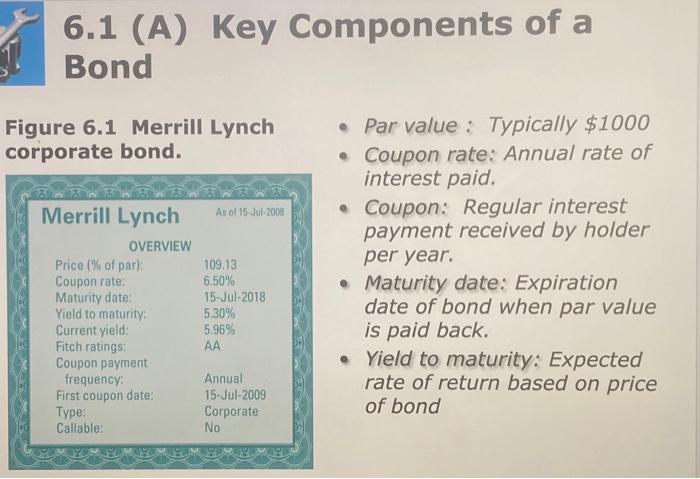

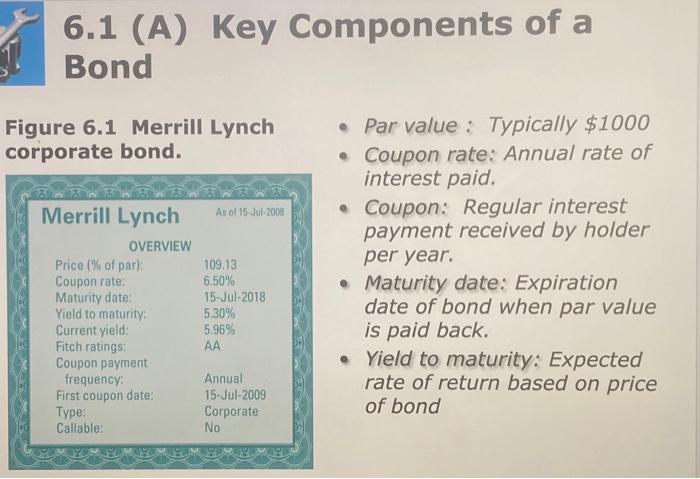

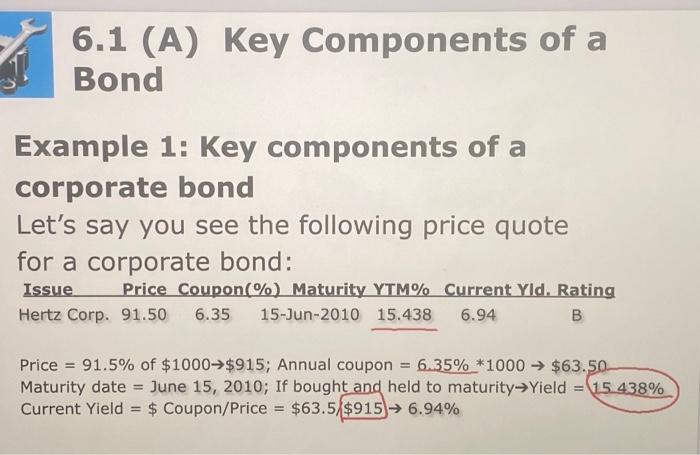

Example 1: Key components of a corporate bond Let's say you see the following price quote for a corporate bond: Price=91.5%of$1000$915;Annualcoupon=6.35%1000$63.50Maturitydate=June15,2010;IfboughtandheldtomaturityYield=15.438%CurrentYield=$Coupon/Price=$63.5$9156.94% 6.1 (A) Key Components of a Bond Example 1: Key components of a corporate bond Let's say you see the following price quote for a corporate bond: Issue Price Coupon(\%) Maturity YTM\% Current Yld. Rating Price =91.5% of $1000$915; Annual coupon =6.35%1000$63.50 Maturity date = June 15,2010 ; If bought and held to maturity Yield =15.438% Current Yield =$ Coupon/Price =$63.5$9156.94% 6.1 (A) Key Components of a Bond Figure 6.1 Merrill Lynch corporate bond. - Par value: Typically $1000 - Coupon rate: Annual rate of interest paid. - Coupon: Regular interest payment received by holder per year. - Maturity date: Expiration date of bond when par value is paid back. - Yield to maturity: Expected rate of return based on price of bond Example 1: Key components of a corporate bond Let's say you see the following price quote for a corporate bond: Price=91.5%of$1000$915;Annualcoupon=6.35%1000$63.50Maturitydate=June15,2010;IfboughtandheldtomaturityYield=15.438%CurrentYield=$Coupon/Price=$63.5$9156.94% 6.1 (A) Key Components of a Bond Example 1: Key components of a corporate bond Let's say you see the following price quote for a corporate bond: Issue Price Coupon(\%) Maturity YTM\% Current Yld. Rating Price =91.5% of $1000$915; Annual coupon =6.35%1000$63.50 Maturity date = June 15,2010 ; If bought and held to maturity Yield =15.438% Current Yield =$ Coupon/Price =$63.5$9156.94% 6.1 (A) Key Components of a Bond Figure 6.1 Merrill Lynch corporate bond. - Par value: Typically $1000 - Coupon rate: Annual rate of interest paid. - Coupon: Regular interest payment received by holder per year. - Maturity date: Expiration date of bond when par value is paid back. - Yield to maturity: Expected rate of return based on price of bondifcr=r - p=fv par

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started