Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you solve this problem, i need help with excel. Can you work on it on excel and show me how you plugged in each

Can you solve this problem, i need help with excel. Can you work on it on excel and show me how you plugged in each answer with detail steps. Below i will attach the work that I have done so far. thank you!

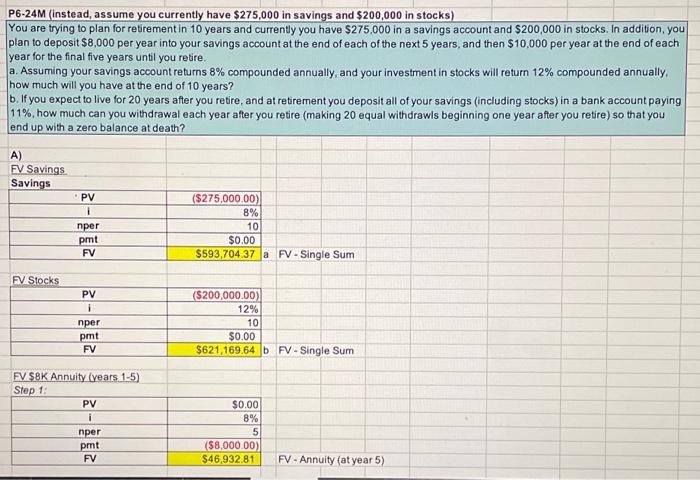

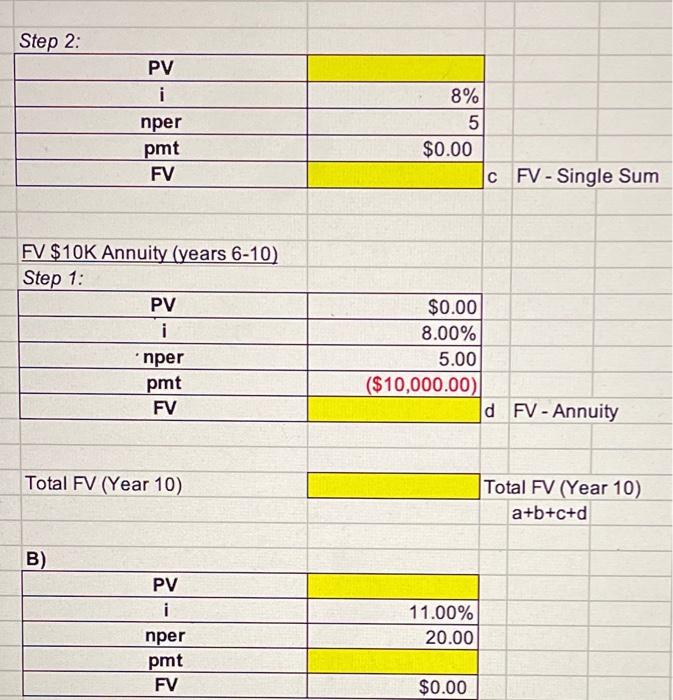

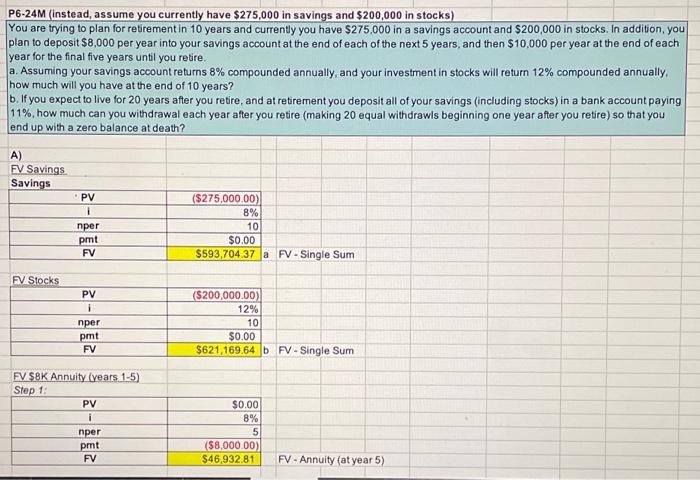

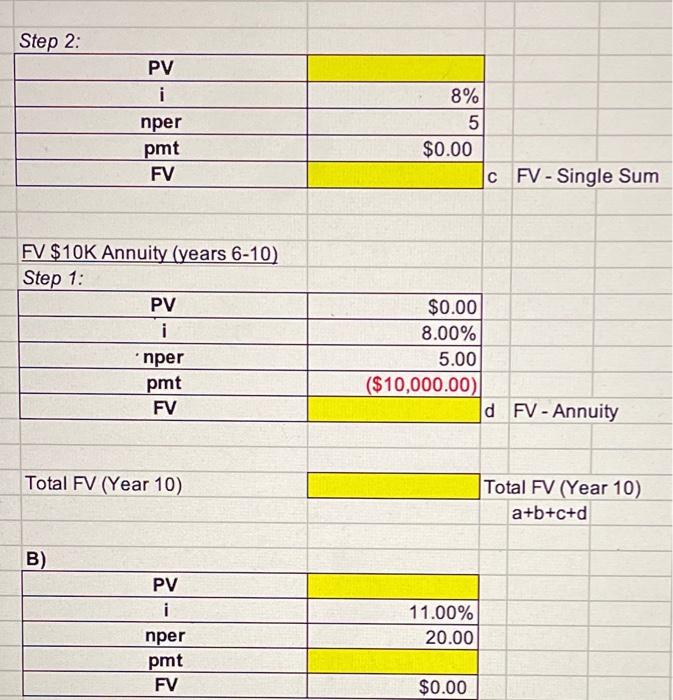

P6-24M (instead, assume you currently have $275,000 in savings and $200,000 in stocks) You are trying to plan for retirement in 10 years and currently you have $275,000 in a savings account and $200,000 in stocks. In addition, you plan to deposit $8,000 per year into your savings account at the end of each of the next 5 years, and then $10,000 per year at the end of each year for the final five years until you retire. a. Assuming your savings account returns 8% compounded annually, and your investment in stocks will return 12% compounded annually. how much will you have at the end of 10 years? b. If you expect to live for 20 years after you retire, and at retirement you deposit all of your savings (including stocks) in a bank account paying 11%, how much can you withdrawal each year after you retire (making 20 equal withdrawls beginning one year after you retire) so that you end up with a zero balance at death? A) FV Savings Savings PV ($275,000.00) 8% nper pmt FV 10 $0.00 $593,704.37 a FV - Single Sum FV Stocks PV i nper pmt FV ($200,000.00) 12% 10 $0.00 $621,169.64 DFV - Single Sum FV SBK Annuity (years 1-5) Step 1: PV i nper pmt FV $0.00 8% 5 ($8,000.00) $46.932.81 FV - Annuity (at year 5) Step 2: PV i nper pmt FV 8% 5 $0.00 CFV - Single Sum FV $10K Annuity (years 6-10) Step 1: PV i nper pmt FV $0.00 8.00% 5.00 ($10,000.00) d FV - Annuity Total FV (Year 10) Total FV (Year 10) a+b+c+d B) PV i 11.00% 20.00 nper pmt FV $0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started