Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you tell me if I solved this problem correctly or if I forgot to finish something, thank you! 2. Exercise Twopart of saving for

can you tell me if I solved this problem correctly or if I forgot to finish something, thank you!

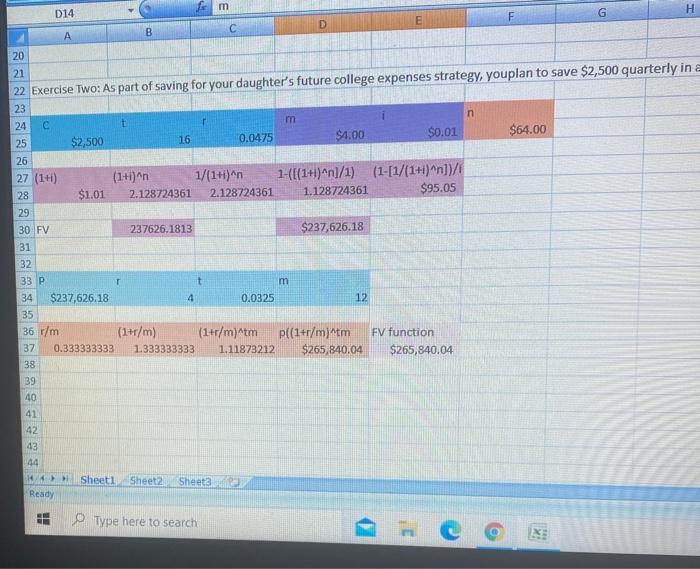

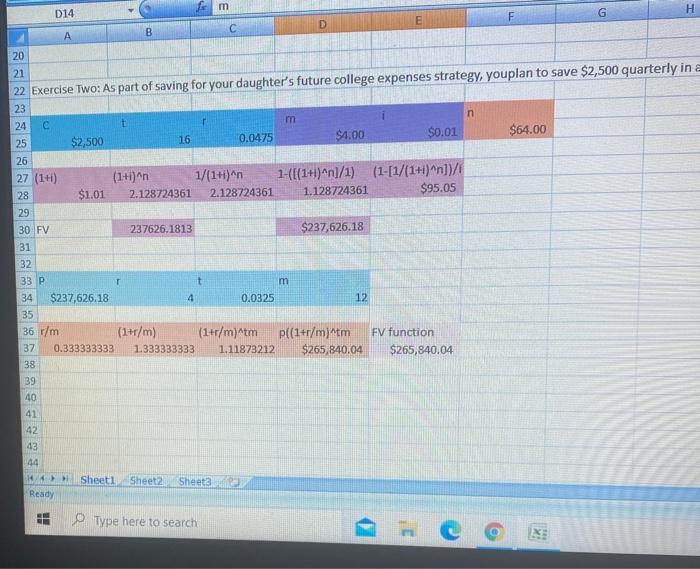

m H D14 E F G A B 20 21 22 Exercise Two: As part of saving for your daughter's future college expenses strategy, youplan to save $2,500 quarterly in a 23 n m 24 $0.01 $4.00 $64.00 0.0475 25 $2,500 16 26 27 (14) 28 (1+)n 2.128724361 1/(1+i) in 1-([(14)^n]/1) (1-[1/(1+1)^n])/ 2.128724361 1.128724361 $95.05 $1.01 29 30 FV 237626,1813 $237,626.18 31 32 33 P it m 34 $237,626.18 4 0.0325 12 35 36 t/m (1+r/m) (1+r/m)tm p((1+r/matm FV function 37 0.333333333 1.333333333 1.11873212 $265,840.04 $265,840.04 38 39 40 41 42 43 44 Sheet1 Sheet2 Sheet Ready Type here to search 2. Exercise Twopart of saving for your daughter's future college expenses strategyyou plan to save $2,500 quarterly in an interest bearing account with an annual interest rate of 4.75%. If you anticipate her to start college 16 years from today() how much money will you have then? (b) Suppose she receives a full scholarship, if you decide to reinvest your funds at maturity for an additional 4 years (for her younger brother's college education expenses), under monthly compounding and an annual interest rate of 3.25% How much money will you have at the end of the reinvestment process?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started