can you solve these using the info above

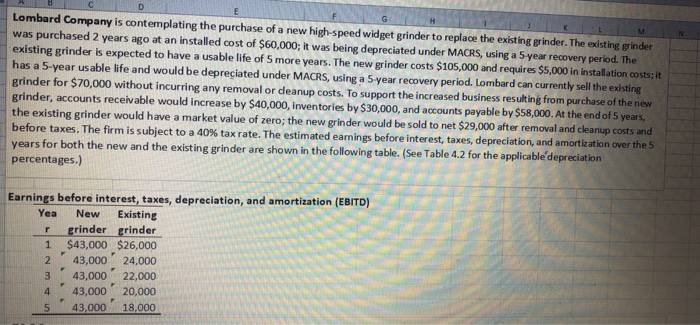

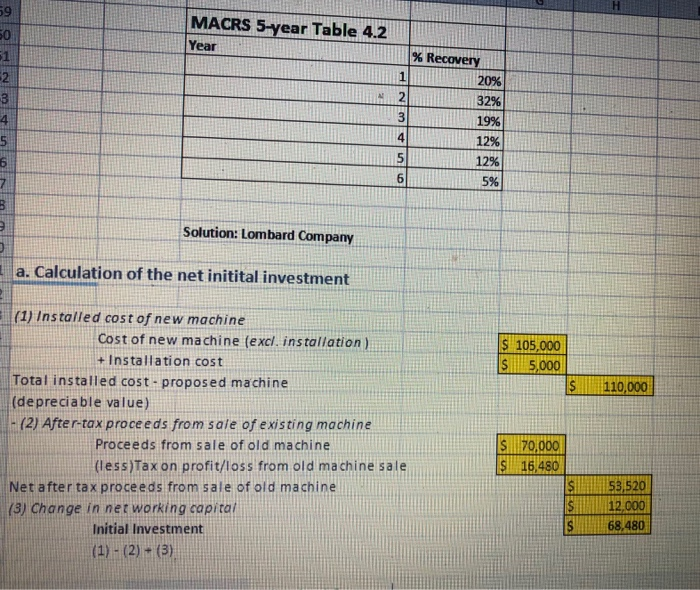

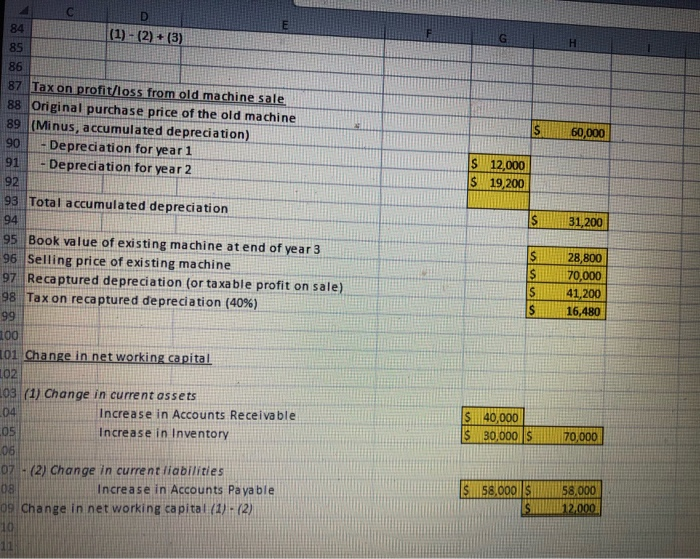

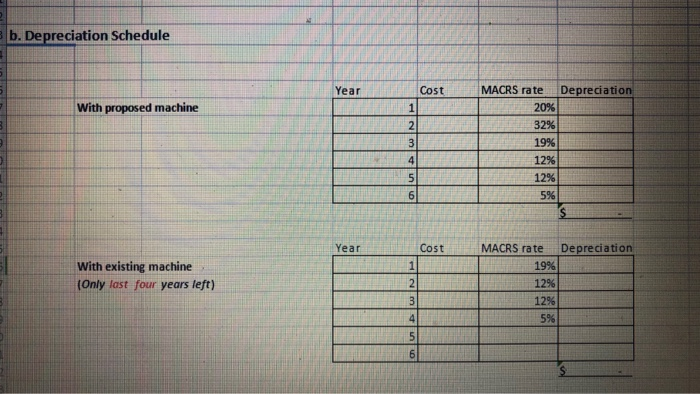

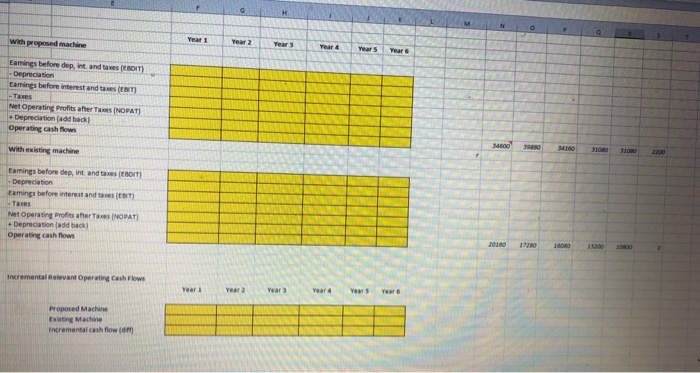

C Lombard Company is contemplating the purchase of a new high-speed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago at an installed cost of $60,000; it was being depreciated under MACRS, using a 5 year recovery period. The existing grinder is expected to have a usable life of 5 more years. The new grinder costs $105,000 and requires $5,000 in Installation costs; it! has a 5-year usable life and would be depreciated under MACRS, using a 5 year recovery period. Lombard can currently sell the existing grinder for $70,000 without incurring any removal or deanup costs. To support the increased business resulting from purchase of the new grinder, accounts receivable would increase by $40,000, inventories by $30,000, and accounts payable by $58,000. At the end of 5 years, the existing grinder would have a market value of zero; the new grinder would be sold to net $29,000 after removal and cleanup costs and before taxes. The firm is subject to a 40% tax rate. The estimated earnings before interest, taxes, depreciation, and amortization over the 5 years for both the new and the existing grinder are shown in the following table. (See Table 4.2 for the applicable depreciation percentages.) Earnings before interest, taxes, depreciation, and amortization (EBITD) Yea New Existing r grinder grinder 1 $43,000 $26,000 2 43,000' 24,000 43,000 22,000 43,000 20,000 43,000 18.000 MACRS 5-year Table 4.2 Year % Recovery 20% 32% 19% 12% 12% 5% Solution: Lombard Company a. Calculation of the net initital investment $ 105,000 $ 5,000 $ 110,000 (1) Installed cost of new machine Cost of new machine (excl. installation) + Installation cost Total installed cost-proposed machine (depreciable value) - (2) After-tax proceeds from sale of existing machine Proceeds from sale of old machine (less)Taxon profit/loss from old machine sale Net after tax proceeds from sale of old machine (3) Change in net working capital Initial Investment (1) - (2) + (3) 70,000 16,480 $ 53,520 12.000 68,480 (1) - (2) + (3) 60.000 87 Tax on profit/loss from old machine sale 88 Original purchase price of the old machine 89 (Minus, accumulated depreciation) 90 - Depreciation for year 1 91 - Depreciation for year 2 $ S 12,000 19,200 92 31,200 93 Total accumulated depreciation 94 28,800 70.000 41,200 16,480 95 Book value of existing machine at end of year 3 96 Selling price of existing machine 97 Recaptured depreciation (or taxable profit on sale) 98 Tax on recaptured depreciation (40%) 99 00 01 Change in net working capital 03 (1) Change in current assets Increase in Accounts Receivable Increase in Inventory S40.000 $ 30,000 $ 70,000 $ 58,000S 58,000 07 - (2) Change in current liabilities Increase in Accounts Payable 109 Change in net working capital (1) - (2) b. Depreciation Schedule Year MACRS rate Depreciation With proposed machine Cost 11 2 3 32% 19% 5% st MACRS rate Depreciation With existing machine (Only last four years left) with proposed machine Earings before dep, Int. and tas ) -Depreciation Lamines before interest and tes (BT) -Taxes Net Operating profits after Taxes (NOPAT) Depreciation add back) Operating cash flows with existing machine Earnings before dep, int and taxes (BIT) -Depreciation Eamings before interest and Net Operating profits afer Taxes (NOPAT) Depreciation (add back Operating cash flows HH Incremental Relevant Operating Cash Flows Proposed Machine Existing Machine incremental cash flow in