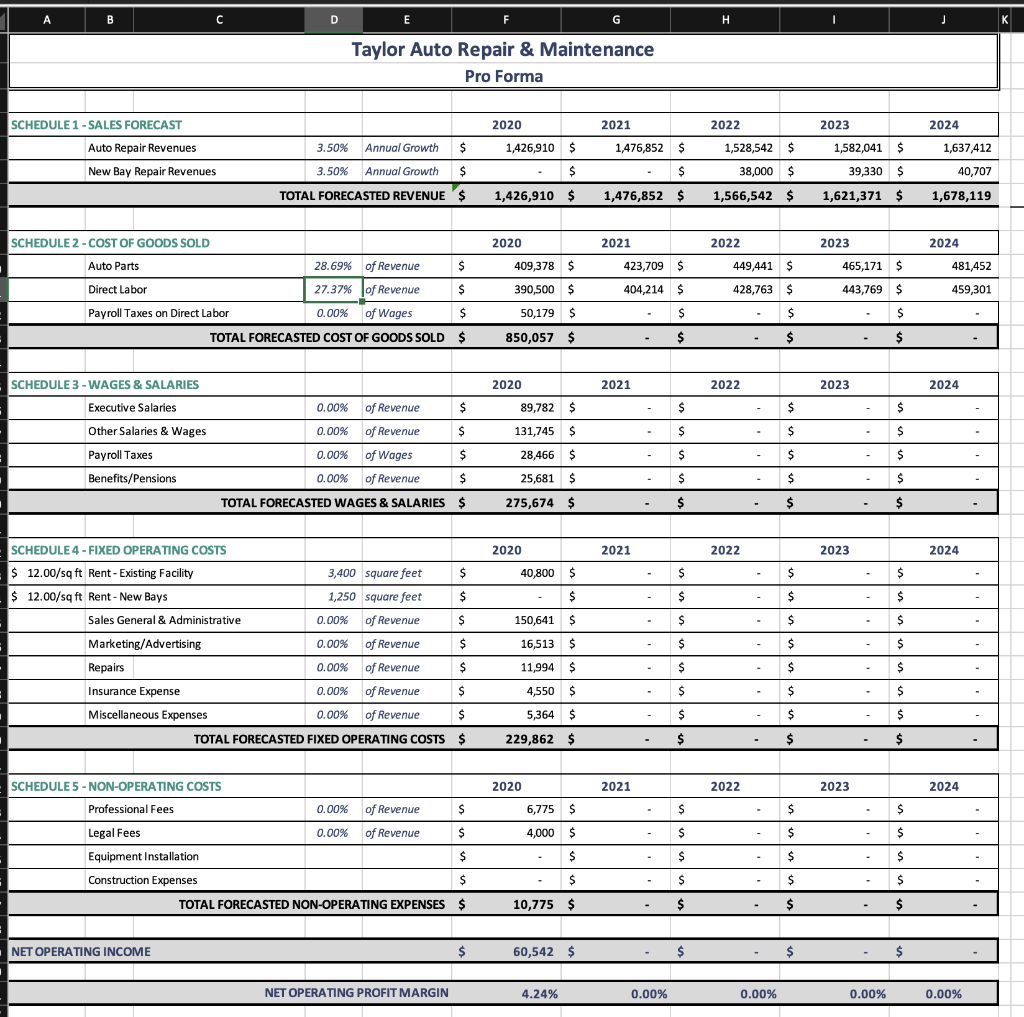

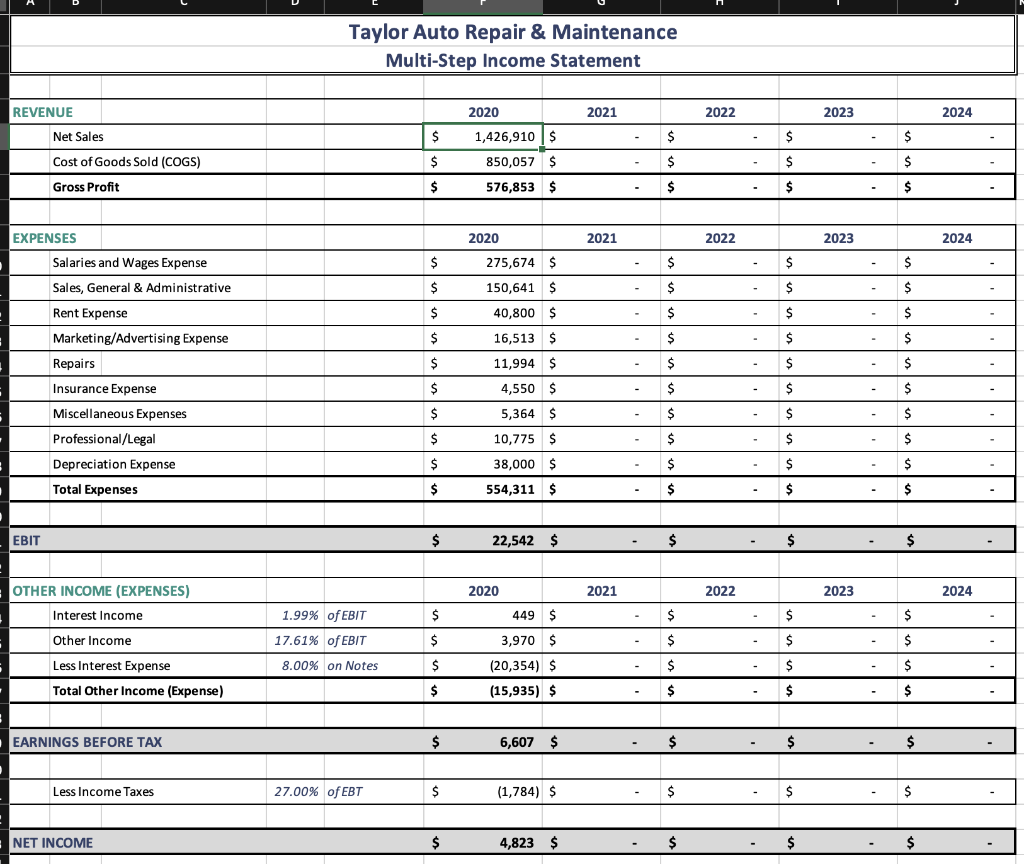

Can you solve the Income Statement by using the Facts & Proforma?

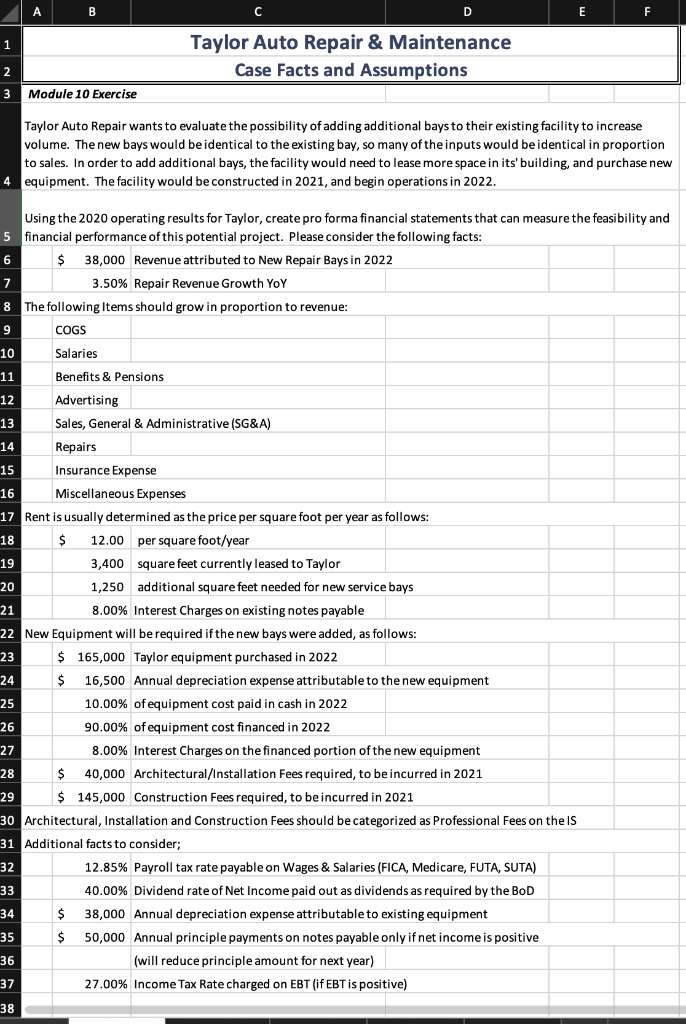

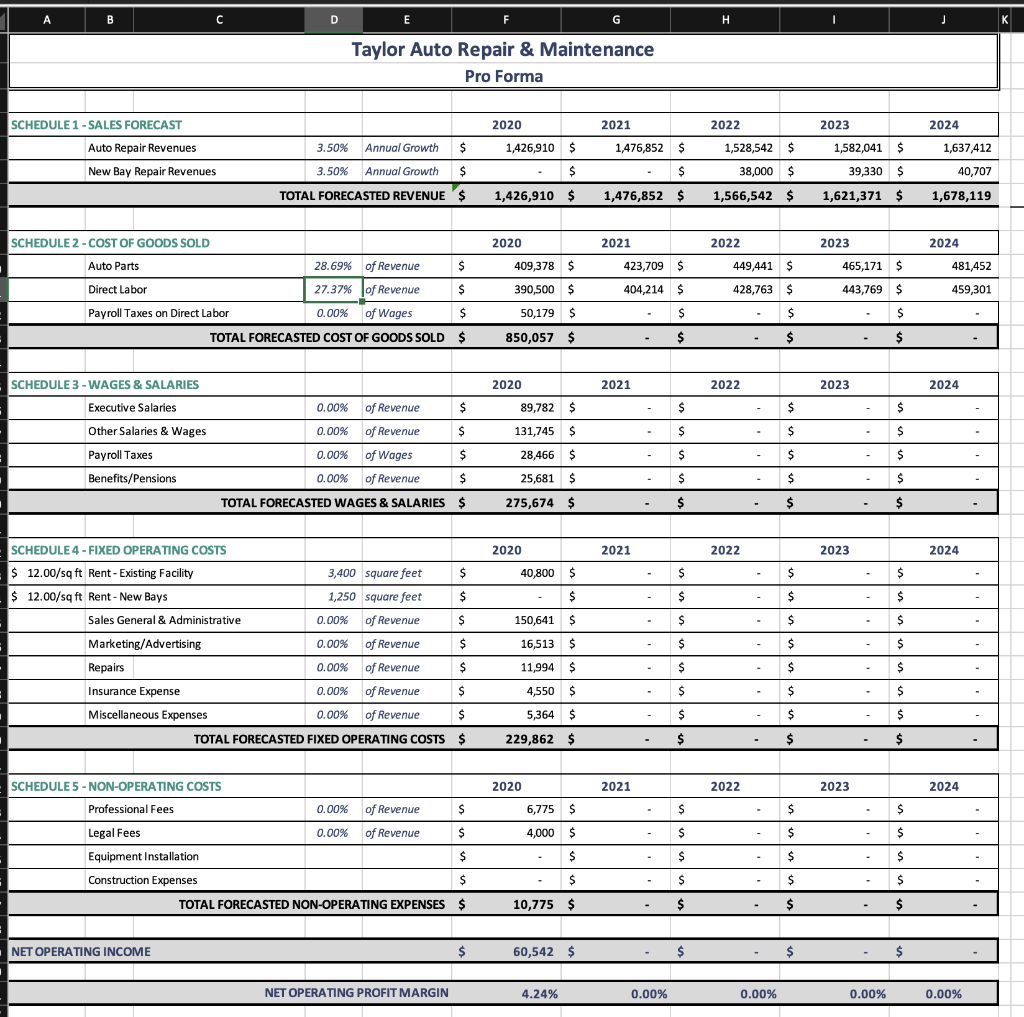

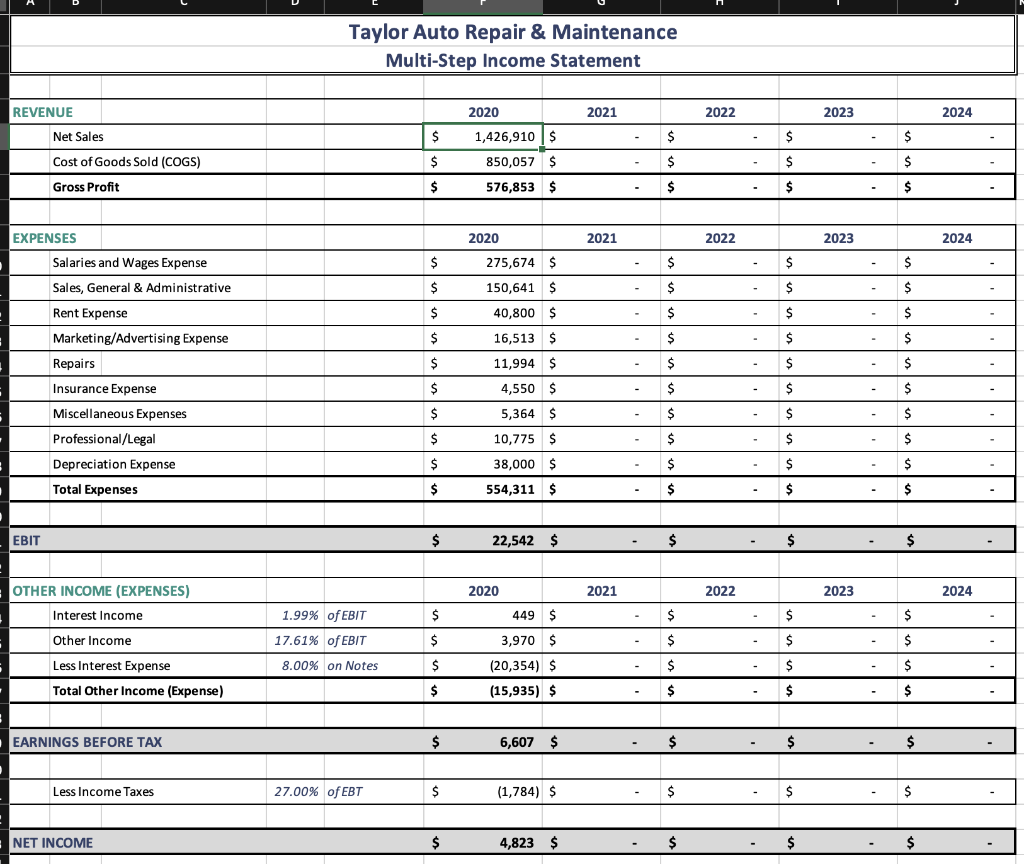

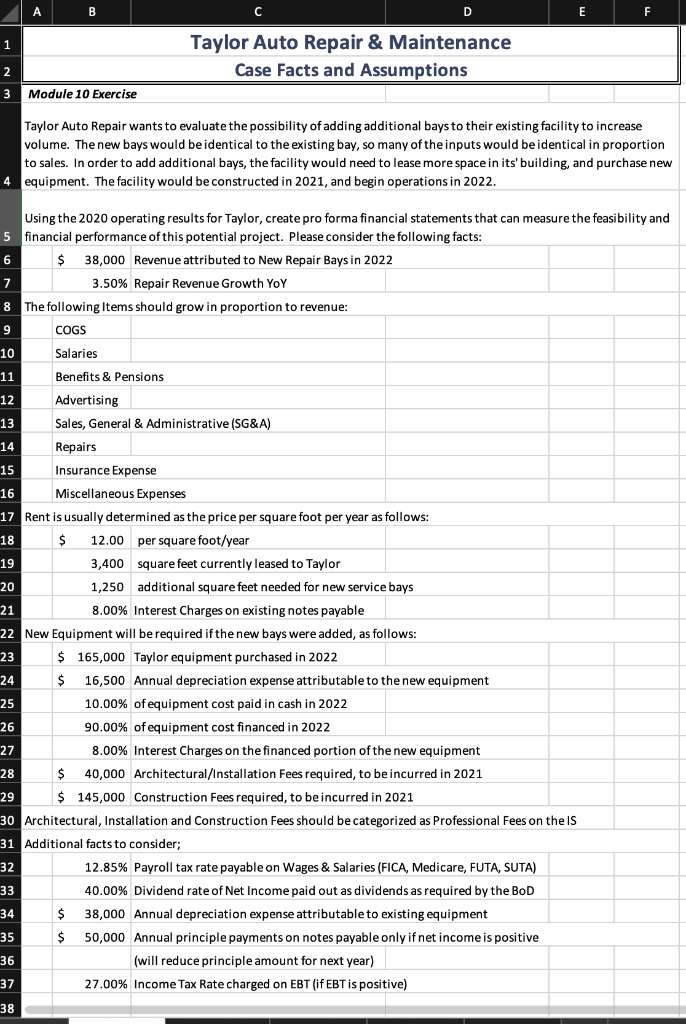

\begin{tabular}{|c|c|c|c} \hline & & & C \\ \hline 1 & & Taylor Auto Repair \& Maintenance \\ \hline \end{tabular} Case Facts and Assumptions 3 Module 10 Exercise Taylor Auto Repair wants to evaluate the possibility of adding additional bays to their existing facility to increase volume. The new bays would be identical to the existing bay, so many of the inputs would be identical in proportion to sales. In order to add additional bays, the facility would need to lease more space in its' building, and purchase new 4 equipment. The facility would be constructed in 2021, and begin operations in 2022. Using the 2020 operating results for Taylor, create pro forma financial statements that can measure the feasibility and financial performance of this potential project. Please consider the following facts: $38,000 Revenue attributed to New Repair Bays in 2022 3.50% Repair Revenue Growth YoY The following Items should grow in proportion to revenue: COGS Salaries Benefits \& Pensions Advertising Sales, General \& Administrative (SG\&A) Repairs Insurance Expense Miscellaneous Expenses Rent is usually determined as the price per square foot per year as follows: $12.00 per square foot/year 3,400 square feet currently leased to Taylor 1,250 additional square feet needed for new service bays 8.00% Interest Charges on existing notes payable New Equipment will be required if the new bays were added, as follows: $165,000 Taylor equipment purchased in 2022 $16,500 Annual depreciation expense attributable to the new equipment 10.00% of equipment cost paid in cash in 2022 90.00% of equipment cost financed in 2022 8.00% Interest Charges on the financed portion of the new equipment $40,000 Architectural/Installation Fees required, to be incurred in 2021 $145,000 Construction Fees required, to be incurred in 2021 Architectural, Installation and Construction Fees should be categorized as Professional Fees on the IS Additional facts to consider; 12.85\% Payroll tax rate payable on Wages \& Salaries (FICA, Medicare, FUTA, SUTA) 40.00% Dividend rate of Net Income paid out as dividends as required by the BoD $38,000 Annual depreciation expense attributable to existing equipment $50,000 Annual principle payments on notes payable only if net income is positive (will reduce principle amount for next year) 27.00% Income Tax Rate charged on EBT (if EBT is positive) NET OPERATING INCOME $ 60,542$ Taylor Auto Repair \& Maintenance Multi-Step Income Statement EARNINGS BEFORE TAX $ 6,607$ $ $ $ Less Income Taxes 27.00% of EBT (1,784)$ NET INCOME $ 4,823$ $ \begin{tabular}{|c|c|c|c} \hline & & & C \\ \hline 1 & & Taylor Auto Repair \& Maintenance \\ \hline \end{tabular} Case Facts and Assumptions 3 Module 10 Exercise Taylor Auto Repair wants to evaluate the possibility of adding additional bays to their existing facility to increase volume. The new bays would be identical to the existing bay, so many of the inputs would be identical in proportion to sales. In order to add additional bays, the facility would need to lease more space in its' building, and purchase new 4 equipment. The facility would be constructed in 2021, and begin operations in 2022. Using the 2020 operating results for Taylor, create pro forma financial statements that can measure the feasibility and financial performance of this potential project. Please consider the following facts: $38,000 Revenue attributed to New Repair Bays in 2022 3.50% Repair Revenue Growth YoY The following Items should grow in proportion to revenue: COGS Salaries Benefits \& Pensions Advertising Sales, General \& Administrative (SG\&A) Repairs Insurance Expense Miscellaneous Expenses Rent is usually determined as the price per square foot per year as follows: $12.00 per square foot/year 3,400 square feet currently leased to Taylor 1,250 additional square feet needed for new service bays 8.00% Interest Charges on existing notes payable New Equipment will be required if the new bays were added, as follows: $165,000 Taylor equipment purchased in 2022 $16,500 Annual depreciation expense attributable to the new equipment 10.00% of equipment cost paid in cash in 2022 90.00% of equipment cost financed in 2022 8.00% Interest Charges on the financed portion of the new equipment $40,000 Architectural/Installation Fees required, to be incurred in 2021 $145,000 Construction Fees required, to be incurred in 2021 Architectural, Installation and Construction Fees should be categorized as Professional Fees on the IS Additional facts to consider; 12.85\% Payroll tax rate payable on Wages \& Salaries (FICA, Medicare, FUTA, SUTA) 40.00% Dividend rate of Net Income paid out as dividends as required by the BoD $38,000 Annual depreciation expense attributable to existing equipment $50,000 Annual principle payments on notes payable only if net income is positive (will reduce principle amount for next year) 27.00% Income Tax Rate charged on EBT (if EBT is positive) NET OPERATING INCOME $ 60,542$ Taylor Auto Repair \& Maintenance Multi-Step Income Statement EARNINGS BEFORE TAX $ 6,607$ $ $ $ Less Income Taxes 27.00% of EBT (1,784)$ NET INCOME $ 4,823$ $