can you the general journal question from 1 to 9?

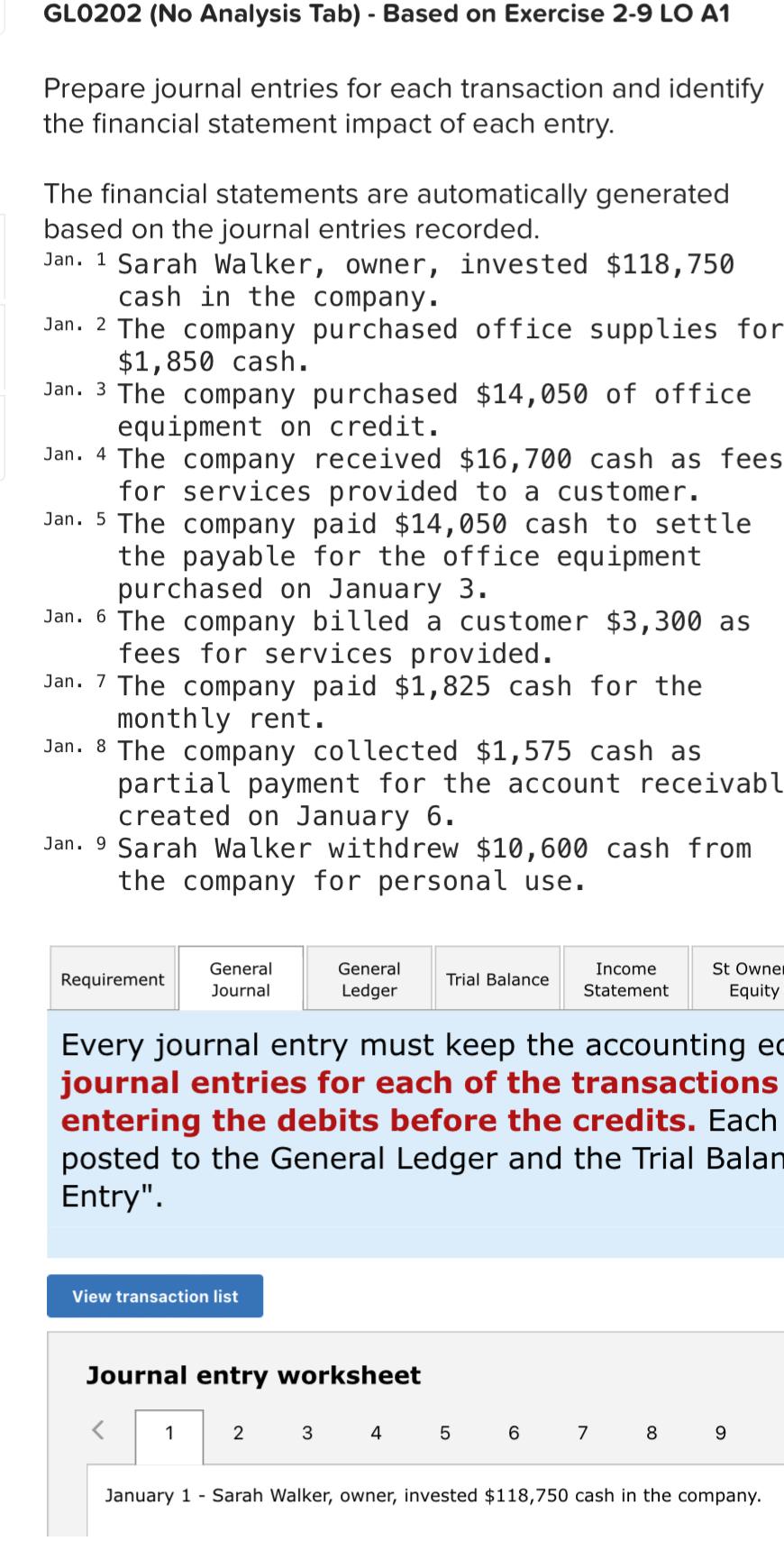

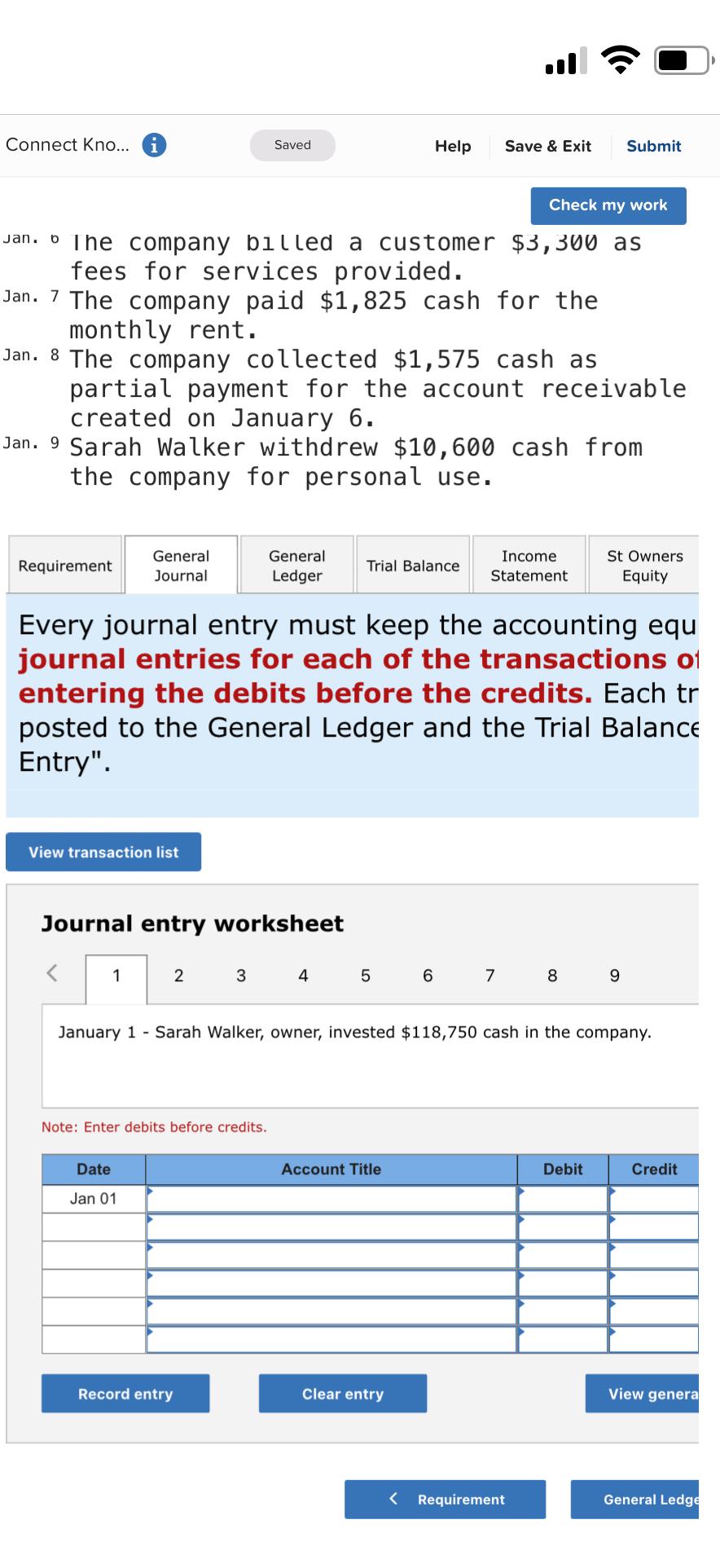

GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. Jan. 1 Sarah Walker, owner, invested $118,750 cash in the company. Jan. 2 The company purchased office supplies for $1,850 cash. Jan. 3 The company purchased $14,050 of office equipment on credit. Jan. 4 The company received $16,700 cash as fees for services provided to a customer. Jan. 5 The company paid $14,050 cash to settle the payable for the office equipment purchased on January 3. Jan. 6 The company billed a customer $3,300 as fees for services provided. Jan. 7 The company paid $1,825 cash for the monthly rent. Jan. 8 The company collected $1,575 cash as partial payment for the account receivabl created on January 6. Jan. 9 Sarah Walker withdrew $10,600 cash from the company for personal use. Requirement General Journal General Ledger Trial Balance Income Statement St Owner Equity Every journal entry must keep the accounting e journal entries for each of the transactions entering the debits before the credits. Each posted to the General Ledger and the Trial Balan Entry". View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 January 1 - Sarah Walker, owner, invested $118,750 cash in the company. Connect Kno... Saved Help Save & Exit Check my work Jan. The company billed a customer $3,300 as fees for services provided. Jan. 7 The company paid $1,825 cash for the monthly rent. Jan. 8 The company collected $1,575 cash as partial payment for the account receivable created on January 6. Jan. 9 Sarah Walker withdrew $10,600 cash from the company for personal use. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Every journal entry must keep the accounting equ journal entries for each of the transactions of entering the debits before the credits. Each tr posted to the General Ledger and the Trial Balance Entry". View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 January 1 Sarah Walker, owner, invested $118,750 cash in the company. Note: Enter debits before credits. Date Account Title Debit Credit Jan 01 Record entry Clear entry View genera General Ledge