Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canadian Parent Company (Parent) has an accounts receivable of US$100,000 due in 30 days. This amount is reflected on the Parent stand-alone statement of

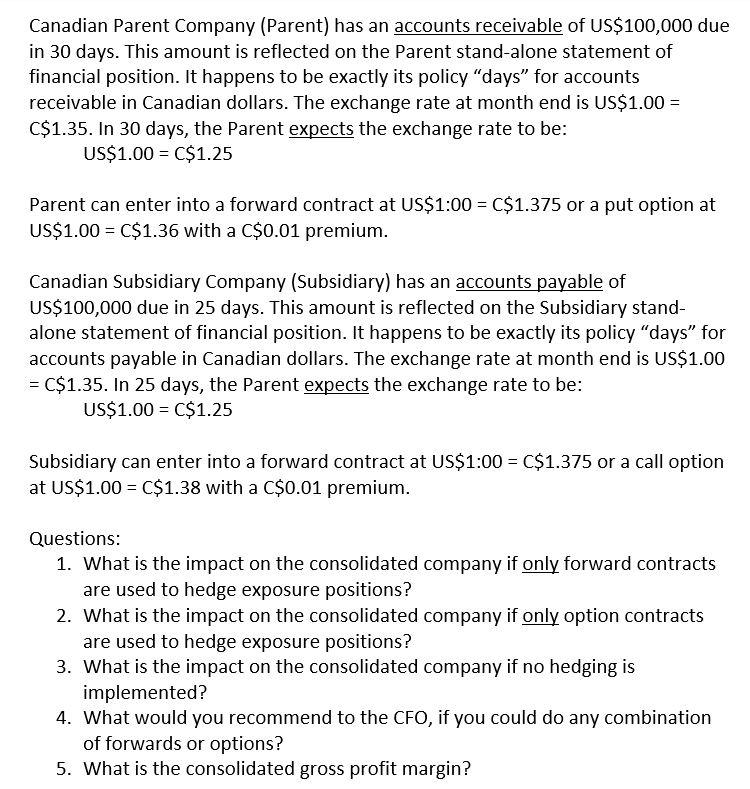

Canadian Parent Company (Parent) has an accounts receivable of US$100,000 due in 30 days. This amount is reflected on the Parent stand-alone statement of financial position. It happens to be exactly its policy "days" for accounts receivable in Canadian dollars. The exchange rate at month end is US$1.00 = C$1.35. In 30 days, the Parent expects the exchange rate to be: US$1.00 C$1.25 Parent can enter into a forward contract at US$1:00 = C$1.375 or a put option at US$1.00 = C$1.36 with a C$0.01 premium. Canadian Subsidiary Company (Subsidiary) has an accounts payable of US$100,000 due in 25 days. This amount is reflected on the Subsidiary stand- alone statement of financial position. It happens to be exactly its policy "days" for accounts payable in Canadian dollars. The exchange rate at month end is US$1.00 = C$1.35. In 25 days, the Parent expects the exchange rate to be: US$1.00 C$1.25 Subsidiary can enter into a forward contract at US$1:00 = C$1.375 or a call option at US$1.00 = C$1.38 with a C$0.01 premium. Questions: 1. What is the impact on the consolidated company if only forward contracts are used to hedge exposure positions? 2. What is the impact on the consolidated company if only option contracts are used to hedge exposure positions? 3. What is the impact on the consolidated company if no hedging is implemented? 4. What would you recommend to the CFO, if you could do any combination of forwards or options? 5. What is the consolidated gross profit margin?

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Impact on the consolidated company if only forward contracts are used to hedge exposure positions Using forward contracts would lock in the exchange rates for both the accounts receivable and accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started