Can you tell me where the figure goes on the cash journal.

I've put them all under DR, but some have to go in CR and some have to go in DR.

Can you please check and help me.

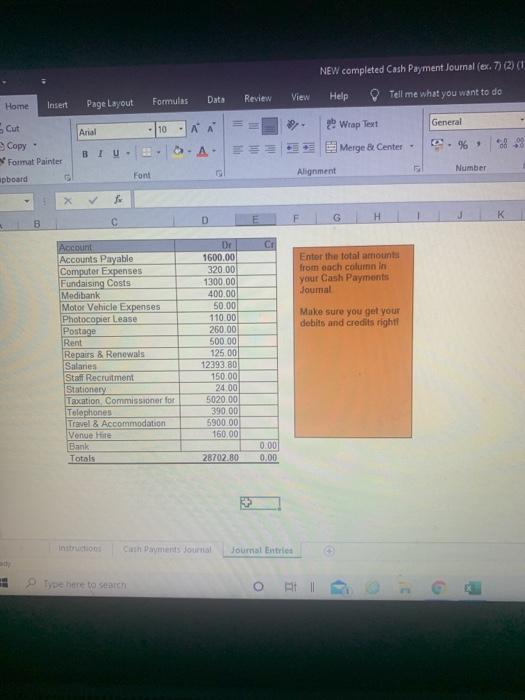

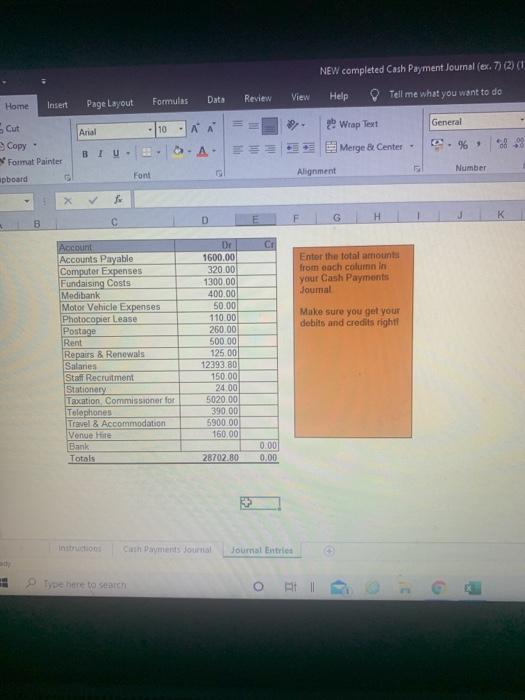

NEW completed Cash Payment Journal (ex. 7) (2) (1. Data Review View Formulas Help Tell me what you want to do Home Insert Page Layout General Arial - 10 Scut Copy - Format Painter pboard 899 AN 2. Wrap Text B.A. ES E Merge Center Alignment BIU- Number Font x G F H K 8 Enter the total amounts from each column in your Cash Payments Joumal Make sure you get your debits and credits rightf Account Accounts Payable Computer Expenses Fundaising Costs Medibank Motor Vehicle Expenses Photocopier Lease Postage Rent Repairs & Renewals Salanes Staff Recruitment Stationery Location Commissioner for Telephones Travel & Accommodation Venue Hire Bank Totals De 1600.00 320.00 1300.00 400.00 50.00 110.00 260.00 500.00 125.00 12393.80 150.00 24 00 5020.00 390.00 5900.00 160.00 0:00 0.00 28702.80 Carin Damen Journal Journal Entries Type here to search Yes so if theres an accounts payable debit for 1600, you can be 100% sure that there will also be a credit for that elsewhere of 1600, however you may not see it exactly as 1600 as it may be included with other costs as well. If you look at the DC ADE LER model, youll see ADE (asset, draw and expenses) come under the debit. That means whenever one of these accounts is increasing, it would be a debit e.g Motor Vehicles (asset type of account) if you buy a car for 15,000, this is written as 15,000 debit to the Motor Vehicles account. The other account that would be affected by this transaction is the Bank account, which is also an asset type of account however this time its decreasing (the 15,000 paying for the car is coming from here). The DC ADE LER model only shows if an account is increasing, what it should be, when its decreasing youll just know its the opposite hence in this scenario, as the bank account is decreasing, this would be written as 15,000 credit to the Bank Account Let me know though, hows your understanding of the DC ADE LER model? Honestly just understanding this model can take you very far in accounting. In relation to your task, most of the things would come under expenses so where is that on the DC ADE LER model? Is it a debit or credit if an expense is increasing? And what account would all the expenses be coming out from (where's the money coming from thats paying for them) and this would be the credit for those expenses