Can you use a table/graph to show your answer?

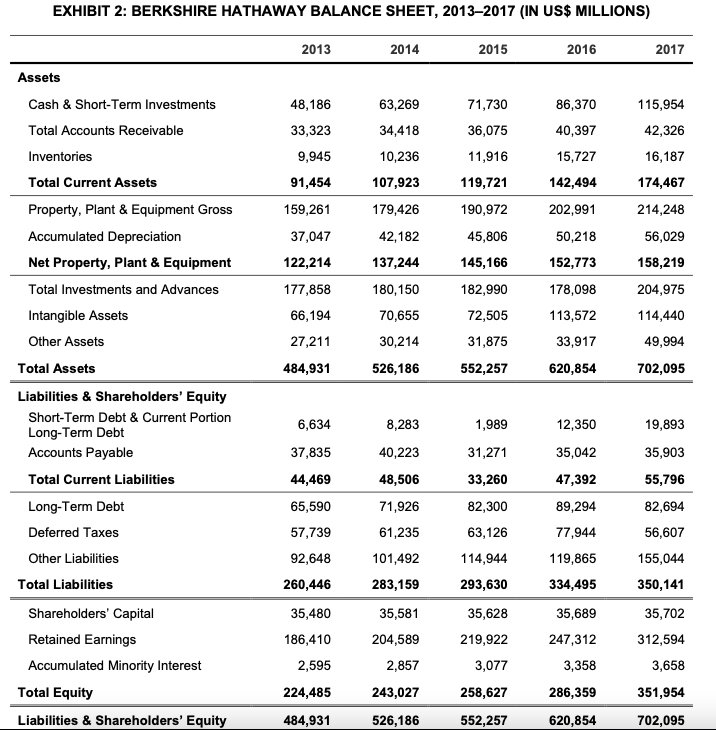

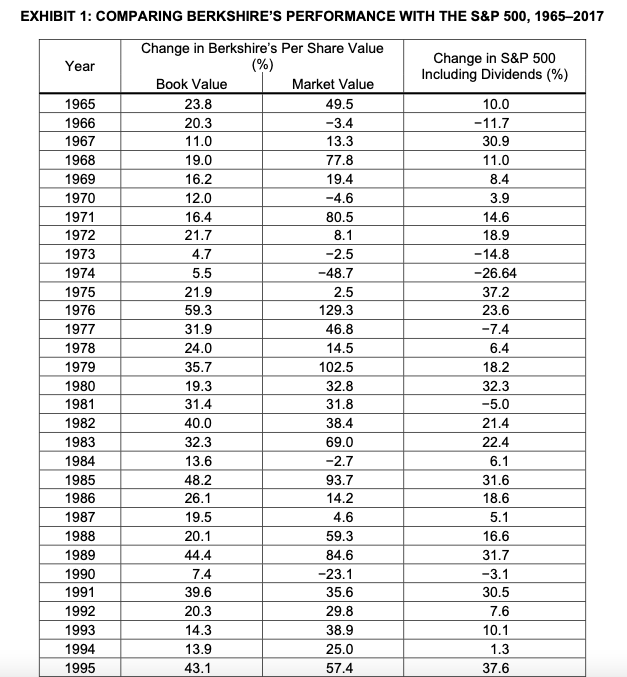

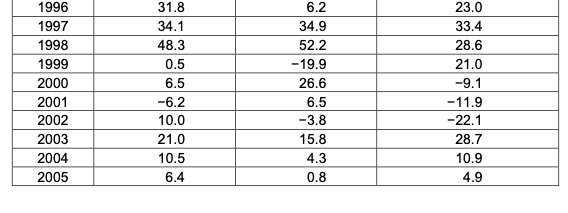

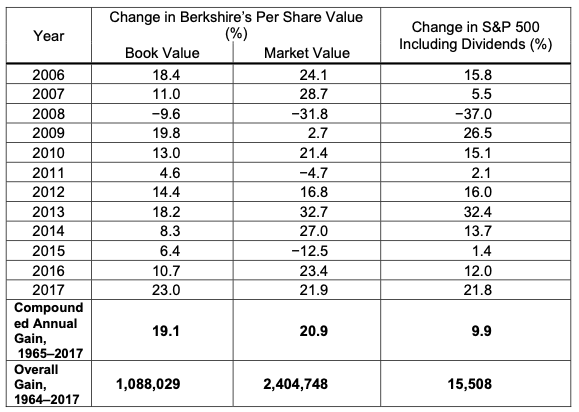

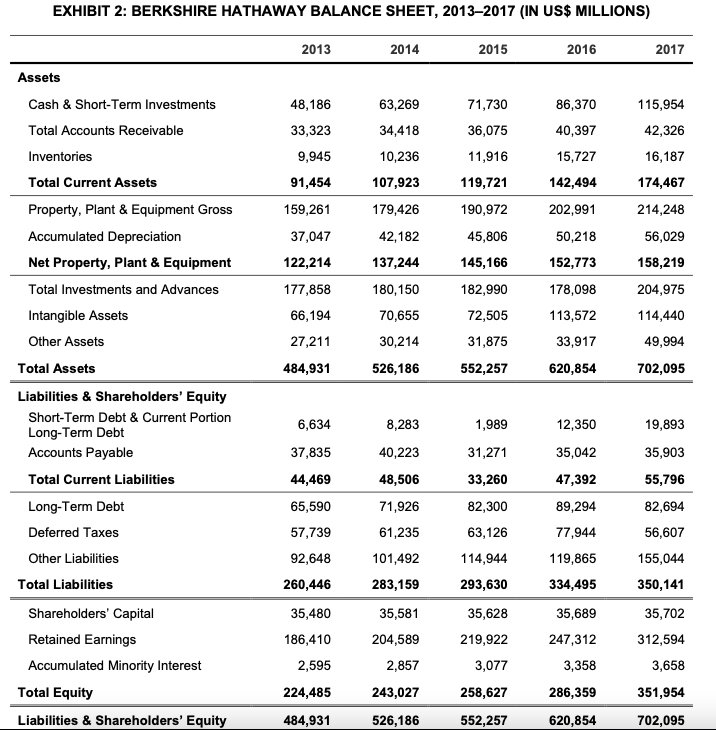

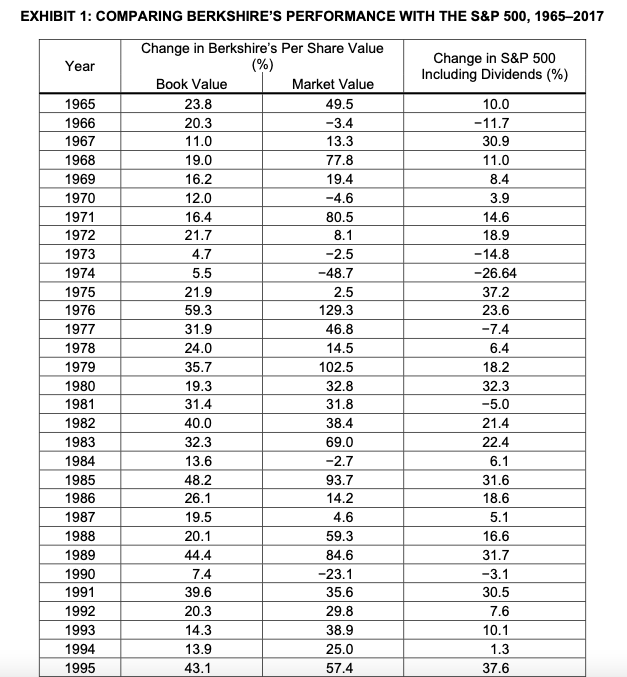

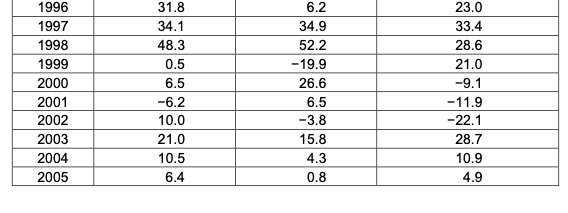

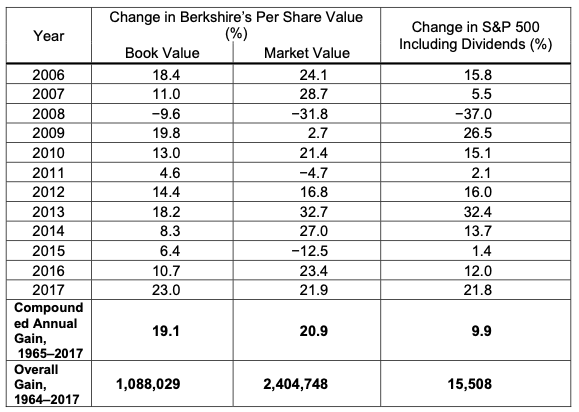

From its inception in 1955, Berkshire Hathaway Inc. (Berkshire Hathaway) had grown by leaps and bounds in various sectors, including financial services, insurance, real estate, utilities, energy, and diversified manufacturing sectors. The company had become a conglomerate of more than 80 operating entities spread into various strata of business. 2 Since 1965, Berkshire Hathaway Class A shares had, on average, grown by almost 21 per cent per year as measured against the Standard \& Poor's (S\&P) 500, which itself had grown an average of 10 per cent per year. Thus, the company had achieved growth more than double the S\&P index. 3 The company existed as a primordial example of value-driven growth, but one with distinctive facets attributable not only to its phenomenal growth but also to its dividend policy. From its formation in 1955 until 2017, Berkshire Hathaway had never paid shareholders in the form of a cash dividend; yet, the company's share price was among the highest in the world. 4 The company had been a staunch propagator of not paying dividends and had preferred to reinvest earnings in business. This approach was the result of the strategic outlook of the company's chairman, Warren Buffet. Considered by Graham \& Doddsville as a "superinvestor" who focused on value investing, 5 Buffet was able to steer Berkshire Hathaway to an overall gain of 1,088,029 per cent in book value per share (see Exhibit 1). 6 However, at Berkshire Hathaway's May 2017 annual general meeting, Buffett reportedly said: A time could come reasonably soon, even while I am around, when Berkshire will have more cash than it can reasonably and profitably deploy. And Berkshire may choose to return those funds with additional stock buybacks, or it could be dividends.? Thus, questions arose as to what factors were influencing the dividend paradigm of the company in 2017, and whether the company should heed Buffett's suggestion and pay a dividend. In 1929, Berkshire Cotton Manufacturing Company merged with Valley Falls Company and formed Berkshire Fine Spinning Associates. 8 In 1955, Berkshire Fine Spinning Associates merged with Hathaway Manufacturing Company and formed Berkshire Hathaway. Seabury Stanton, who was experienced in the operations rather than strategy, headed this new company. But local and international competition along with the falling prices of cotton turned the company's future grey. 9 In 1961, Berkshire Hathaway had to reduce its operational days to four days a week at many plants due to the continued losses year after year. 10 In 1963, Buffett and his associates were purchasing Berkshire Hathaway shares because Buffett expected profit from a forecasted buyback. 11 By 1965 , Buffett and his associates held significant shares in the company. 12 Stanton, who wanted to strengthen his family control, wished to buy back shares from Buffet and agreed to a price of US $11.5013 per share; however, in the official offer letter Stanton sent, he quoted a price of $11.371/2 per share. 14 Stanton's letter angered Buffett, who was purchasing a major stake in the company. 15 Subsequently, Buffett and his associates took over the company's management. At that time, the company had 2,300 employees and two mills. In 1969, Buffett became the chairman of Berkshire Hathaway, and the company continued with a strategy of diversification. 16 In 1987, the Wall Street Journal reported that Berkshire Hathaway's stock had surpassed the Dow Jones average. On October 19 of the same year (later known as Black Monday), the stock market crashed. Berkshire Hathaway, however, managed to survive the collapse, and by 1988, Berkshire Hathaway, which had been trading over the counter as off-exchange stock, was listed on the New York Stock Exchange. At listing, its highest price was $4,300 per share, which was a significant increase from the price of $7.50 per share that Buffett had paid in 1962..17 In 1967, as the first step in moving away from the cyclical nature of the textile industry, which was unable to yield stable profits, the company purchased the National Indemnity Company and the National Fire \& Marine Insurance Company. The purchased companies primarily dealt with automobile insurance, which was more stable than the textile industry. 18 In 1968, Berkshire Hathaway acquired Sun Newspapers, a group of Omaha weeklies. The next year, the company acquired Continental Illinois National Bank \& Trust Company, based in Rockford (Chicago), Illinois. The company continued its acquisitions, acquiring Wesco Financial Corporation in 1970. The company also continued its foray into the newspaper business, acquiring what was then the Buffalo Evening News. 19 In 1985, Berkshire Hathaway closed the last textile mill, thus marking its exit from the textile industry. The company also continued its growth, making monumental acquisitions that included companies such as Blue Chip Stamps, a loyalty program; Nebraska Furniture Mart, one of the largest home furnishing stores in North America; the Scott Fetzer Company, manufacturer of the well-known Kirby vacuums, World Book reference materials, and other products for the home; and the Fireman's Fund Insurance Company. 20 At the end of the 1980s, Berkshire Hathaway acquired a significant portion of the shares of many wellknown and established companies, such as Gillette Corporation, US Airways Group, the Coca-Cola Company, and forest products enterprise, Champion International Corporation. 21 In 1996, Berkshire Hathaway achieved a major milestone with its insurance business, acquiring the Government Employees Insurance Company (GEICO). That acquisition and the company's other investment decisions sent Berkshire Hathaway's stock price to $36,000 per share.. 22 The company continued with valuable and diverse acquisitions as the calendar turned to the 21 st century. Prominent companies among these acquisitions were Benjamin Moore \& Co. and Johns Manville in 2001; Shaw Industries Group Inc. and Pampered Chef Ltd. in 2002; McLane Company Inc. in 2003; Medical Protective (later MedPro Group) and Forest River Inc. in 2005; Russell Brands LLC, Business Wire, and Brooks Sports Inc. in 2006; TTI Inc., Clayton Homes, and Boat Owners Association of the United States (Boat U.S.) in 2007; Cavalier Homes Inc. in 2008; Burlington Northern Santa Fe LLC (BNSF Railway) in 2010; Lubrizol Corporation in 2011; Oriental Trading Company Inc. in 2012; television station WPLG and Charter Brokerage LLC in 2014; Louis Motorcycle Company in 2015; and Precision Castparts Corp. and Duracell Inc. in 2016.23 Share Class Berkshire Hathaway had two classes of shares - Class A and Class B - trading on the New York Stock Exchange. The Class A shares had existed even before Buffett took over the business. Berkshire Hathaway had never split those stocks. As of January 24, 2018, approximately 11 per cent of the Class A shares were held by members of the general public; 48 per cent were held by institutions and 41 per cent by insider investors. 24 At the end of 2017, the average price of Berkshire Hathaway's Class A stocks was $297,600 per share. 25 The Class B shares were created in 1996. They gave the Class A shareholders the right to convert each Class A share into 30 Class B shares. The intention was to allow small investors to hold a stake in the company-a response to the threat of financial entrepreneurs who were attempting to create alternative investment vehicles. 26 On January 21,2010 , each Class B share was split into 50 shares, thus increasing the number of Class B shares in circulation. 27 As of January 24, 2018, approximately 35 per cent of Berkshire Hathaway's Class B shares were held by members of the general public; 47 per cent were held by institutions and 19 per cent by insider investors. 28 At the end of 2017 , the average price of Berkshire Hathaway's Class B stocks was $200 per share. 29 DIVIDEND POLICY Buffett's strategy was to make it a priority to diligently reinvest earnings in the company's existing multisector businesses. In 2012, Berkshire Hathaway made capital expenditures of $12.1 billion in current businesses and new acquisitions. Buffet also highlighted Berkshire Hathaway's presence in numerous sectors which provided the company with varied options, showing that the company was in a strategically advantageous position. 30 Buffet's principles were articulated in a two-step priority, which made it clear that funds would not be used for dividend payments: (1): The first priority with available funds would always be to evaluate whether they could be diligently reinvested in the existing businesses; (2): The next step was to search for acquisitions unrelated to the current businesses. 31 To emphasize why the repurchase option might be better, Buffett provided an example with two scenarios. 33 Assume there were two equal owners of a business with a net worth of $2 million. If the return on net worth was 12 per cent per annum, the earnings would be $240,000 per year. Assume there also existed a buyer who had agreed to buy into the company at a value of 125 per cent of net worth. The offer thus implied that the market value for the company would be $2.5 million and each individual share would be worth $1.25 million. Scenario A: Pay Out One-Third of the Earnings as a Dividend and Reinvest the Remaining Two-Thirds This scenario reflected the preference of investors who wanted a balanced investment policy that catered to both current income and capital appreciation. In year zero, one-third of the earnings ( $240,0001/3=$80,000 ) would be paid to the owners as a dividend, which gave each of them an income of $40,000. After payment, the company would be left with $160,000 to reinvest in the business. Earnings would continue to grow, and dividends would increase proportionately. Thus, dividends and earnings would grow by 8 per cent per annum ( 12 per cent earned on net worth less 4 per cent paid out from net worth). After 10 years, the company's net worth would be $4,317,850 - the result of the original $2 million compounded at 8 per cent per annum. The dividend payment would be $86,357. The market value of each individual's holding would be $2,698,656. This scenario reflected Buffet's philosophy and was followed by Berkshire Hathaway. Under this scenario, there would be no dividend payment and the entire earnings would be reinvested in the business. In order to maintain an income without dividends, each owner would sell 3.2 per cent of their respective holding. Based on the prospective buyer's offer, the sale would earn 125 per cent of the shares' book value. So, in year zero, each owner would be able to earn the same $40,000 from the sale of shares ( $2.5 million 3.2 per cent 2 ). At the same time, the entire earnings of $240,000 would be reinvested in the company, which has a growth rate of 12 per cent per annum. After 10 years, the company's net worth would be $6,211,696 - the result of the original $2 million compounded at 12 per cent per annum. Because the owners had been selling shares each year, the percentage of each owner's share would have dropped. After 10 years, each owner would hold 36.12 per cent of the business, which would amount to a value of $2,243,665. The market value would be 125 per cent of the net worth, meaning the market value of the individual shares would amount to $2,804,425. Thus, the sell-off scenario, while providing the owners with their required income, added more value to the capital-approximately $105,770 more than with the dividend scenario. 34 DECISION Considering the history of Berkshire Hathaway and Buffet's historical investment strategy, what would you recommend the company do with almost $116 billion in cash and cash-equivalent reserves? Are Buffet's strategic reasons for not paying dividends sustainable? Is the company's share repurchase plan still a viable alternative to a dividend? Looking at Berkshire Hathaway's financials (see Exhibits 2-4), if you were in Buffet's position, would you alter the dividend policy or leave it unaltered? EXHIBIT 2: BERKSHIRE HATHAWAY BALANCE SHEET, 2013-2017 (IN US\$ MILLIONS) EXHIRIT 1. COMPARING RFRKSHIRF'S PFRFORMANCF WITH THF SRP 500 1965-2017 \begin{tabular}{|r|r|r|r|} \hline 1996 & 31.8 & 6.2 & 23.0 \\ \hline 1997 & 34.1 & 34.9 & 33.4 \\ \hline 1998 & 48.3 & 52.2 & 28.6 \\ \hline 1999 & 0.5 & -19.9 & 21.0 \\ \hline 2000 & 6.5 & 26.6 & -9.1 \\ \hline 2001 & -6.2 & 6.5 & -11.9 \\ \hline 2002 & 10.0 & -3.8 & -22.1 \\ \hline 2003 & 21.0 & 15.8 & 28.7 \\ \hline 2004 & 10.5 & 4.3 & 10.9 \\ \hline 2005 & 6.4 & 0.8 & 4.9 \\ \hline \end{tabular} From its inception in 1955, Berkshire Hathaway Inc. (Berkshire Hathaway) had grown by leaps and bounds in various sectors, including financial services, insurance, real estate, utilities, energy, and diversified manufacturing sectors. The company had become a conglomerate of more than 80 operating entities spread into various strata of business. 2 Since 1965, Berkshire Hathaway Class A shares had, on average, grown by almost 21 per cent per year as measured against the Standard \& Poor's (S\&P) 500, which itself had grown an average of 10 per cent per year. Thus, the company had achieved growth more than double the S\&P index. 3 The company existed as a primordial example of value-driven growth, but one with distinctive facets attributable not only to its phenomenal growth but also to its dividend policy. From its formation in 1955 until 2017, Berkshire Hathaway had never paid shareholders in the form of a cash dividend; yet, the company's share price was among the highest in the world. 4 The company had been a staunch propagator of not paying dividends and had preferred to reinvest earnings in business. This approach was the result of the strategic outlook of the company's chairman, Warren Buffet. Considered by Graham \& Doddsville as a "superinvestor" who focused on value investing, 5 Buffet was able to steer Berkshire Hathaway to an overall gain of 1,088,029 per cent in book value per share (see Exhibit 1). 6 However, at Berkshire Hathaway's May 2017 annual general meeting, Buffett reportedly said: A time could come reasonably soon, even while I am around, when Berkshire will have more cash than it can reasonably and profitably deploy. And Berkshire may choose to return those funds with additional stock buybacks, or it could be dividends.? Thus, questions arose as to what factors were influencing the dividend paradigm of the company in 2017, and whether the company should heed Buffett's suggestion and pay a dividend. In 1929, Berkshire Cotton Manufacturing Company merged with Valley Falls Company and formed Berkshire Fine Spinning Associates. 8 In 1955, Berkshire Fine Spinning Associates merged with Hathaway Manufacturing Company and formed Berkshire Hathaway. Seabury Stanton, who was experienced in the operations rather than strategy, headed this new company. But local and international competition along with the falling prices of cotton turned the company's future grey. 9 In 1961, Berkshire Hathaway had to reduce its operational days to four days a week at many plants due to the continued losses year after year. 10 In 1963, Buffett and his associates were purchasing Berkshire Hathaway shares because Buffett expected profit from a forecasted buyback. 11 By 1965 , Buffett and his associates held significant shares in the company. 12 Stanton, who wanted to strengthen his family control, wished to buy back shares from Buffet and agreed to a price of US $11.5013 per share; however, in the official offer letter Stanton sent, he quoted a price of $11.371/2 per share. 14 Stanton's letter angered Buffett, who was purchasing a major stake in the company. 15 Subsequently, Buffett and his associates took over the company's management. At that time, the company had 2,300 employees and two mills. In 1969, Buffett became the chairman of Berkshire Hathaway, and the company continued with a strategy of diversification. 16 In 1987, the Wall Street Journal reported that Berkshire Hathaway's stock had surpassed the Dow Jones average. On October 19 of the same year (later known as Black Monday), the stock market crashed. Berkshire Hathaway, however, managed to survive the collapse, and by 1988, Berkshire Hathaway, which had been trading over the counter as off-exchange stock, was listed on the New York Stock Exchange. At listing, its highest price was $4,300 per share, which was a significant increase from the price of $7.50 per share that Buffett had paid in 1962..17 In 1967, as the first step in moving away from the cyclical nature of the textile industry, which was unable to yield stable profits, the company purchased the National Indemnity Company and the National Fire \& Marine Insurance Company. The purchased companies primarily dealt with automobile insurance, which was more stable than the textile industry. 18 In 1968, Berkshire Hathaway acquired Sun Newspapers, a group of Omaha weeklies. The next year, the company acquired Continental Illinois National Bank \& Trust Company, based in Rockford (Chicago), Illinois. The company continued its acquisitions, acquiring Wesco Financial Corporation in 1970. The company also continued its foray into the newspaper business, acquiring what was then the Buffalo Evening News. 19 In 1985, Berkshire Hathaway closed the last textile mill, thus marking its exit from the textile industry. The company also continued its growth, making monumental acquisitions that included companies such as Blue Chip Stamps, a loyalty program; Nebraska Furniture Mart, one of the largest home furnishing stores in North America; the Scott Fetzer Company, manufacturer of the well-known Kirby vacuums, World Book reference materials, and other products for the home; and the Fireman's Fund Insurance Company. 20 At the end of the 1980s, Berkshire Hathaway acquired a significant portion of the shares of many wellknown and established companies, such as Gillette Corporation, US Airways Group, the Coca-Cola Company, and forest products enterprise, Champion International Corporation. 21 In 1996, Berkshire Hathaway achieved a major milestone with its insurance business, acquiring the Government Employees Insurance Company (GEICO). That acquisition and the company's other investment decisions sent Berkshire Hathaway's stock price to $36,000 per share.. 22 The company continued with valuable and diverse acquisitions as the calendar turned to the 21 st century. Prominent companies among these acquisitions were Benjamin Moore \& Co. and Johns Manville in 2001; Shaw Industries Group Inc. and Pampered Chef Ltd. in 2002; McLane Company Inc. in 2003; Medical Protective (later MedPro Group) and Forest River Inc. in 2005; Russell Brands LLC, Business Wire, and Brooks Sports Inc. in 2006; TTI Inc., Clayton Homes, and Boat Owners Association of the United States (Boat U.S.) in 2007; Cavalier Homes Inc. in 2008; Burlington Northern Santa Fe LLC (BNSF Railway) in 2010; Lubrizol Corporation in 2011; Oriental Trading Company Inc. in 2012; television station WPLG and Charter Brokerage LLC in 2014; Louis Motorcycle Company in 2015; and Precision Castparts Corp. and Duracell Inc. in 2016.23 Share Class Berkshire Hathaway had two classes of shares - Class A and Class B - trading on the New York Stock Exchange. The Class A shares had existed even before Buffett took over the business. Berkshire Hathaway had never split those stocks. As of January 24, 2018, approximately 11 per cent of the Class A shares were held by members of the general public; 48 per cent were held by institutions and 41 per cent by insider investors. 24 At the end of 2017, the average price of Berkshire Hathaway's Class A stocks was $297,600 per share. 25 The Class B shares were created in 1996. They gave the Class A shareholders the right to convert each Class A share into 30 Class B shares. The intention was to allow small investors to hold a stake in the company-a response to the threat of financial entrepreneurs who were attempting to create alternative investment vehicles. 26 On January 21,2010 , each Class B share was split into 50 shares, thus increasing the number of Class B shares in circulation. 27 As of January 24, 2018, approximately 35 per cent of Berkshire Hathaway's Class B shares were held by members of the general public; 47 per cent were held by institutions and 19 per cent by insider investors. 28 At the end of 2017 , the average price of Berkshire Hathaway's Class B stocks was $200 per share. 29 DIVIDEND POLICY Buffett's strategy was to make it a priority to diligently reinvest earnings in the company's existing multisector businesses. In 2012, Berkshire Hathaway made capital expenditures of $12.1 billion in current businesses and new acquisitions. Buffet also highlighted Berkshire Hathaway's presence in numerous sectors which provided the company with varied options, showing that the company was in a strategically advantageous position. 30 Buffet's principles were articulated in a two-step priority, which made it clear that funds would not be used for dividend payments: (1): The first priority with available funds would always be to evaluate whether they could be diligently reinvested in the existing businesses; (2): The next step was to search for acquisitions unrelated to the current businesses. 31 To emphasize why the repurchase option might be better, Buffett provided an example with two scenarios. 33 Assume there were two equal owners of a business with a net worth of $2 million. If the return on net worth was 12 per cent per annum, the earnings would be $240,000 per year. Assume there also existed a buyer who had agreed to buy into the company at a value of 125 per cent of net worth. The offer thus implied that the market value for the company would be $2.5 million and each individual share would be worth $1.25 million. Scenario A: Pay Out One-Third of the Earnings as a Dividend and Reinvest the Remaining Two-Thirds This scenario reflected the preference of investors who wanted a balanced investment policy that catered to both current income and capital appreciation. In year zero, one-third of the earnings ( $240,0001/3=$80,000 ) would be paid to the owners as a dividend, which gave each of them an income of $40,000. After payment, the company would be left with $160,000 to reinvest in the business. Earnings would continue to grow, and dividends would increase proportionately. Thus, dividends and earnings would grow by 8 per cent per annum ( 12 per cent earned on net worth less 4 per cent paid out from net worth). After 10 years, the company's net worth would be $4,317,850 - the result of the original $2 million compounded at 8 per cent per annum. The dividend payment would be $86,357. The market value of each individual's holding would be $2,698,656. This scenario reflected Buffet's philosophy and was followed by Berkshire Hathaway. Under this scenario, there would be no dividend payment and the entire earnings would be reinvested in the business. In order to maintain an income without dividends, each owner would sell 3.2 per cent of their respective holding. Based on the prospective buyer's offer, the sale would earn 125 per cent of the shares' book value. So, in year zero, each owner would be able to earn the same $40,000 from the sale of shares ( $2.5 million 3.2 per cent 2 ). At the same time, the entire earnings of $240,000 would be reinvested in the company, which has a growth rate of 12 per cent per annum. After 10 years, the company's net worth would be $6,211,696 - the result of the original $2 million compounded at 12 per cent per annum. Because the owners had been selling shares each year, the percentage of each owner's share would have dropped. After 10 years, each owner would hold 36.12 per cent of the business, which would amount to a value of $2,243,665. The market value would be 125 per cent of the net worth, meaning the market value of the individual shares would amount to $2,804,425. Thus, the sell-off scenario, while providing the owners with their required income, added more value to the capital-approximately $105,770 more than with the dividend scenario. 34 DECISION Considering the history of Berkshire Hathaway and Buffet's historical investment strategy, what would you recommend the company do with almost $116 billion in cash and cash-equivalent reserves? Are Buffet's strategic reasons for not paying dividends sustainable? Is the company's share repurchase plan still a viable alternative to a dividend? Looking at Berkshire Hathaway's financials (see Exhibits 2-4), if you were in Buffet's position, would you alter the dividend policy or leave it unaltered? EXHIBIT 2: BERKSHIRE HATHAWAY BALANCE SHEET, 2013-2017 (IN US\$ MILLIONS) EXHIRIT 1. COMPARING RFRKSHIRF'S PFRFORMANCF WITH THF SRP 500 1965-2017 \begin{tabular}{|r|r|r|r|} \hline 1996 & 31.8 & 6.2 & 23.0 \\ \hline 1997 & 34.1 & 34.9 & 33.4 \\ \hline 1998 & 48.3 & 52.2 & 28.6 \\ \hline 1999 & 0.5 & -19.9 & 21.0 \\ \hline 2000 & 6.5 & 26.6 & -9.1 \\ \hline 2001 & -6.2 & 6.5 & -11.9 \\ \hline 2002 & 10.0 & -3.8 & -22.1 \\ \hline 2003 & 21.0 & 15.8 & 28.7 \\ \hline 2004 & 10.5 & 4.3 & 10.9 \\ \hline 2005 & 6.4 & 0.8 & 4.9 \\ \hline \end{tabular}