Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canada Semiconductor Inc (CSCI) makes software and circuit boards for secure communications. The firm is privately held, and all equity financed. To preserve its ultra-high

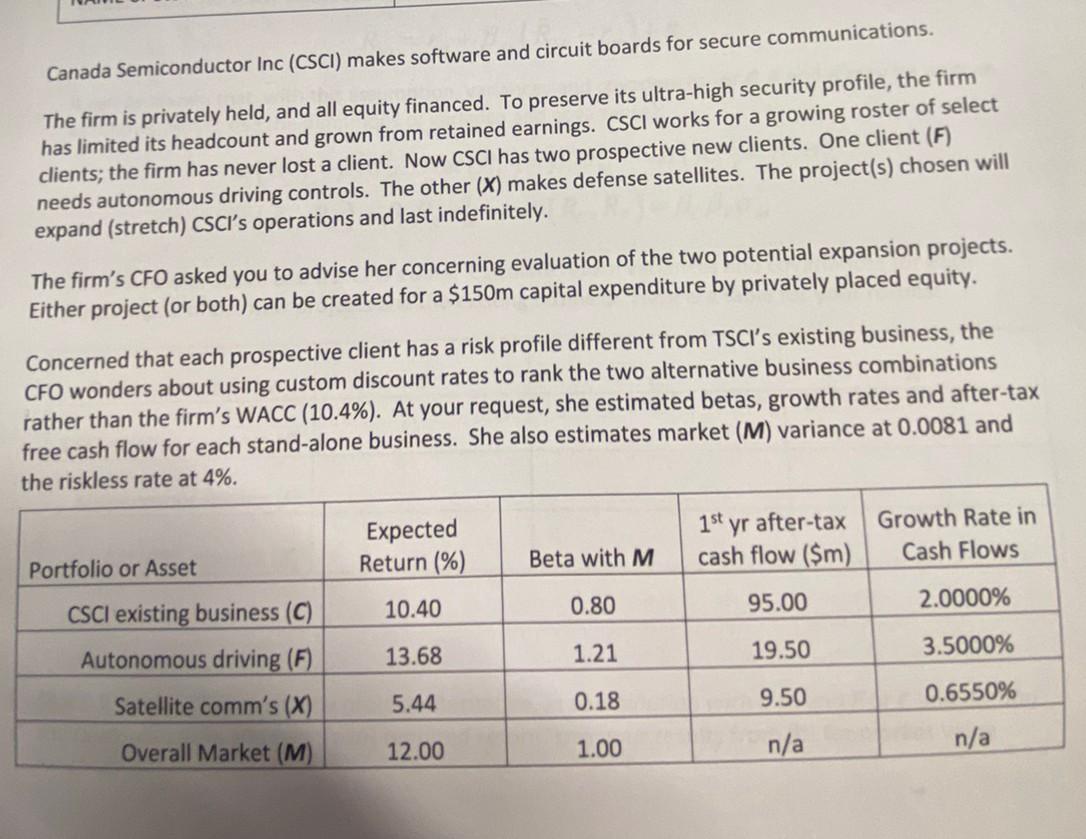

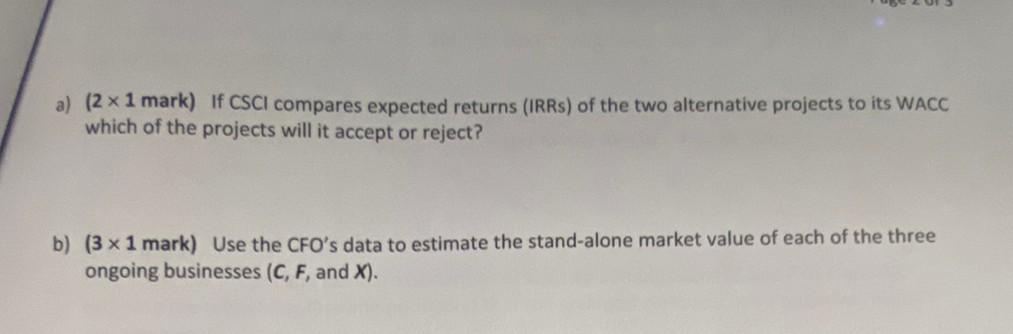

Canada Semiconductor Inc (CSCI) makes software and circuit boards for secure communications. The firm is privately held, and all equity financed. To preserve its ultra-high security profile, the firm has limited its headcount and grown from retained earnings. CSCI works for a growing roster of select clients; the firm has never lost a client. Now CSCI has two prospective new clients. One client (F) needs autonomous driving controls. The other (X) makes defense satellites. The project(s) chosen will expand (stretch) CSCI's operations and last indefinitely. The firm's CFO asked you to advise her concerning evaluation of the two potential expansion projects. Either project (or both) can be created for a $150m capital expenditure by privately placed equity. Concerned that each prospective client has a risk profile different from TSCI's existing business, the CFO wonders about using custom discount rates to rank the two alternative business combinations rather than the firm's WACC (10.4\%). At your request, she estimated betas, growth rates and after-tax free cash flow for each stand-alone business. She also estimates market (M) variance at 0.0081 and a) ( 21 mark) If CSCI compares expected returns (IRRs) of the two alternative projects to its WACC which of the projects will it accept or reject? b) ( 31 mark) Use the CFO's data to estimate the stand-alone market value of each of the three ongoing businesses (C,F, and X )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started