Answered step by step

Verified Expert Solution

Question

1 Approved Answer

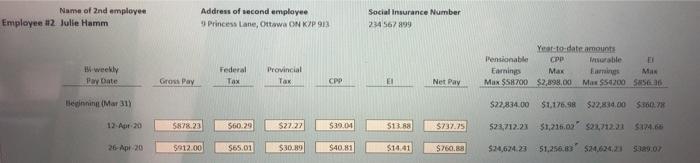

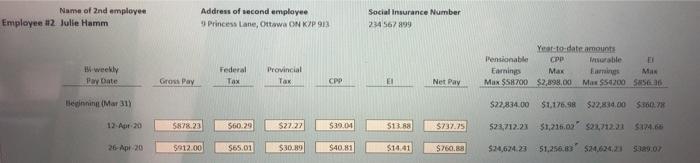

Canadian payroll can someone check if my work is correct? Name of 2nd employee Employee 2 Julie Hamm Address of second employee Princess Lane, Ottawa

Canadian payroll

Name of 2nd employee Employee 2 Julie Hamm Address of second employee Princess Lane, Ottawa ON KIP 912 Social Insurance Number 234567899 weekly Pay Date Federal Tax Year-to-date amount Pensionable CPP Insurable Earnings Max Erns Mas Max $58700 $2,898,00 Max SS4200 550 Provincial TOK Gross Pay CPP El Net Pay Beginning (Mar 31) $22,834.00 $1,176,98 $22,34.00 $100,7 12-Apr 20 5878.23 560.20 $27.22 $39.011 $17 5737.75 523,712.23 $1,216.03 $21,71231 S1265 26-Apr 20 $912.00 $65.01 $10.89 $40.81 $10.41 $760.89 $24,6242351,256.63 $24.624.21 can someone check if my work is correct?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started