Question

Canada Manuwear Inc. (CMI) is a Montreal based company that designs, manufactures and distributes undecorated active wear (t-shirts, track pants and hoodies) in large quantities.

Canada Manuwear Inc. (CMI) is a Montreal based company that designs, manufactures and distributes undecorated active wear (t-shirts, track pants and hoodies) in large quantities. CMIs customers are primarily wholesale distributors who in turn decorate the products with designs and logos and sell the imprinted active wear. CMIs active wear products are often used for work or school uniforms, athletic team wear or company promotional materials. CMI produces approximately 150 different product styles and each style is offered in a variety of colours and sizes (approx. 3600 different combinations of style and colour). Every year CMI introduces approximately 50 new styles and colours and discontinues the same number of styles. The industry for undecorated active wear is highly competitive. Maintaining a product line that is consistent with current fashion trends is one of CMIs main competitive advantages. However, the classic T-shirt and the various colours and sizes has been a standard item in the product line since inception. The classic T-Shirt normally constitutes 30% of the inventory balance at any point in time. CMI was founded in 2008 and is equally owned by Catherine Binder and Francis Draper. Both owners are actively involved in the day to day operations of the business. Catherine oversees the sales, administrative and finance areas while Francis oversees inventory management. CMI is a profitable company and since 2008 it has experienced tremendous growth. In 2015, CMI purchased a manufacturing facility in Bradford Ontario. The purchase was financed by a $7 million bank loan. The terms of the loan require CMI to maintain a current ratio of above 1.3 and the manufacturing facility is pledged as collateral for the loan. The bank loan also requires that CMI provide audited financial statements in compliance with ASPE within 60 days of year end. CMIs year-end is December 31st.

Cotton is the main raw material used in the manufacturing. CMI mitigates fluctuations in cotton prices by purchasing cotton futures (sold in U.S. dollars). In late 2020 the costs of cotton futures declined and Catherine and Francis decided to reduce selling prices in order to pass on the cost reductions to its distributers. Due to a miscommunication between Francis and Catherine, Catherine reduced the selling prices before the reduction in cotton prices were realized. The impact was a severe reduction in gross margins for the 2021 fiscal year.

This error has caused a significant disagreement between Catherine and Francis and, as a result, Francis doesnt feel that she can continue to work collaboratively with Catherine anymore. She is considering triggering a buy-out clause in the shareholders agreement. The clause allows her to purchase Catherines shares for 5 times net income. Once Francis places this offer, Catherine must either accept the offer or counter the offer with a 30% premium.

CMIs credit risk for trade accounts receivable is highly concentrated as the majority of its sales are to a relatively small group of wholesale distributors. CMIs ten largest customers constitute 61% of total trade receivable and its largest customer, Print and Go Inc. accounts for 20% of total accounts receivable. Many of CMIs customers are highly leveraged and rely on CMI providing favourable credit terms. Most customers receive 45 day terms and long standing customers receive 60 day terms. Terms greater than 30 days are standard in the industry because of the time lapse between when the wholesale distributer will ultimately receive collection from the end consumer.

Extending credit to customers involves considerable judgment. CMI has a dedicated credit manager, Nancy Tight, who evaluates each customers financial condition and payment history. It is her responsibility to prepare recommendations for customer credit limits and payment terms. Nancy reviews external credit ratings (if available), the customers financial statements and obtains bank and other references. In the case of existing customers she also reviews the customers past payment history. Based on this analysis she prepares a recommendation and forwards it to Francis for approval.

Francis is very conservative when it comes to granting credit to new customers or increasing credit limits of existing customers. She diligently reviews the research conducted by Nancy. She often requires Nancy to reduce her recommended limits and has often denied extending credit to potential customers despite Nancys recommendation. Historically, due to this stringent process, CMI has had insignificant bad debts.

Once new customers are approved Nancy enters the new customer details and agreed upon terms into the companys ERP system. Nancy and Francis are the only employees who have access rights to add new customers and make changes to credit terms. The system requires that Francis approve all changes. At the end of each week the system generates a report noting all changes to the customer Masterfile. This report is reviewed by both Francis and Catherine.

When customer orders are received they are entered into the system by a customer order clerk. The system automatically validates the order and performs a check to ensure the order value plus the current customer balance is below the authorized credit limit. When goods are shipped, the system automatically generates the sales invoice and the sales is recorded. Standard sales terms are FOB shipping point.

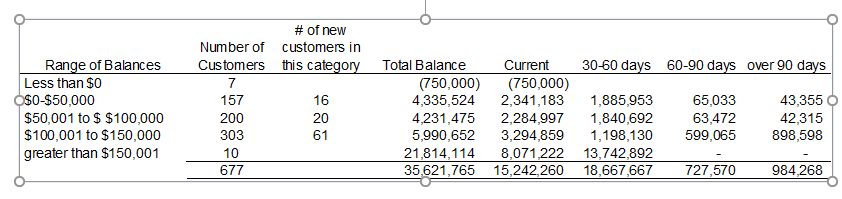

The accounts receivable aging for the period ended December 31st 2021 is as follows:

When Catherine reduced the selling prices many customers complained that they had recently purchased the large quantities of product at the historical price. Many customers threatened to find a new supplier and since CMI offers a right to return up to 30 days they threatened to return the merchandise. Catherine provided relief to these customers by offering all suppliers a price concession for orders they placed and delivered up to 3 months prior to the price change coming into effect. All customers were issued credit notes for the difference between the new selling price and the price they had paid for the merchandise.

Catherine made this decision unilaterally without consulting Francis. It was this decision that caused the current ratio of the company to decline to 1.29. This is one of the main reasons why Francis feels she can no longer work with Catherine. Catherine has a tendency to make unilateral decisions without consulting Francis.

Inventory consists mainly of raw materials and finished goods. Average cost is the costing method used to value inventory. Inventory counts take place on December 31st of each year. The warehouse is closed on December 31st and all items are tagged in numerical sequence. Counters work in pairs and recount the others work. Francis prepares detailed count instructions and supervises the count. At the end of the count Francis ensures all tags are accounted for. The results are entered into the system and a report is generated noting all products which had discrepancies between the count quantity and the quantity recorded in the perpetual records. All discrepancies of greater $20,000 are recounted.

One area of the warehouse is maintained to hold slow moving items. When trends change and styles are discontinued Francis ensures that the items are protected from getting damaged and stores them in the slow moving section. She saves the items in anticipation of the trend for that particular item or colour will comeback in fashion.

Required: You are the audit senior on the CMI audit engagement and this is the first year your firm is completing the audit. Previously, the audit was conducted by a local sole practitioner. The audit manager has asked that you complete the following components of the audit file.

Overall Risk of Material Misstatement (RMM)

Sales & A/R cycle

Part A. Identify 2 factors which impact the RMM for sales and accounts receivable cycle. For each factor indicate the relevant account(s) and related assertion(s), the impact on RMM (increase or decrease), the type of risk (inherent or control) and the rationale for the impact. (5 marks)

Part B. Assume that you have decided to rely on controls in the sales cycle. Select 3 different controls in the sales cycle. For each control provide a procedure that would test the effectiveness of control.

Use the following chart format to complete your answer.

PART C. Prepare the audit plan for the accounts receivable confirmations. The plan should include:

i. The type of confirmations to be used: positive or negative confirmations. Include a rationale based on case facts.

Inventory Cycle

Part D. Identify 2 factors which impact the RMM for inventory cycle. For each factor indicate the relevant related assertion(s), the impact on RMM (increase or decrease), the type of risk (inherent or control) and the rationale for the impact.

PART E. Based on the case facts, prepare an audit plan which outlines 4 procedures that the auditor should perform during the inventory count. For each procedure indicate the related assertion.

30-60 days 60-90 days over 90 days Range of Balances Less than $0 O$0-$50,000 $50,001 to $ $100,000 $100,001 to $150,000 greater than $150,001 # of new Number of customers in Customers this category 7 157 16 200 20 303 61 10 677 Total Balance (750,000) 4,335,524 4,231,475 5,990,652 21,814,114 35,621,765 Current (750,000) 2,341,183 2,284,997 3,294,859 8,071,222 15,242,260 1,885,953 1,840,692 1,198,130 13,742,892 18,667,667 65,033 63,472 599,065 43,355 42,315 898,598 727,570 984,268 Description of Factor Relevant Type of Risk Account(s) and (Inherent or Related Control) Assertion(s) Impact on RMM (increase or decrease) and Rationale Description of Factor Relevant Type of Risk Account(s) and (Inherent or Related Control) Assertion(s) Impact on RMM ( increase or decrease) and Rationale + Control in Sales Cycle Procedure that would test the effectiveness of the control Description of Factor Relevant Assertion(s) Impact on RMM (increase or decrease) and Rationale 30-60 days 60-90 days over 90 days Range of Balances Less than $0 O$0-$50,000 $50,001 to $ $100,000 $100,001 to $150,000 greater than $150,001 # of new Number of customers in Customers this category 7 157 16 200 20 303 61 10 677 Total Balance (750,000) 4,335,524 4,231,475 5,990,652 21,814,114 35,621,765 Current (750,000) 2,341,183 2,284,997 3,294,859 8,071,222 15,242,260 1,885,953 1,840,692 1,198,130 13,742,892 18,667,667 65,033 63,472 599,065 43,355 42,315 898,598 727,570 984,268 Description of Factor Relevant Type of Risk Account(s) and (Inherent or Related Control) Assertion(s) Impact on RMM (increase or decrease) and Rationale Description of Factor Relevant Type of Risk Account(s) and (Inherent or Related Control) Assertion(s) Impact on RMM ( increase or decrease) and Rationale + Control in Sales Cycle Procedure that would test the effectiveness of the control Description of Factor Relevant Assertion(s) Impact on RMM (increase or decrease) and Rationale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started