can yoy please calculate the full cycle of accounting?

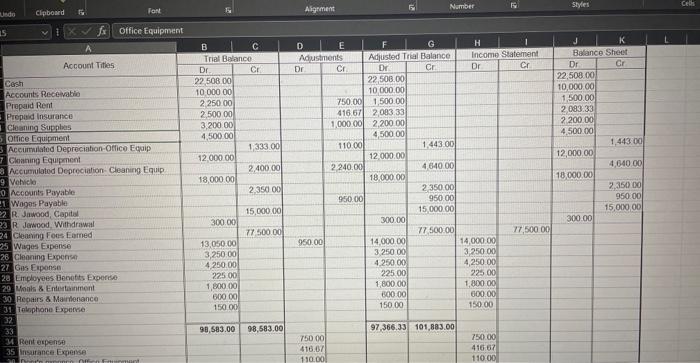

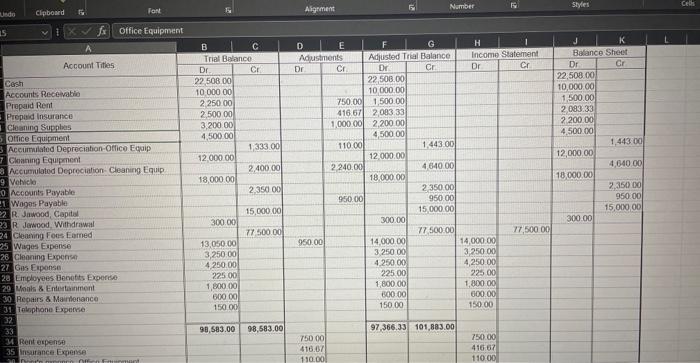

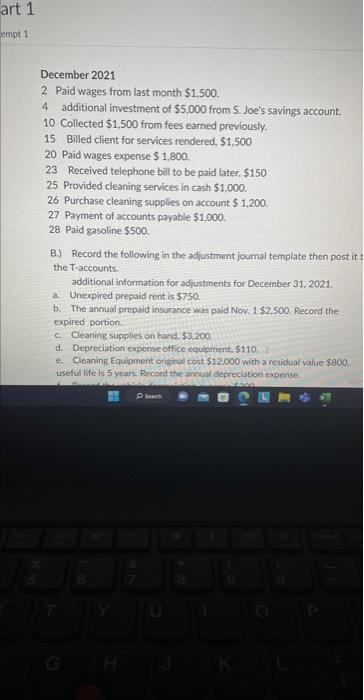

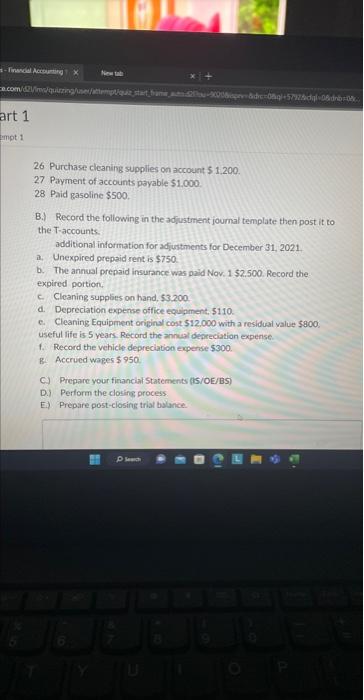

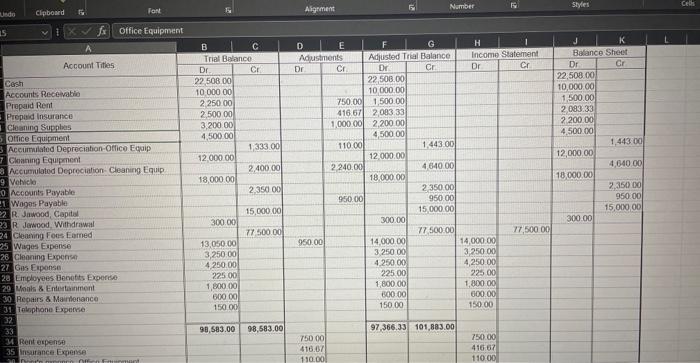

December 2021 2 Paid wages from last month $1,500. 4 additional investment of $5,000 from 5 . Joe's savings account. 10 Collected $1,500 from fees earned previously. 15 Billed client for services rendered, $1,500 20 Paid wages expense $1,800. 23 Received telephone bill to be paid later, $150 25 Provided cleaning services in cash $1,000. 26 Purchase cleaning supplies on account $1,200. 27 Payment of accounts payable 51,000 . 28 Paid gasoline $500. B.) Record the following in the adiustment joumal template then post it t the T-accounts. additional information for adjustments for December 31,2021 . a. Unexpired prepaid rent is $750. b. The annual prepaid insurance was paid Nov. 152,500 . Record the expired portion- c. Cleaning suppsies on hard, 53,200. d. Depreciation expense office equicment, $110. e. Cleaning Equipment oniginal cont $12.000 with a residual value $800. usetul ilife is 5 years. Record the annual depreciation expense. 26 Purchase cleaning supplies on account $1,200. 27 Payment of accounts payable $1.000. 28 Paid gasoline $500. B.) Record the following in the adiustment joumal template then post it to the T-accounts. additional information for adjustments for December 31, 2021. a. Unexpired prepaid rent is $750. b. The annual prepaid insurance was paid Nov. 152.500. Record the: expired portion, c. Cleaning supplets on hand, 53,200. d. Depreciation expense office equioment, 5110 . e. Cleaning Equipment original cost $12,000 with a residual yalue $800, useful life is 5 years. Record the annual depreciation expense. f. Record the vehicle depreclation expense 5300 . B. Accrued wages 5950 C) Prepare your financial Statements (15/OE/BS) D.) Perform the closing process. December 2021 2 Paid wages from last month $1,500. 4 additional investment of $5,000 from 5 . Joe's savings account. 10 Collected $1,500 from fees earned previously. 15 Billed client for services rendered, $1,500 20 Paid wages expense $1,800. 23 Received telephone bill to be paid later, $150 25 Provided cleaning services in cash $1,000. 26 Purchase cleaning supplies on account $1,200. 27 Payment of accounts payable 51,000 . 28 Paid gasoline $500. B.) Record the following in the adiustment joumal template then post it t the T-accounts. additional information for adjustments for December 31,2021 . a. Unexpired prepaid rent is $750. b. The annual prepaid insurance was paid Nov. 152,500 . Record the expired portion- c. Cleaning suppsies on hard, 53,200. d. Depreciation expense office equicment, $110. e. Cleaning Equipment oniginal cont $12.000 with a residual value $800. usetul ilife is 5 years. Record the annual depreciation expense. 26 Purchase cleaning supplies on account $1,200. 27 Payment of accounts payable $1.000. 28 Paid gasoline $500. B.) Record the following in the adiustment joumal template then post it to the T-accounts. additional information for adjustments for December 31, 2021. a. Unexpired prepaid rent is $750. b. The annual prepaid insurance was paid Nov. 152.500. Record the: expired portion, c. Cleaning supplets on hand, 53,200. d. Depreciation expense office equioment, 5110 . e. Cleaning Equipment original cost $12,000 with a residual yalue $800, useful life is 5 years. Record the annual depreciation expense. f. Record the vehicle depreclation expense 5300 . B. Accrued wages 5950 C) Prepare your financial Statements (15/OE/BS) D.) Perform the closing process