Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you solve the parts in red with the X's please? I can't work out the correct answer! Thank you! Dahlia Colby, CFO of Charming

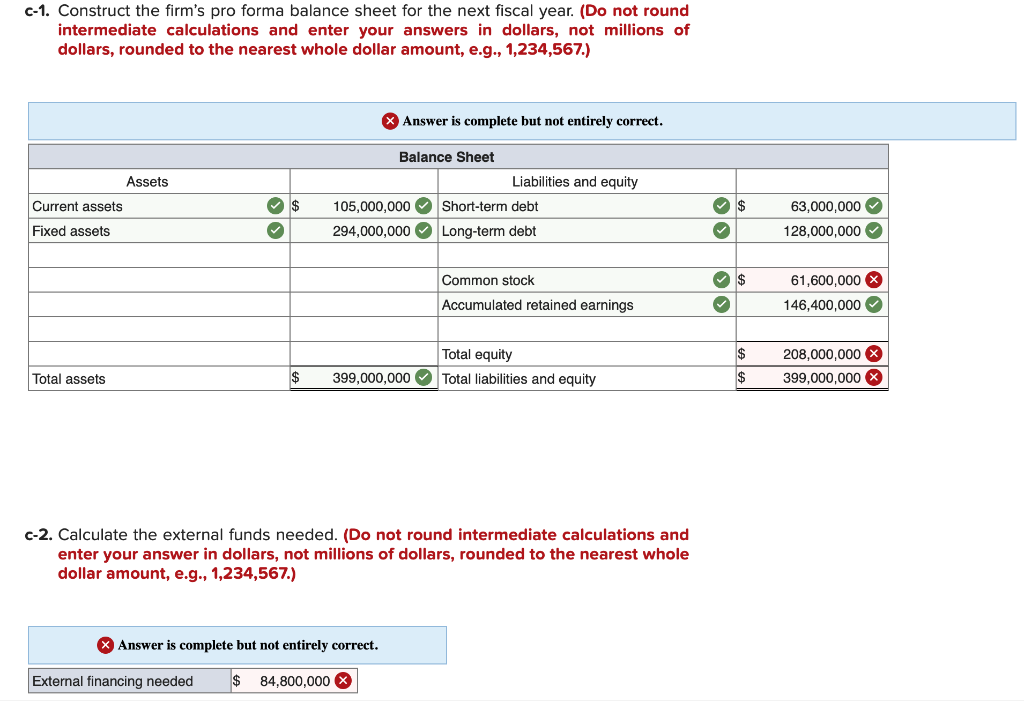

Can you solve the parts in red with the X's please? I can't work out the correct answer! Thank you!

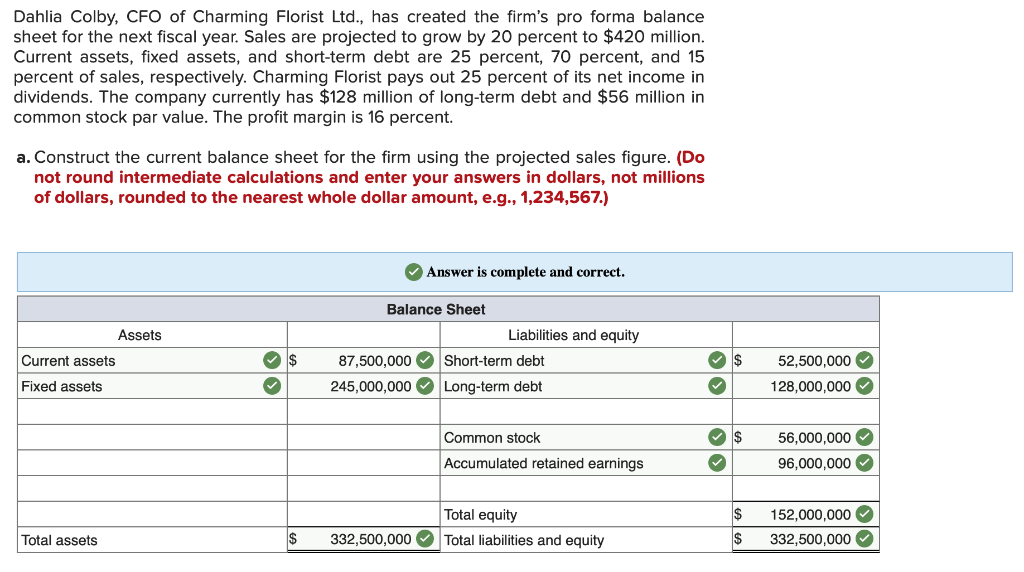

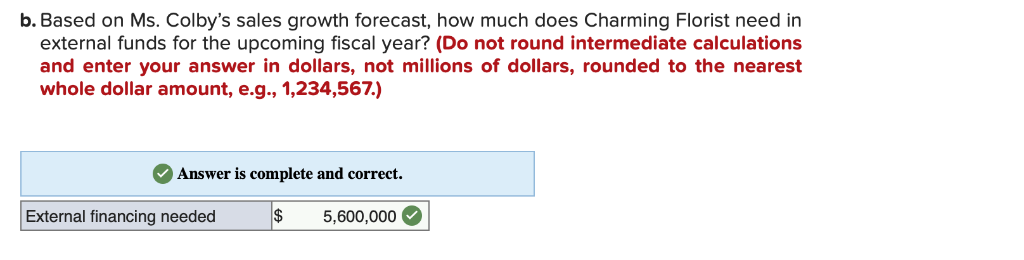

Dahlia Colby, CFO of Charming Florist Ltd., has created the firm's pro forma balance sheet for the next fiscal year. Sales are projected to grow by 20 percent to $420 million Current assets, fixed assets, and short-term debt are 25 percent, 70 percent, and 15 percent of sales, respectively. Charming Florist pays out 25 percent of its net income in dividends. The company currently has $128 million of long-term debt and $56 million in common stock par value. The profit margin is 16 percent. a. Construct the current balance sheet for the firm using the projected sales figure. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) Answer is complete and correct. Balance Sheet Assets Liabilities and equity $ 52,500,000 128,000,000 $ 87,500,000Short-term debt 245,000,000Long-term debt Current assets Fixed assets s 56,000,000 Common stock Accumulated retained earnings 96,000,000 $ 152,000,000 $ 332,500,000 Total equity $332,500,000Total liabilities and eauity Total assets b. Based on Ms. Colby's sales growth forecast, how much does Charming Florist need in external funds for the upcoming fiscal year? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567) Answer is complete and correct. External financing needed5,600,000 c-1. Construct the firm's pro forma balance sheet for the next fiscal year. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) Answer is complete but not entirely correct Balance Sheet Liabilities and equity Assets 63,000,000 $105,000,000 Short-term debt 294,000,000 Long-term debt Current assets 128,000,000 Fixed assets 61,600,000 146,400,000 Common stock Accumulated retained earnings $208,000,000 Total equity $ 399,000,000Total liabilities and equity $ 399,000,000 Total assets c-2. Calculate the external funds needed. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567) Answer is complete but not entirely correct $ 84,800,000 External financing neededStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started