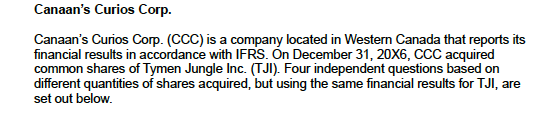

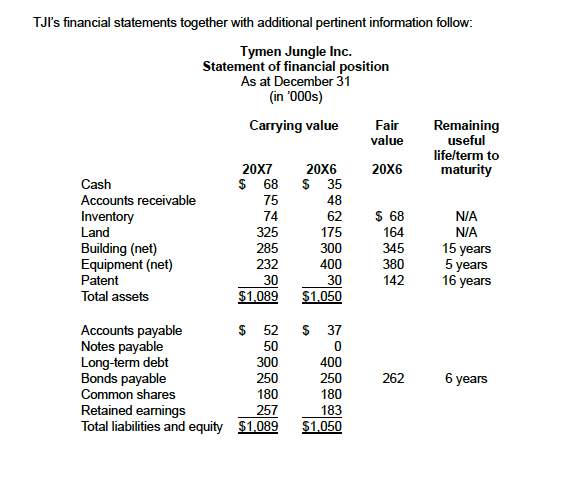

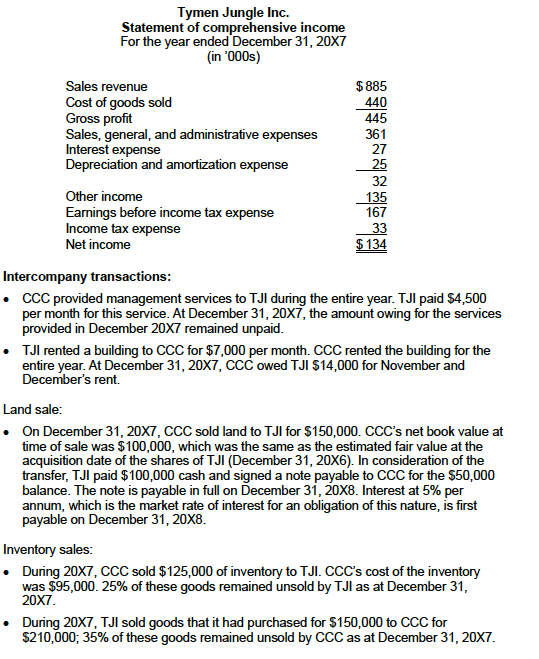

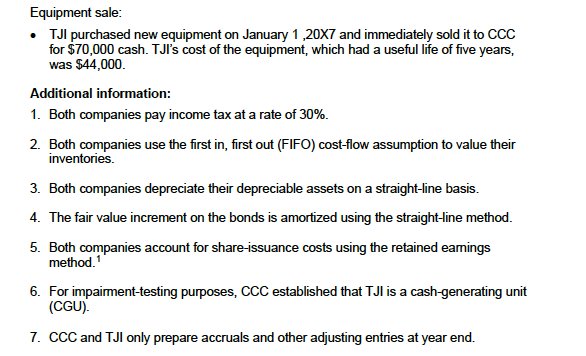

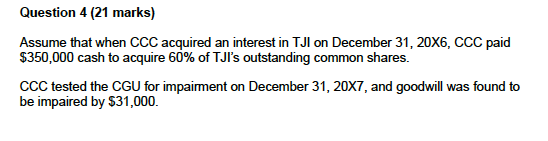

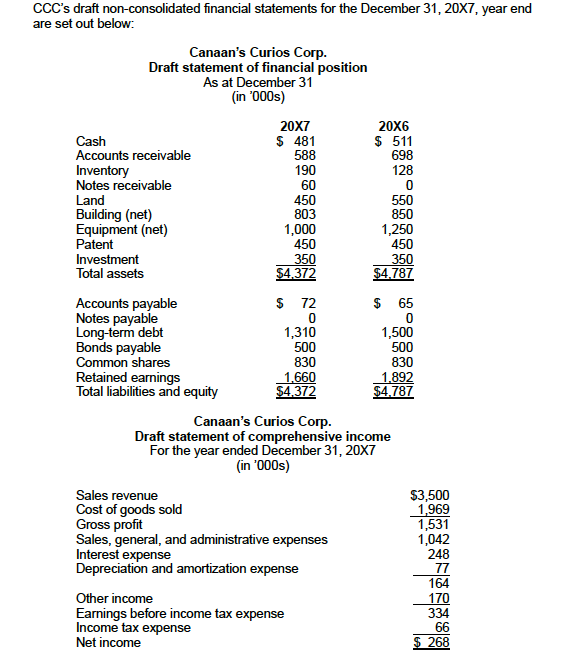

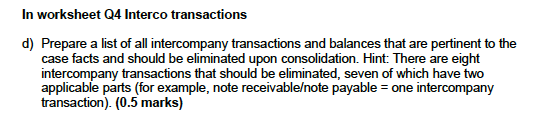

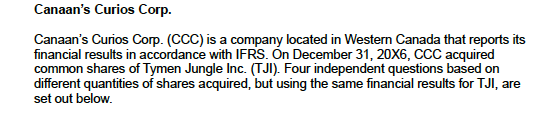

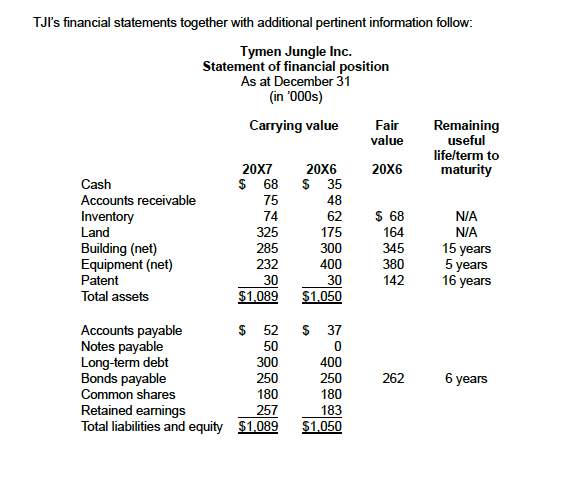

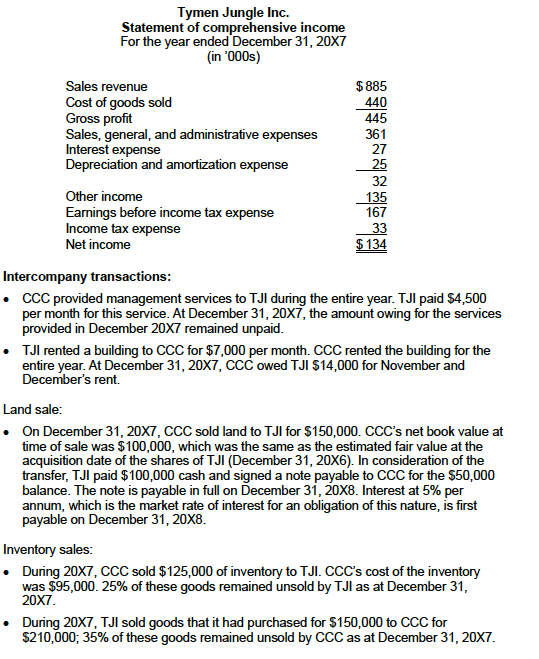

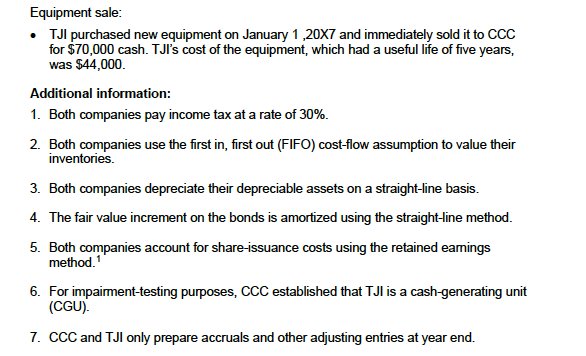

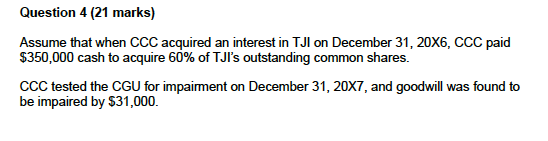

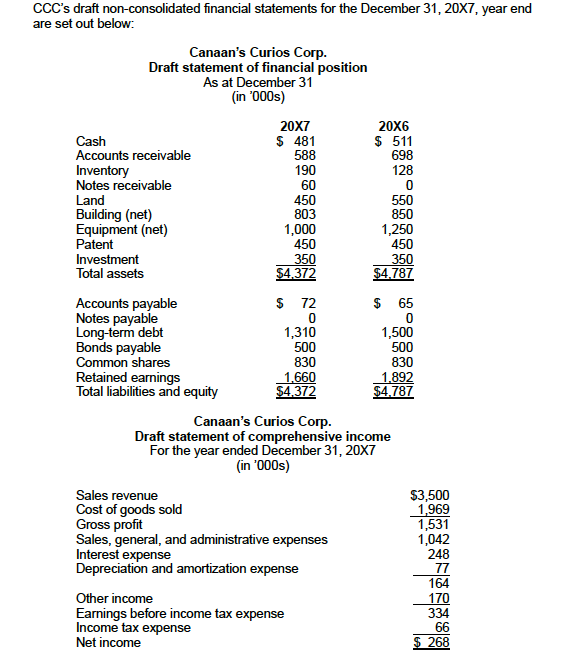

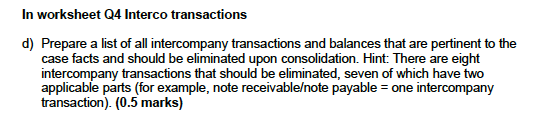

Canaan's Curios Corp. Canaan's Curios Corp. (CCC) is a company located in Western Canada that reports its financial results in accordance with IFRS. On December 31, 20X6, CCC acquired common shares of Tymen Jungle Inc. (TJI). Four independent questions based on different quantities of shares acquired, but using the same financial results for TJI, are set out below. TJI's financial statements together with additional pertinent information follow: Tymen Jungle Inc. Statement of financial position As at December 31 (in '000s) Carrying value Fair Remaining value useful life/term to 20x7 20x6 20X6 maturity Cash $ 68 $ 35 Accounts receivable 75 48 Inventory 74 62 $ 68 N/A Land 325 175 164 N/A Building (net) 285 300 345 15 years Equipment (net) 232 400 380 5 years Patent 30 30 142 16 years Total assets $1,089 $1.050 Accounts payable $ 52 Notes payable 50 Long-term debt 300 Bonds payable 250 Common shares 180 Retained earnings 257 Total liabilities and equity $1,089 $ 37 0 400 250 180 183 $1.050 262 6 years 25 Tymen Jungle Inc. Statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue $885 Cost of goods sold 440 Gross profit 445 Sales, general, and administrative expenses 361 Interest expense 27 Depreciation and amortization expense 32 Other income 135 Earnings before income tax expense 167 Income tax expense 33 Net income $ 134 Intercompany transactions: CCC provided management services to TJI during the entire year. TJI paid $4,500 per month for this service. At December 31, 20X7, the amount owing for the services provided in December 20X7 remained unpaid. TJl rented a building to CCC for $7,000 per month. CCC rented the building for the entire year. At December 31, 20X7, CCC owed TJI $14,000 for November and December's rent. Land sale: On December 31, 20X7, CCC sold land to TJI for $150,000. CCC's net book value at time of sale was $100,000, which was the same as the estimated fair value at the acquisition date of the shares of TJI (December 31, 20X6). In consideration of the transfer, TJI paid $100,000 cash and signed a note payable to CCC for the $50,000 balance. The note is payable in full on December 31, 20X8. Interest at 5% per annum, which is the market rate of interest for an obligation of this nature, is first payable on December 31, 20X8. Inventory sales: During 20X7, CCC sold $125,000 of inventory to TJI. CCC's cost of the inventory was $95,000.25% of these goods remained unsold by TJI as at December 31, 20x7. During 20X7, TJI sold goods that it had purchased for $150,000 to CCC for $210,000; 35% of these goods remained unsold by CCC as at December 31, 20x7. Equipment sale: TJI purchased new equipment on January 1, 20X7 and immediately sold it to CCC for $70,000 cash. Tul's cost of the equipment, which had a useful life of five years, was $44,000 Additional information: 1. Both companies pay income tax at a rate of 30%. 2. Both companies use the first in, first out (FIFO) cost-flow assumption to value their inventories. 3. Both companies depreciate their depreciable assets on a straight-line basis. 4. The fair value increment on the bonds is amortized using the straight-line method. 5. Both companies account for share-issuance costs using the retained earings method.' 6. For impaiment-testing purposes, CCC established that TJl is a cash-generating unit (CGU) 7. CCC and TJI only prepare accruals and other adjusting entries at year end. Question 4 (21 marks) Assume that when CCC acquired an interest in TJI on December 31, 20X6, CCC paid $350,000 cash to acquire 60% of TJl's outstanding common shares. CCC tested the CGU for impairment on December 31, 20X7, and goodwill was found to be impaired by $31,000. CCC's draft non-consolidated financial statements for the December 31, 20X7, year end are set out below: Canaan's Curios Corp. Draft statement of financial position As at December 31 (in '000s) 20X7 20X6 Cash $ 481 $ 511 Accounts receivable 588 698 Inventory 190 128 Notes receivable 60 0 Land 450 550 Building (net) 803 850 Equipment (net) 1,000 1,250 Patent 450 450 Investment 350 350 Total assets $4,372 $4.787 Accounts payable $ 72 $ 65 Notes payable 0 0 Long-term debt 1,310 1,500 Bonds payable 500 500 Common shares 830 830 Retained earnings 1.660 1,892 Total liabilities and equity $4,372 $4.787 Canaan's Curios Corp. Draft statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue $3,500 Cost of goods sold 1,969 Gross profit 1,531 Sales, general, and administrative expenses 1,042 Interest expense 248 Depreciation and amortization expense 77 164 Other income Earnings before income tax expense Income tax expense 66 Net income $ 268 170 334 In worksheet Q4 Interco transactions d) Prepare a list of all intercompany transactions and balances that are pertinent to the case facts and should be eliminated upon consolidation. Hint: There are eight intercompany transactions that should be eliminated, seven of which have two applicable parts (for example, note receivableote payable = one intercompany transaction). (0.5 marks) Canaan's Curios Corp. Canaan's Curios Corp. (CCC) is a company located in Western Canada that reports its financial results in accordance with IFRS. On December 31, 20X6, CCC acquired common shares of Tymen Jungle Inc. (TJI). Four independent questions based on different quantities of shares acquired, but using the same financial results for TJI, are set out below. TJI's financial statements together with additional pertinent information follow: Tymen Jungle Inc. Statement of financial position As at December 31 (in '000s) Carrying value Fair Remaining value useful life/term to 20x7 20x6 20X6 maturity Cash $ 68 $ 35 Accounts receivable 75 48 Inventory 74 62 $ 68 N/A Land 325 175 164 N/A Building (net) 285 300 345 15 years Equipment (net) 232 400 380 5 years Patent 30 30 142 16 years Total assets $1,089 $1.050 Accounts payable $ 52 Notes payable 50 Long-term debt 300 Bonds payable 250 Common shares 180 Retained earnings 257 Total liabilities and equity $1,089 $ 37 0 400 250 180 183 $1.050 262 6 years 25 Tymen Jungle Inc. Statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue $885 Cost of goods sold 440 Gross profit 445 Sales, general, and administrative expenses 361 Interest expense 27 Depreciation and amortization expense 32 Other income 135 Earnings before income tax expense 167 Income tax expense 33 Net income $ 134 Intercompany transactions: CCC provided management services to TJI during the entire year. TJI paid $4,500 per month for this service. At December 31, 20X7, the amount owing for the services provided in December 20X7 remained unpaid. TJl rented a building to CCC for $7,000 per month. CCC rented the building for the entire year. At December 31, 20X7, CCC owed TJI $14,000 for November and December's rent. Land sale: On December 31, 20X7, CCC sold land to TJI for $150,000. CCC's net book value at time of sale was $100,000, which was the same as the estimated fair value at the acquisition date of the shares of TJI (December 31, 20X6). In consideration of the transfer, TJI paid $100,000 cash and signed a note payable to CCC for the $50,000 balance. The note is payable in full on December 31, 20X8. Interest at 5% per annum, which is the market rate of interest for an obligation of this nature, is first payable on December 31, 20X8. Inventory sales: During 20X7, CCC sold $125,000 of inventory to TJI. CCC's cost of the inventory was $95,000.25% of these goods remained unsold by TJI as at December 31, 20x7. During 20X7, TJI sold goods that it had purchased for $150,000 to CCC for $210,000; 35% of these goods remained unsold by CCC as at December 31, 20x7. Equipment sale: TJI purchased new equipment on January 1, 20X7 and immediately sold it to CCC for $70,000 cash. Tul's cost of the equipment, which had a useful life of five years, was $44,000 Additional information: 1. Both companies pay income tax at a rate of 30%. 2. Both companies use the first in, first out (FIFO) cost-flow assumption to value their inventories. 3. Both companies depreciate their depreciable assets on a straight-line basis. 4. The fair value increment on the bonds is amortized using the straight-line method. 5. Both companies account for share-issuance costs using the retained earings method.' 6. For impaiment-testing purposes, CCC established that TJl is a cash-generating unit (CGU) 7. CCC and TJI only prepare accruals and other adjusting entries at year end. Question 4 (21 marks) Assume that when CCC acquired an interest in TJI on December 31, 20X6, CCC paid $350,000 cash to acquire 60% of TJl's outstanding common shares. CCC tested the CGU for impairment on December 31, 20X7, and goodwill was found to be impaired by $31,000. CCC's draft non-consolidated financial statements for the December 31, 20X7, year end are set out below: Canaan's Curios Corp. Draft statement of financial position As at December 31 (in '000s) 20X7 20X6 Cash $ 481 $ 511 Accounts receivable 588 698 Inventory 190 128 Notes receivable 60 0 Land 450 550 Building (net) 803 850 Equipment (net) 1,000 1,250 Patent 450 450 Investment 350 350 Total assets $4,372 $4.787 Accounts payable $ 72 $ 65 Notes payable 0 0 Long-term debt 1,310 1,500 Bonds payable 500 500 Common shares 830 830 Retained earnings 1.660 1,892 Total liabilities and equity $4,372 $4.787 Canaan's Curios Corp. Draft statement of comprehensive income For the year ended December 31, 20X7 (in '000s) Sales revenue $3,500 Cost of goods sold 1,969 Gross profit 1,531 Sales, general, and administrative expenses 1,042 Interest expense 248 Depreciation and amortization expense 77 164 Other income Earnings before income tax expense Income tax expense 66 Net income $ 268 170 334 In worksheet Q4 Interco transactions d) Prepare a list of all intercompany transactions and balances that are pertinent to the case facts and should be eliminated upon consolidation. Hint: There are eight intercompany transactions that should be eliminated, seven of which have two applicable parts (for example, note receivableote payable = one intercompany transaction). (0.5 marks)