Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The 1-year risk-free interest rate of investments in US dollars is TUSD = 1.46%. The 1-year risk-free interest rate of investments in Canadian dollars

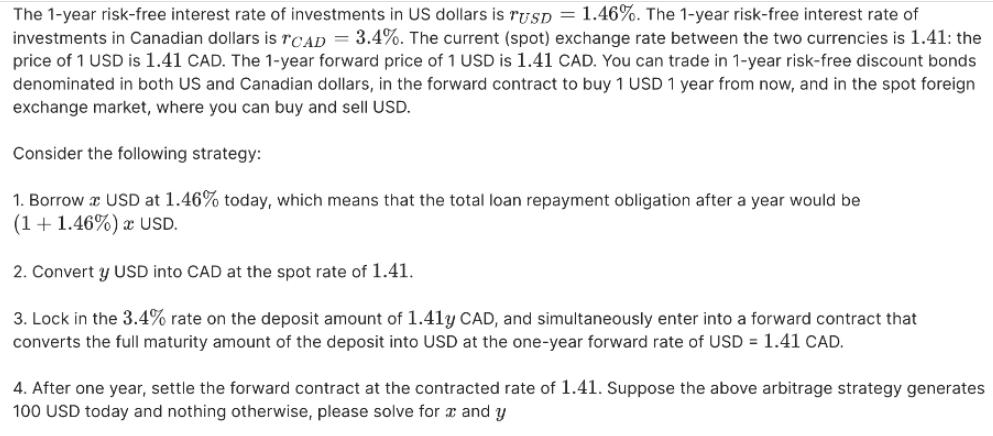

The 1-year risk-free interest rate of investments in US dollars is TUSD = 1.46%. The 1-year risk-free interest rate of investments in Canadian dollars is TCAD = 3.4%. The current (spot) exchange rate between the two currencies is 1.41: the price of 1 USD is 1.41 CAD. The 1-year forward price of 1 USD is 1.41 CAD. You can trade in 1-year risk-free discount bonds denominated in both US and Canadian dollars, in the forward contract to buy 1 USD 1 year from now, and in the spot foreign exchange market, where you can buy and sell USD. Consider the following strategy: 1. Borrow a USD at 1.46% today, which means that the total loan repayment obligation after a year would be (1 + 1.46%) x USD. 2. Convert y USD into CAD at the spot rate of 1.41. 3. Lock in the 3.4% rate on the deposit amount of 1.41y CAD, and simultaneously enter into a forward contract that converts the full maturity amount of the deposit into USD at the one-year forward rate of USD = 1.41 CAD. 4. After one year, settle the forward contract at the contracted rate of 1.41. Suppose the above arbitrage strategy generates 100 USD today and nothing otherwise, please solve for x and y

Step by Step Solution

★★★★★

3.38 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

This is a covered interest arbitrage opportunity which involves borrowing in one currency conv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started