Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you solve this for taxation this is all the info I have Martin Jones was transferred from Vancouver to Montreal by his employer on

can you solve this for taxation

this is all the info I have

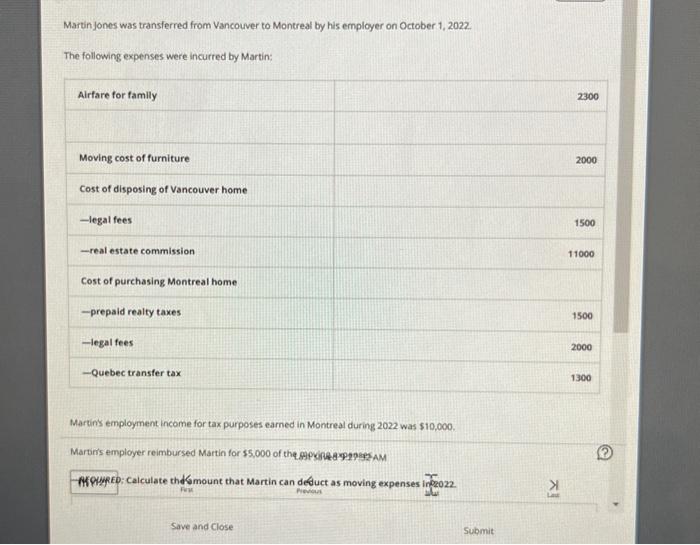

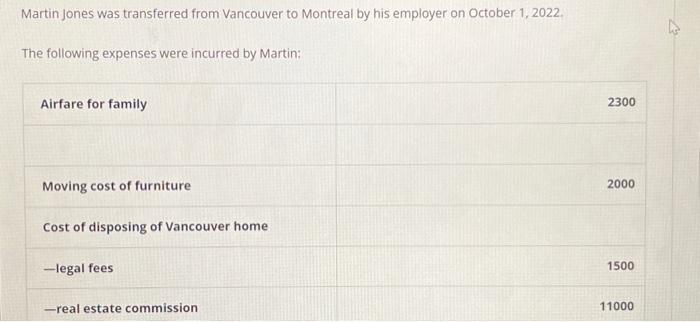

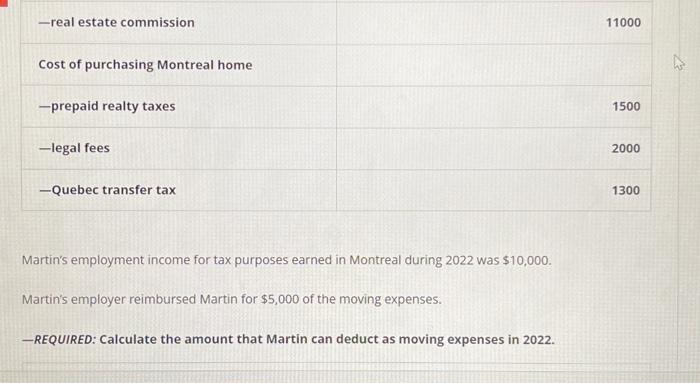

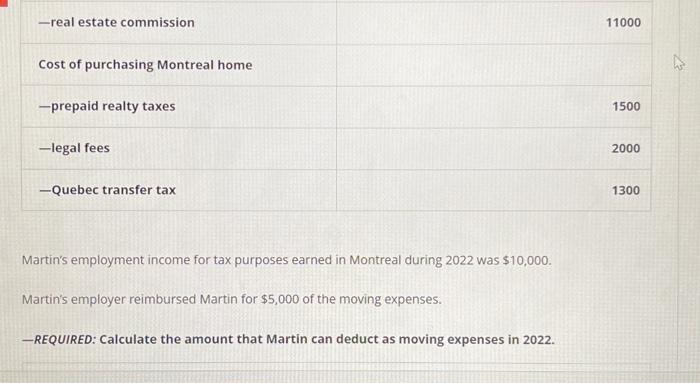

Martin Jones was transferred from Vancouver to Montreal by his employer on October 1, 2022. The following expenses were incurred by Martin: Airfare for family 2300 Moving cost of furniture 2000 Cost of disposing of Vancouver home -legal fees 1500 -real estate commission 11000 Martin jones was transferred from Vancouver to Montreal by his employer on October 1, 2022. The following expenses were incurred by Martin: Martin's employment income for tax purposes earned in Montreal during 2022 was \\( \\$ 10,000 \\). Martin's employer reimbursed Martin for \\( \\$ 5,000 \\) of the moving expenses. -REQUIRED: Calculate the amount that Martin can deduct as moving expenses in 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started