Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rachel Ebbett is the controller for New Age Battery Manufacturing (NABM) and she has been asked by her CFO to prepare the company's financial

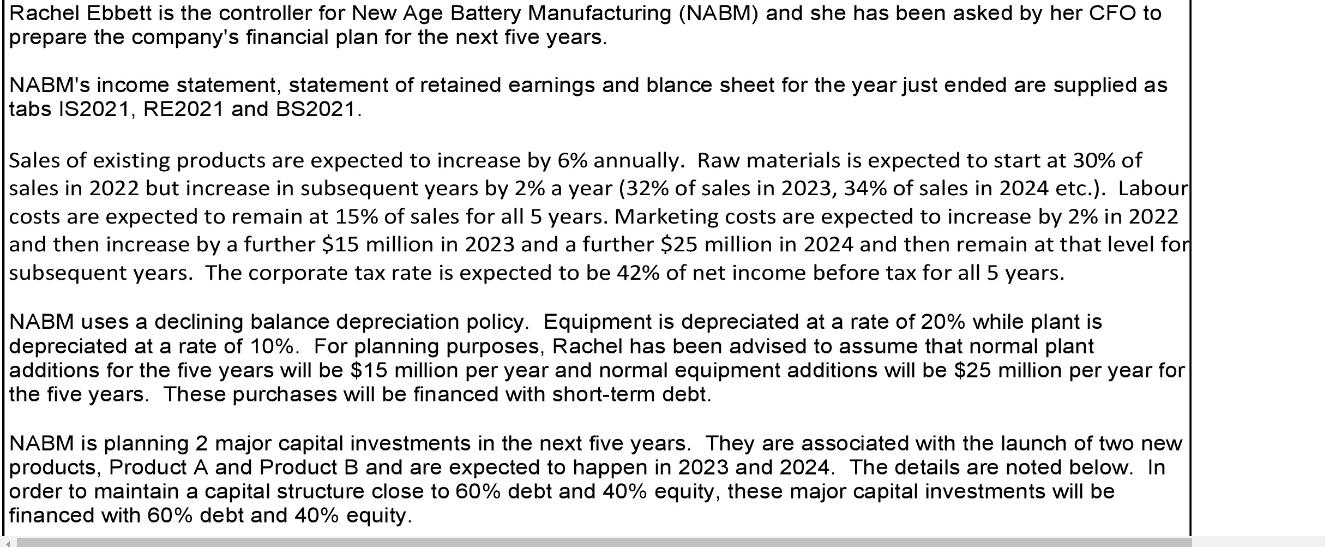

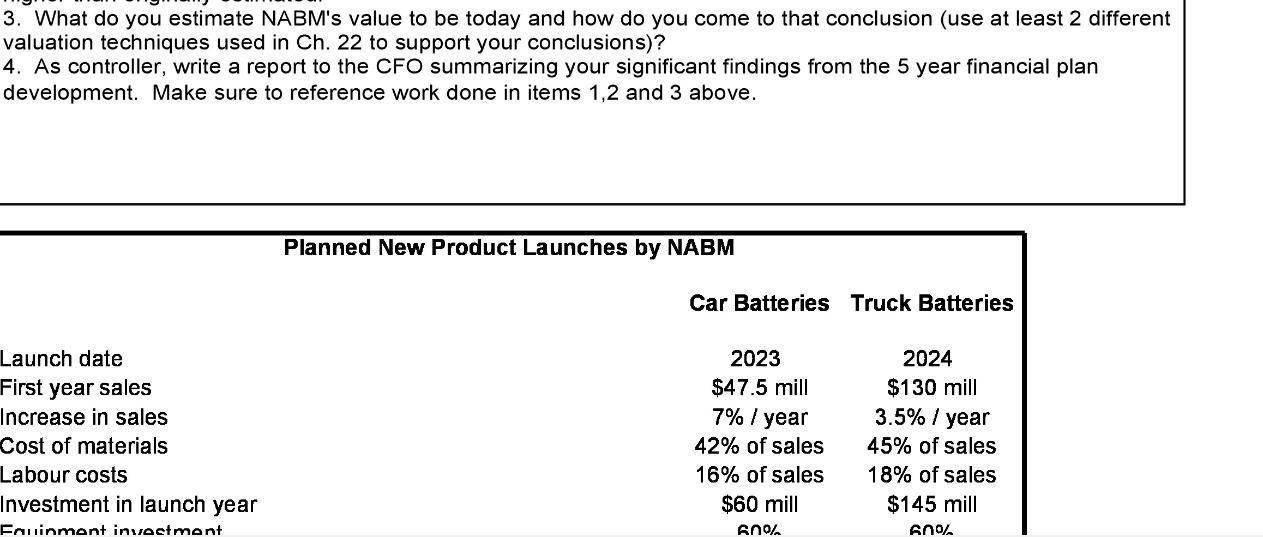

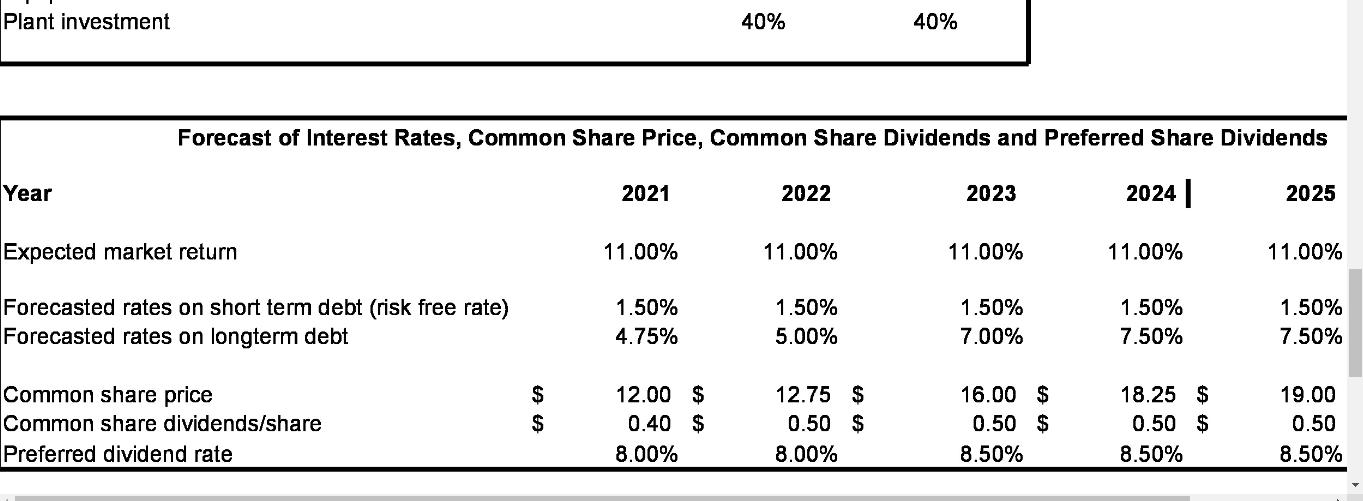

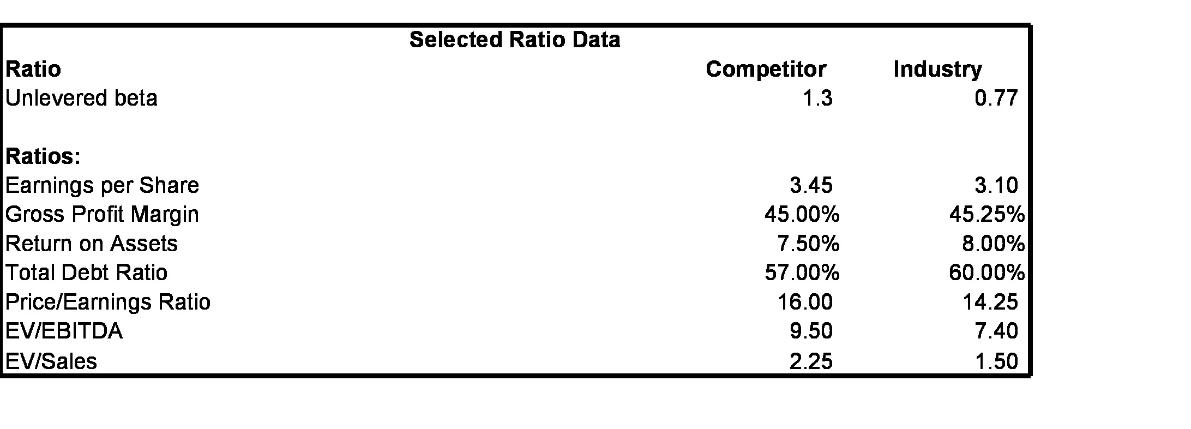

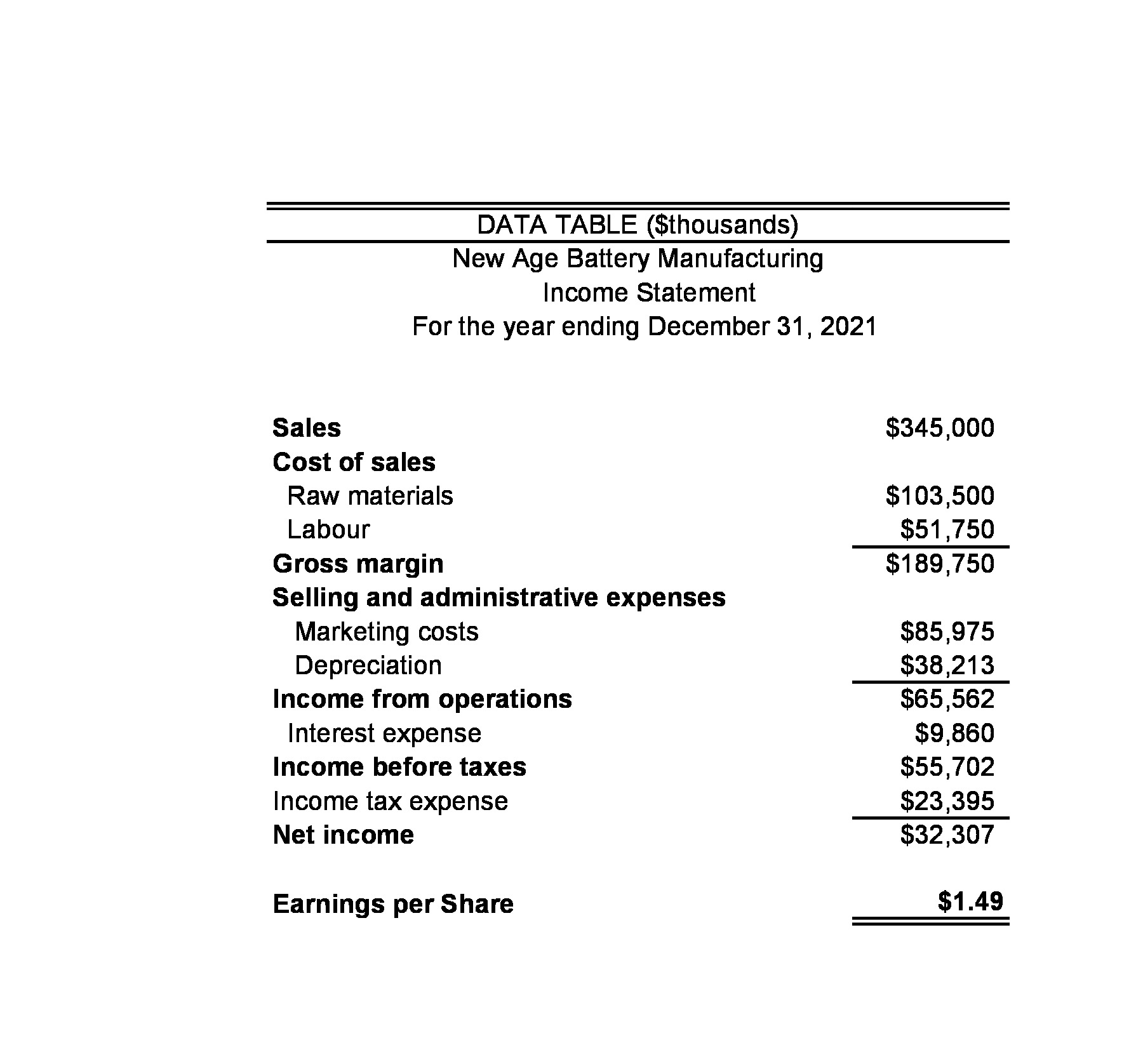

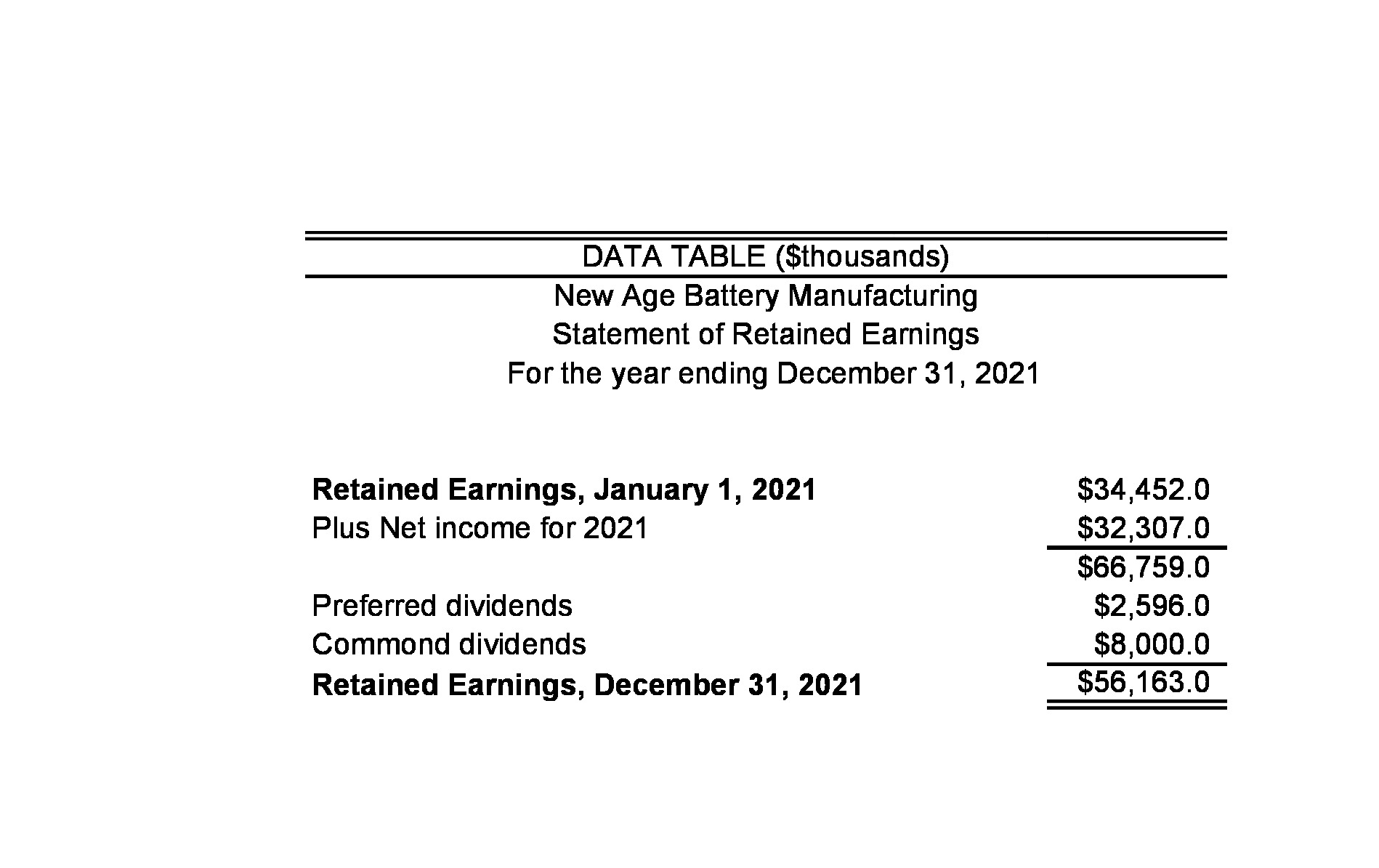

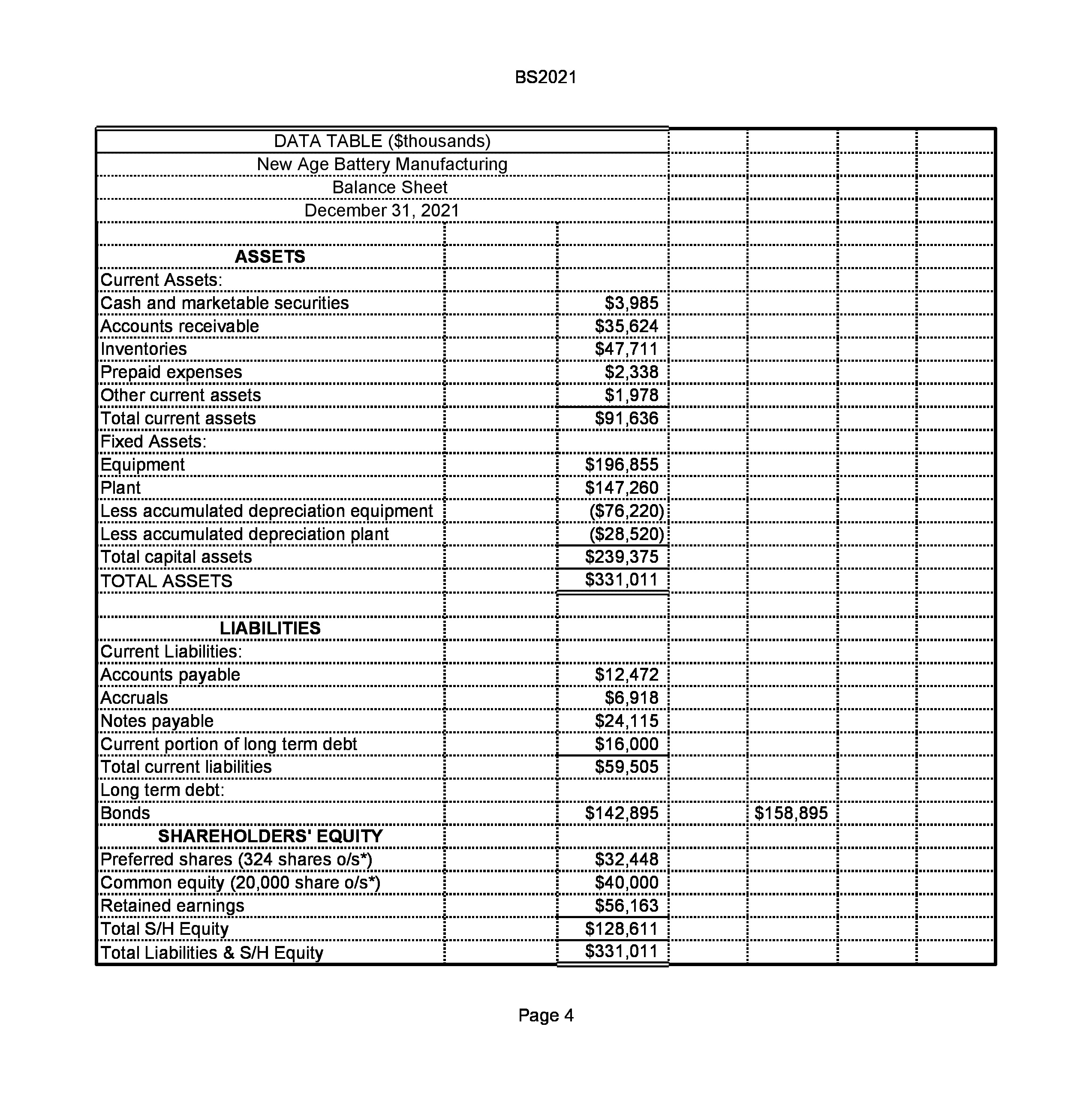

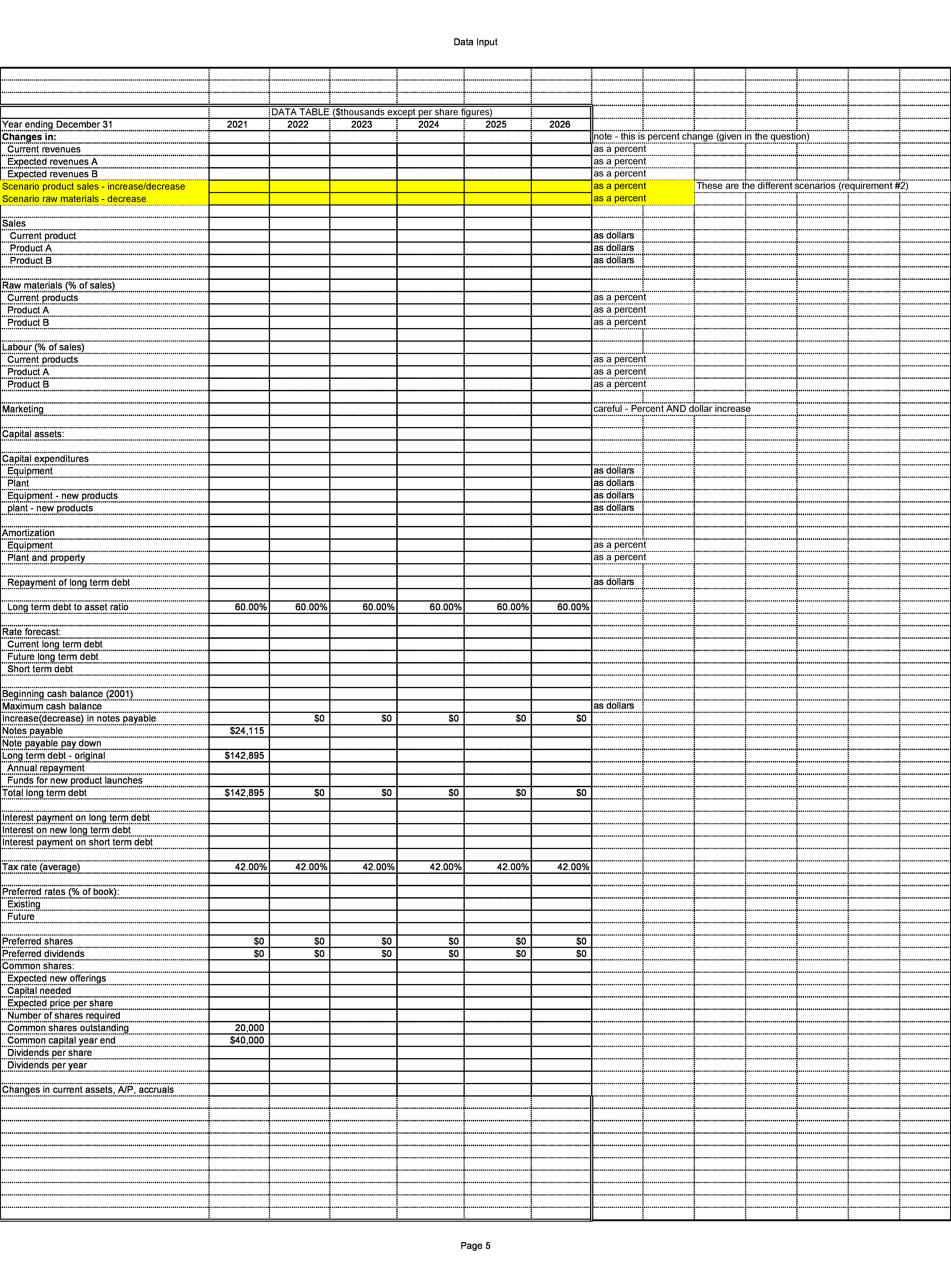

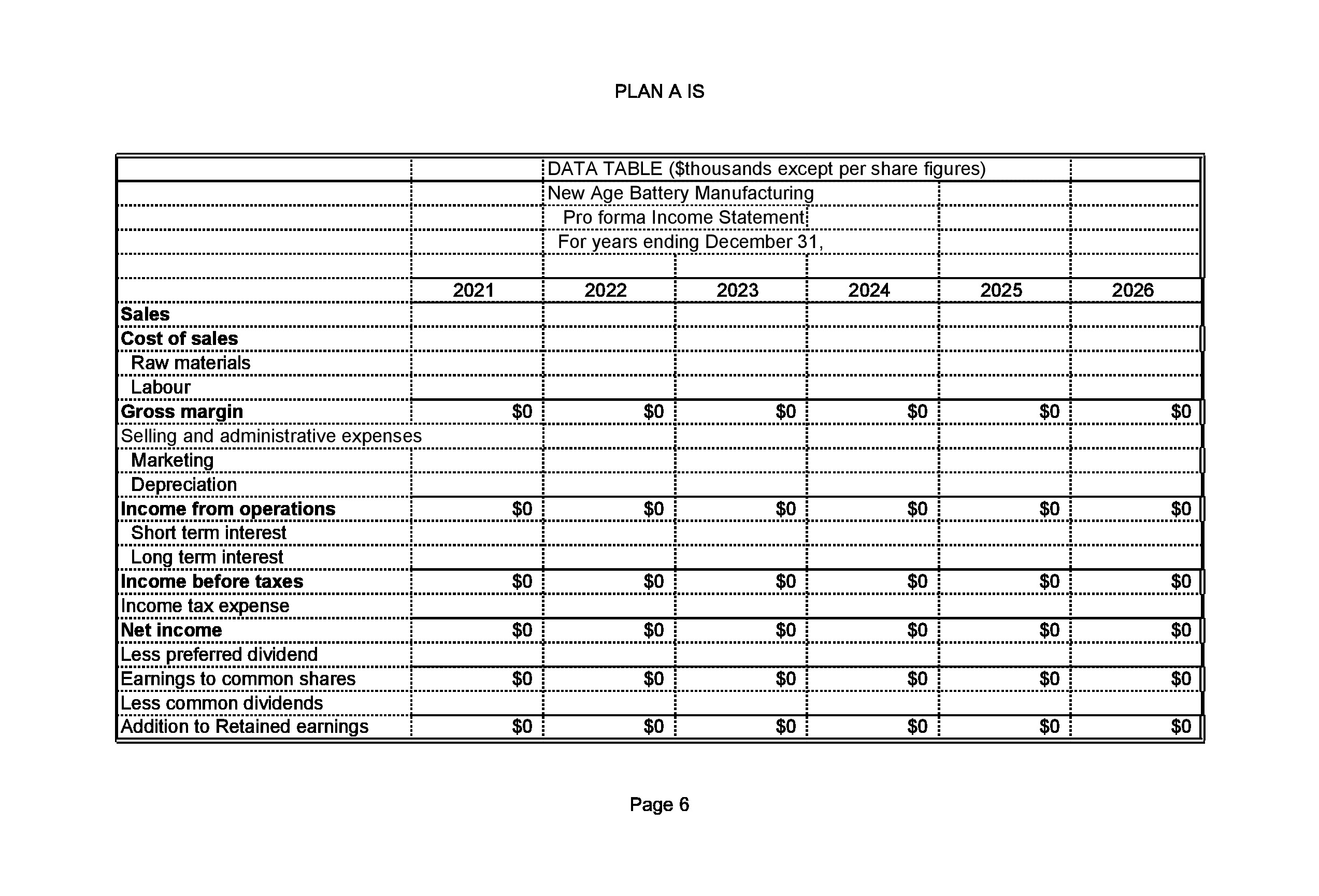

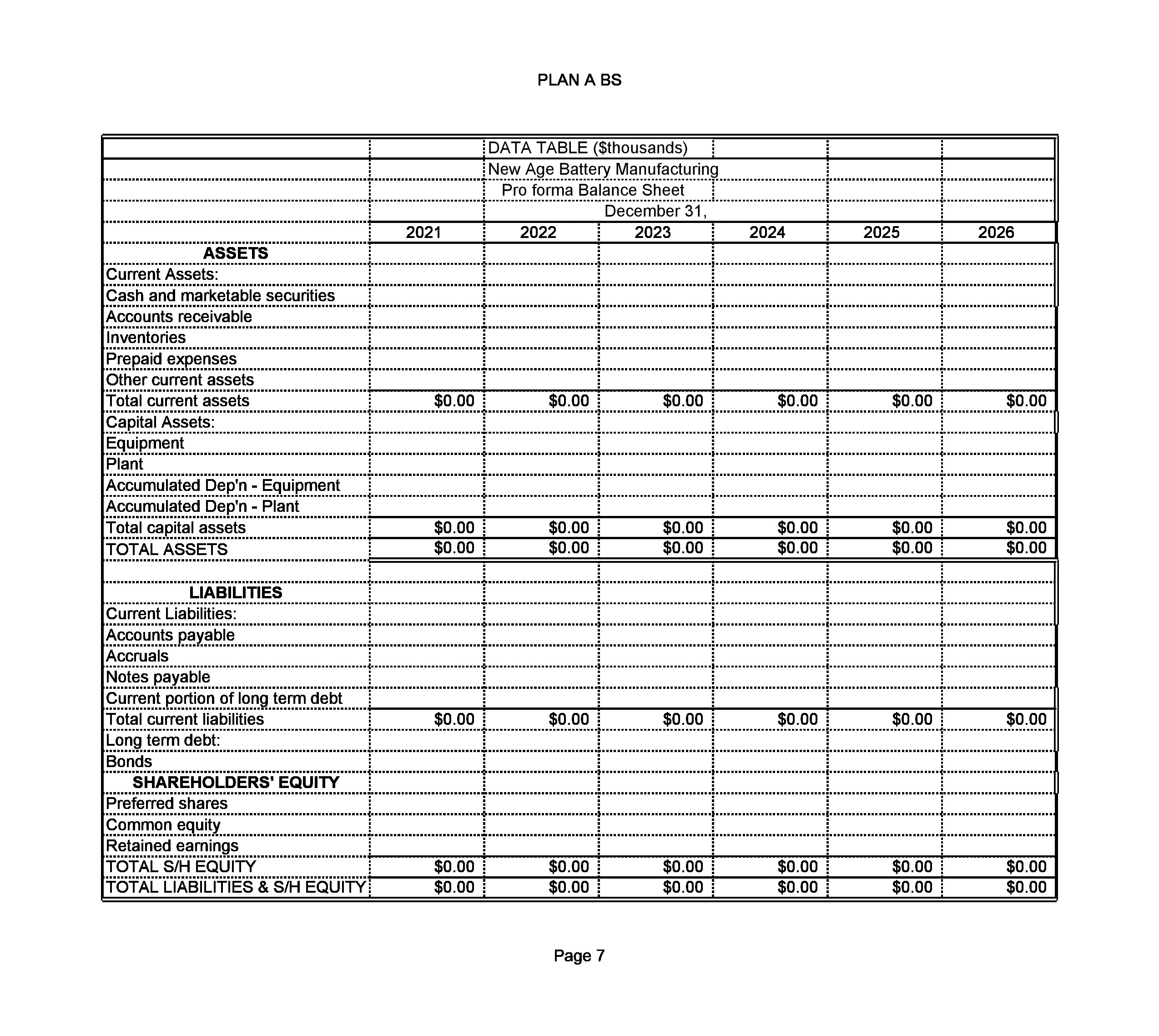

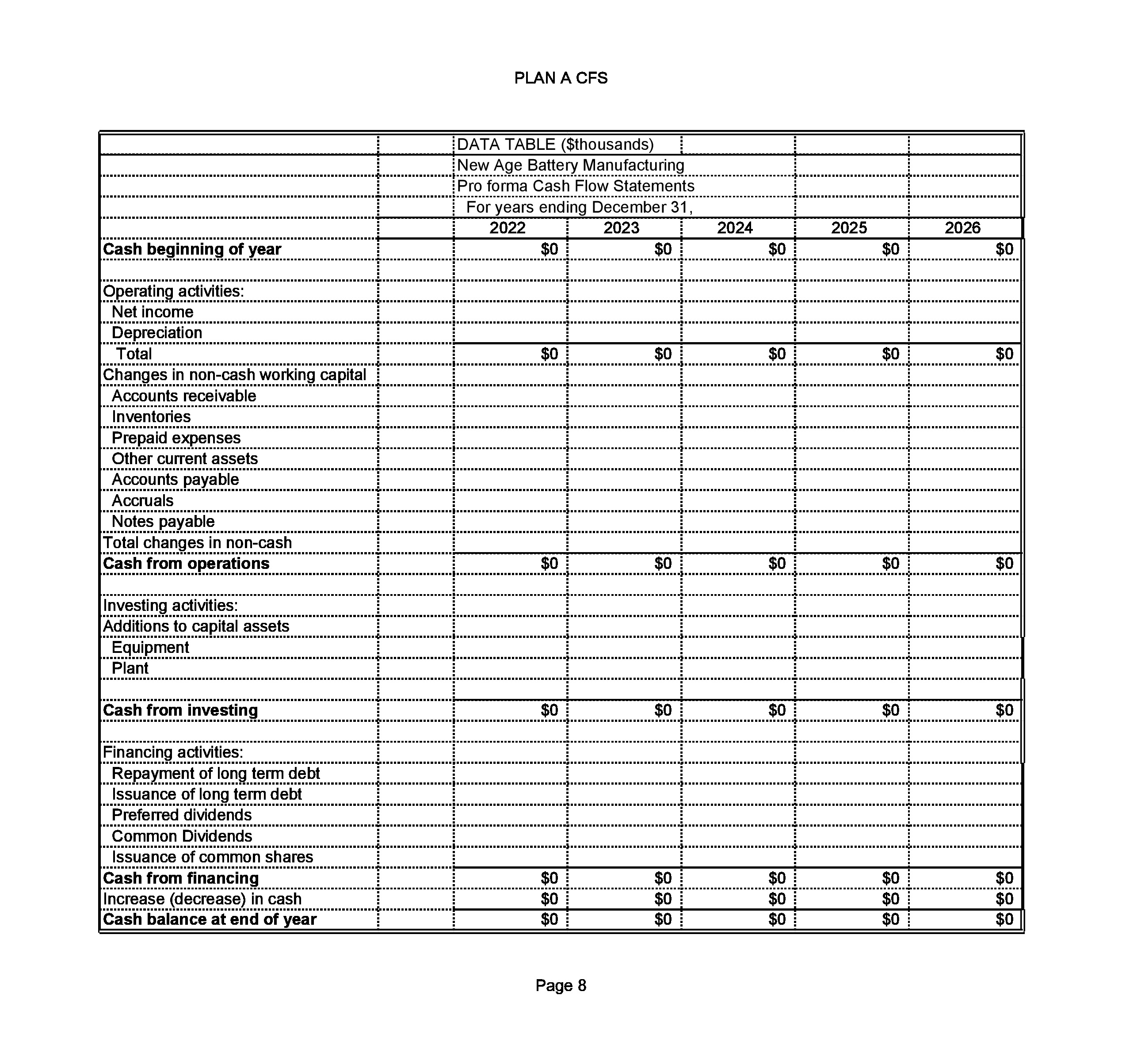

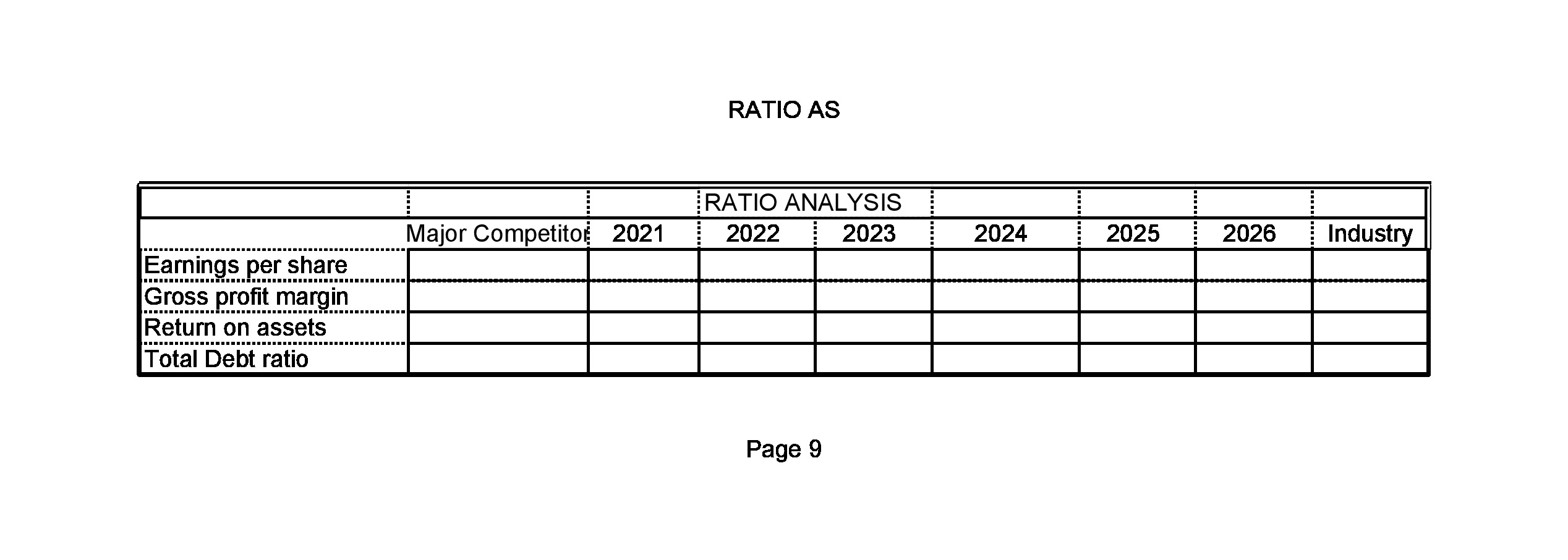

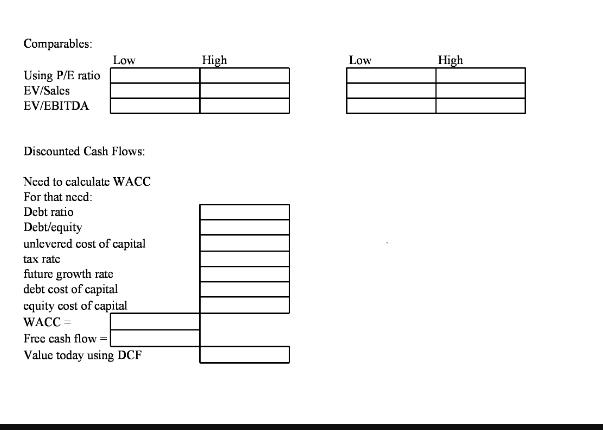

Rachel Ebbett is the controller for New Age Battery Manufacturing (NABM) and she has been asked by her CFO to prepare the company's financial plan for the next five years. NABM's income statement, statement of retained earnings and blance sheet for the year just ended are supplied as tabs IS2021, RE2021 and BS2021. Sales of existing products are expected to increase by 6% annually. Raw materials is expected to start at 30% of sales in 2022 but increase in subsequent years by 2% a year (32% of sales in 2023, 34% of sales in 2024 etc.). Labour costs are expected to remain at 15% of sales for all 5 years. Marketing costs are expected to increase by 2% in 2022 and then increase by a further $15 million in 2023 and a further $25 million in 2024 and then remain at that level for subsequent years. The corporate tax rate is expected to be 42% of net income before tax for all 5 years. NABM uses a declining balance depreciation policy. Equipment is depreciated at a rate of 20% while plant is depreciated at a rate of 10%. For planning purposes, Rachel has been advised to assume that normal plant additions for the five years will be $15 million per year and normal equipment additions will be $25 million per year for the five years. These purchases will be financed with short-term debt. NABM is planning 2 major capital investments in the next five years. They are associated with the launch of two new products, Product A and Product B and are expected to happen in 2023 and 2024. The details are noted below. In order to maintain a capital structure close to 60% debt and 40% equity, these major capital investments will be financed with 60% debt and 40% equity. Rachel also received a memo from NABM's investment advisors with their analysis of market returns and forecast for interest rates, both short term and long term rates and common share prices and forecasted dividends for both common and preferred shares. See chart below. Short term debt has variable rate interest and long term debt has fixed interest rates. To minimize short term interest and increase asset efficiency any access cash beyond a year end balance of $40,000 will be used to pay down notes payable at the beginning of the next year. Normally NABM's current assets, accounts payable and accruals grow at the same rate as sales growth. Notes payable are mainly loans from NABM's line of credit and are used to finance any normal fixed asset purchases. NABM is required to pay $16 million of its long term debt annually. As part of Rachel's financial plan development she has been asked to estimate NABM's value today considering comparables and future cash flows.. Some valuation relevant ratios for a major competitor and the average for the industry within which NABM operates have been provided below. Required: 1. As controller, write a report to the CFO summarizing your significant findings from the 5 year financial plan development. To support your findings you will need to complete a cash budget, proforma income statement and balance sheet and a proper ratio analysis using the ratios provided. 2. Perform some scenario analysis considering the impact if sales for each new product launch is 15% lower than estimated and 10% higher than estimated. NABM's new products are related to the electric vehicle battery industry. Also consider what happens if there is a shortage in raw materials and as a result all raw material costs are 20% higher than originally estimated. 3. What do you estimate NABM's value to be today and how do you come to that conclusion (use at least 2 different 3. What do you estimate NABM's value to be today and how do you come to that conclusion (use at least 2 different valuation techniques used in Ch. 22 to support your conclusions)? 4. As controller, write a report to the CFO summarizing your significant findings from the 5 year financial plan development. Make sure to reference work done in items 1,2 and 3 above. Launch date First year sales Increase in sales Cost of materials Labour costs Investment in launch year Fauinment investment Planned New Product Launches by NABM Car Batteries Truck Batteries 2023 $47.5 mill 7% / year 42% of sales 16% of sales $60 mill 60% 2024 $130 mill 3.5% / year 45% of sales 18% of sales $145 mill 60% Plant investment Year Expected market return Forecasted rates on short term debt (risk free rate) Forecasted rates on longterm debt Forecast of Interest Rates, Common Share Price, Common Share Dividends and Preferred Share Dividends Common share price Common share dividends/share Preferred dividend rate $ $ SA SA 2021 11.00% 1.50% 4.75% 12.00 $ 0.40 $ 40% 8.00% 2022 11.00% 1.50% 5.00% 40% 12.75 $ $ 0.50 8.00% 2023 11.00% 1.50% 7.00% 16.00 $ 0.50 $ 8.50% 2024 11.00% 1.50% 7.50% 18.25 $ 0.50 $ 8.50% 2025 11.00% 1.50% 7.50% 19.00 0.50 8.50% Ratio Unlevered beta Ratios: Earnings per Share Gross Profit Margin Return on Assets Total Debt Ratio Price/Earnings Ratio EV/EBITDA EV/Sales Selected Ratio Data Competitor 1.3 3.45 45.00% 7.50% 57.00% 16.00 9.50 2.25 Industry 0.77 3.10 45.25% 8.00% 60.00% 14.25 7.40 1.50 DATA TABLE ($thousands) New Age Battery Manufacturing Income Statement For the year ending December 31, 2021 Sales Cost of sales Raw materials Labour Gross margin Selling and administrative expenses Marketing costs Depreciation Income from operations Interest expense Income before taxes Income tax expense Net income Earnings per Share $345,000 $103,500 $51,750 $189,750 $85,975 $38,213 $65,562 $9,860 $55,702 $23,395 $32,307 $1.49 DATA TABLE ($thousands) New Age Battery Manufacturing Statement of Retained Earnings For the year ending December 31, 2021 Retained Earnings, January 1, 2021 Plus Net income for 2021 Preferred dividends Commond dividends Retained Earnings, December 31, 2021 $34,452.0 $32,307.0 $66,759.0 $2,596.0 $8,000.0 $56,163.0 DATA TABLE ($thousands) New Age Battery Manufacturing Balance Sheet ASSETS Current Assets: Cash and marketable securities Accounts receivable Inventories December 31, 2021 Prepaid expenses Other current assets Total current assets Fixed Assets: Equipment Plant Less accumulated depreciation equipment Less accumulated depreciation plant Total capital assets TOTAL ASSETS Current Liabilities: Accounts payable Accruals Long term debt: Bonds LIABILITIES - Notes payable Current portion of long term debt Total current liabilities SHAREHOLDERS' EQUITY Preferred shares (324 shares o/s*) Common equity (20,000 share o/s*) Retained earnings Total S/H Equity Total Liabilities & S/H Equity BS2021 Page 4 $3,985 $35,624 $47,711 $2,338 $1,978 $91,636 $196,855 $147,260 ($76,220) ($28,520) $239,375 $331,011 $12,472 $6,918 $24,115 $16,000 $59,505 $142,895 $32,448 $40,000 $56,163 $128,611 $331,011 $158,895 Year ending December 31 Changes in: Current revenues Expected revenues A Expected revenues B Scenario product sales - increase/decrease Scenario raw materials - decrease Sales Current product Product A Product B Raw materials (% of sales) Current products Product A Product B Labour (% of sales) Current products Product A Product B ------------------------------------------------------------- Marketing Capital assets: Capital expenditures Equipment Plant Equipment - new products plant - new products Amortization Equipment Plant and property Repayment of long term debt Long term debt to asset ratio Rate forecast: Current long term debt Future long term debt Short term debt Beginning cash balance (2001) Maximum cash balance Increase(decrease) in notes payable Notes payable Note payable pay down Long term debt - original Preferred shares Preferred dividends Common shares: Annual repayment Funds for new product launches Total long term debt Interest payment on long term debt Interest on new long term debt Interest payment on short term debt Tax rate (average) Preferred rates (% of book): Existing Future Expected new offerings Capital needed Expected price per share Number of shares required - Common shares outstanding Common capital year end Dividends per share Dividends per year Changes in current assets, A/P, accruals 2021 60.00% $24,115 $142,895 $142,895 42.00% $0 $0 20,000 $40,000 DATA TABLE ($thousands except per share figures) 2022 2023 2024 60.00% $0 $0 42.00% $0 $0 60.00% $0 $0 42.00% Data Input $0 $0 60.00% $0 $0 42.00% $0 $0 2025 Page 5 60.00% $0 $0 42.00% 818 $0 $0 2026 60.00% $0 $0 42.00% $0 $0 note - this is percent change (given in the question) as a percent as a percent as a percent as a percent as a percent as dollars as dollars as dollars as a percent as a percent as a percent as a percent as a percent as a percent as dollars as dollars as dollars as dollars careful - Percent AND dollar increase I F as a percent as a percent as dollars as dollars These are the different scenarios (requirement #2) Sales Cost of sales Raw materials Labour Gross margin Selling and administrative expenses Marketing Depreciation Income from operations Short term interest Long term interest Income before taxes Income tax expense Net income Less preferred dividend Earnings to common shares Less common dividends Addition to Retained earnings 2021 $0 $0 $0 $0 $0 $0 PLAN A IS DATA TABLE ($thousands except per share figures) New Age Battery Manufacturing Pro forma Income Statement For years ending December 31, 2022 $0 $0 $0 $0 $0 $0 Page 6 2023 $0 $0 $0 $0 $0 $0 2024 $0 $0 $0 $0 $0 $0 2025 $0 $0 $0 $0 $0 $0 2026 $0 $0 $0 $0 $0 $0 ASSETS Current Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Other current assets Total current assets Capital Assets: Equipment Plant Accumulated Dep'n - Equipment Accumulated Dep'n - Plant Total capital assets TOTAL ASSETS LIABILITIES Current Liabilities: Accounts payable Accruals Notes payable Current portion of long term debt Total current liabilities Long term debt: Bonds SHAREHOLDERS' EQUITY Preferred shares Common equity Retained earnings TOTAL S/H EQUITY TOTAL LIABILITIES & S/H EQUITY 2021 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 PLAN A BS DATA TABLE ($thousands) New Age Battery Manufacturing Pro forma Balance Sheet 2022 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Page 7 December 31, 2023 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 2024 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 2025 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 2026 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Cash beginning of year Operating activities: Net income Depreciation Total Changes in non-cash working capital Accounts receivable Inventories Prepaid expenses Other current assets Accounts payable Accruals Notes payable Total changes in non-cash Cash from operations Investing activities: Additions to capital assets Equipment Plant Cash from investing Financing activities: Repayment of long term debt Issuance of long term debt Preferred dividends Common Dividends Issuance of common shares Cash from financing Increase (decrease) in cash Cash balance at end of year PLAN A CFS DATA TABLE ($thousands) I New Age Battery Manufacturing Pro forma Cash Flow Statements For years ending December 31, 2022 2023 $0 $0 $0 $0 $0 888 $0 $0 Page 8 $0 $0 $0 $0 $0 $0 $0 2024 $0 $0 $0 $0 $0 $0 $0 2025 $0 $0 $0 $0 $0 $0 $0 2026 $0 $0 $0 $0 $0 $0 $0 Earnings per share Gross profit margin Return on assets Total Debt ratio Major Competito 2021 RATIO AS RATIO ANALYSIS 2022 2023 Page 9 2024 2025 2026 Industry Comparables: Using P/E ratio EV/Sales EV/EBITDA Low Discounted Cash Flows: Need to calculate WACC For that need: Debt ratio Debt/equity unlevered cost of capital tax ratc future growth rate debt cost of capital equity cost of capital WACC = Free cash flow = Value today using DCF High Low High

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to address the requirements 1 Report to CFO Complete 5year cash budget pro forma ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started