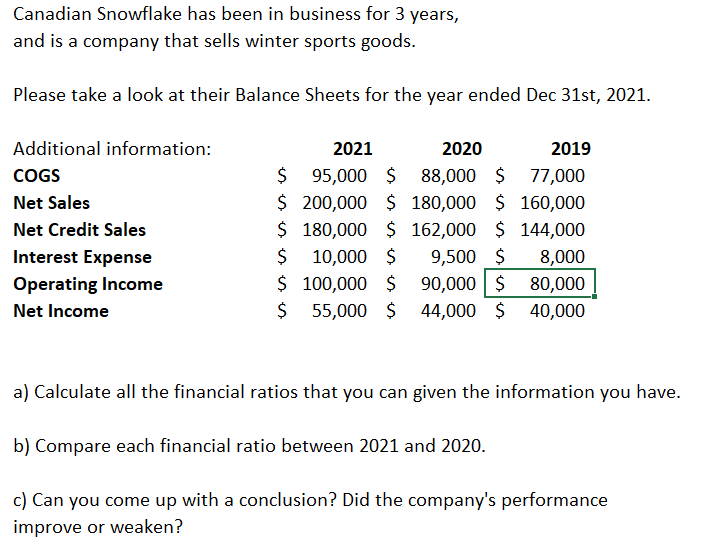

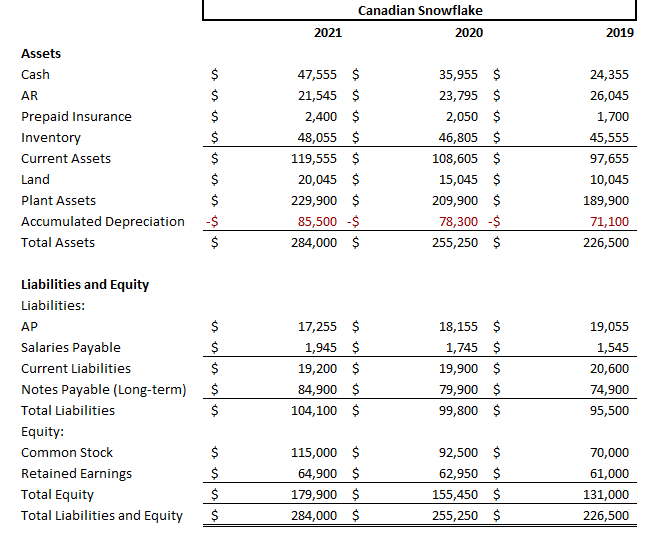

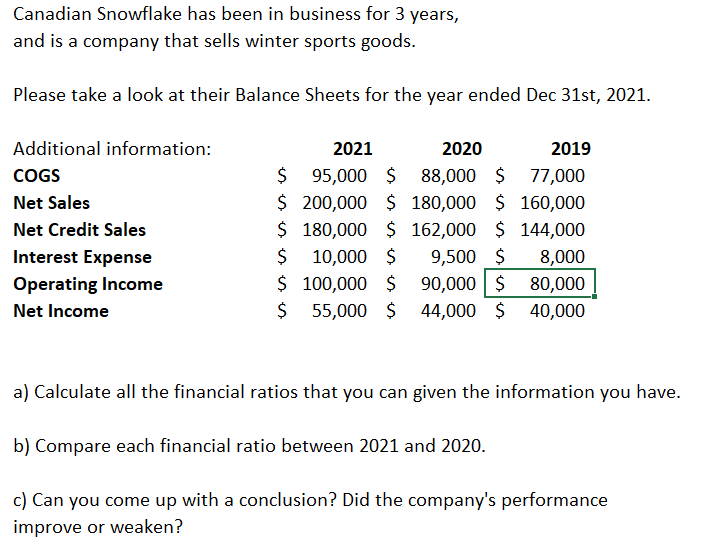

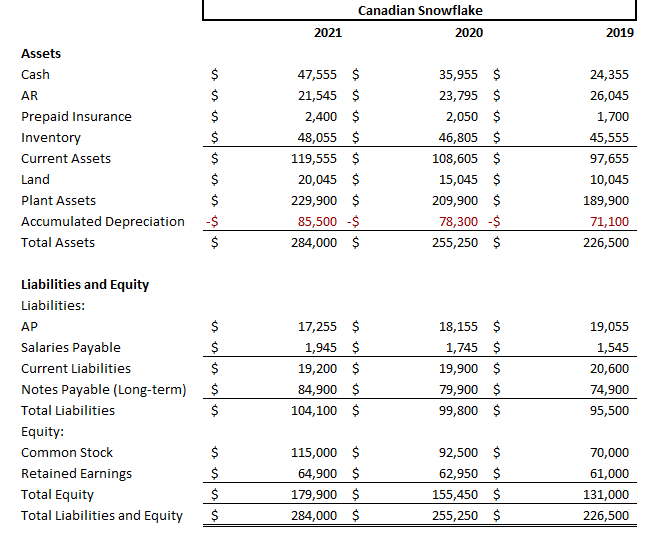

Canadian Snowflake has been in business for 3 years, and is a company that sells winter sports goods. Please take a look at their Balance Sheets for the year ended Dec 31st, 2021. Additional information: COGS Net Sales Net Credit Sales Interest Expense Operating Income Net Income 2021 2020 2019 $ 95,000 $ 88,000 $ 77,000 $ 200,000 $ 180,000 $ 160,000 $ 180,000 $ 162,000 $144,000 $ 10,000 $ 9,500 $ 8,000 $ 100,000 $ 90,000$ 80,000 $ 55,000 $ 44,000 $ 40,000 a) Calculate all the financial ratios that you can given the information you have. b) Compare each financial ratio between 2021 and 2020. c) Can you come up with a conclusion? Did the company's performance improve or weaken? Canadian Snowflake 2020 2021 2019 Assets Cash AR Prepaid Insurance Inventory Current Assets Land Plant Assets Accumulated Depreciation Total Assets $ $ $ $ $ $ $ -$ $ 47,555 $ 21,545 $ 2,400 $ 48,055 $ 119,555 $ 20,045 $ 229,900 $ 85,500 $ 284,000 $ 35,955 $ 23,795 $ 2,050 $ 46,805 $ 108,605 $ 15,045 $ 209,900 $ 78,300 $ 255,250 $ 24,355 26,045 1,700 45,555 97,655 10,045 189,900 71,100 226,500 Liabilities and Equity Liabilities: AP Salaries Payable Current Liabilities Notes Payable (Long-term) Total Liabilities Equity: Common Stock Retained Earnings Total Equity Total Liabilities and Equity $ $ $ $ $ 17,255 $ 1,945 $ 19,200 $ 84,900 $ 104,100 $ 18,155 $ 1,745 $ 19,900 $ 79,900 $ 99,800 $ 19,055 1,545 20,600 74,900 95,500 $ $ $ $ 115,000 $ 64,900 $ 179,900 $ 284,000 $ 92,500 $ 62,950 $ 155,450 $ 255,250 $ 70,000 61,000 131,000 226,500 Canadian Snowflake has been in business for 3 years, and is a company that sells winter sports goods. Please take a look at their Balance Sheets for the year ended Dec 31st, 2021. Additional information: COGS Net Sales Net Credit Sales Interest Expense Operating Income Net Income 2021 2020 2019 $ 95,000 $ 88,000 $ 77,000 $ 200,000 $ 180,000 $ 160,000 $ 180,000 $ 162,000 $144,000 $ 10,000 $ 9,500 $ 8,000 $ 100,000 $ 90,000$ 80,000 $ 55,000 $ 44,000 $ 40,000 a) Calculate all the financial ratios that you can given the information you have. b) Compare each financial ratio between 2021 and 2020. c) Can you come up with a conclusion? Did the company's performance improve or weaken? Canadian Snowflake 2020 2021 2019 Assets Cash AR Prepaid Insurance Inventory Current Assets Land Plant Assets Accumulated Depreciation Total Assets $ $ $ $ $ $ $ -$ $ 47,555 $ 21,545 $ 2,400 $ 48,055 $ 119,555 $ 20,045 $ 229,900 $ 85,500 $ 284,000 $ 35,955 $ 23,795 $ 2,050 $ 46,805 $ 108,605 $ 15,045 $ 209,900 $ 78,300 $ 255,250 $ 24,355 26,045 1,700 45,555 97,655 10,045 189,900 71,100 226,500 Liabilities and Equity Liabilities: AP Salaries Payable Current Liabilities Notes Payable (Long-term) Total Liabilities Equity: Common Stock Retained Earnings Total Equity Total Liabilities and Equity $ $ $ $ $ 17,255 $ 1,945 $ 19,200 $ 84,900 $ 104,100 $ 18,155 $ 1,745 $ 19,900 $ 79,900 $ 99,800 $ 19,055 1,545 20,600 74,900 95,500 $ $ $ $ 115,000 $ 64,900 $ 179,900 $ 284,000 $ 92,500 $ 62,950 $ 155,450 $ 255,250 $ 70,000 61,000 131,000 226,500