Answered step by step

Verified Expert Solution

Question

1 Approved Answer

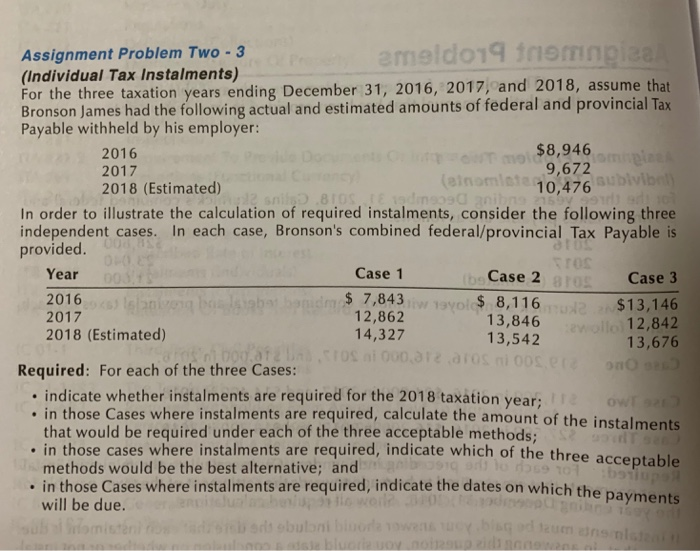

Canadian tax principles, methods using esimate of the three years given to calculate the instalments. ameldo1 nmngieak Assignment Problem Two-3 (Individual Tax Instalments) For the

Canadian tax principles, methods using esimate of the three years given to calculate the instalments.

ameldo1 nmngieak Assignment Problem Two-3 (Individual Tax Instalments) For the three taxation years ending December 31, 2016, 2017, and 2018, assume that Bronson James had the following actual and estimated amounts of federal and provincial Tax Payable withheld by his employer: om mol8,946 m (etnomiatao 476ublviba 2018 (Estimated sni 810 dinsosd anibne 159 99d sd o In order to illustrate the calculation of required instalments, consider the following three independent cases. In each case, Bronson's combined federal/provincial Tax Payable is 2016 2017 9,672 provided. 0.0 Case 1 (bCase 2 8ros Year Case 3 $7,843w 1yolS 8,116u 12,862 14,327 Tos ai 000,ar2 aros ni 00er 2016 $13,146 wollol 12,842 13,676 2017 13,846 13,542 2018 (Estimated) Required: For each of the three Cases: indicate whether instalments are required for the 2018 taxation year; in those Cases where instalments are required, calculate the amount of the instalments that would be required under each of the three acceptable methods; in those cases where instalments are required, indicate which of the three acceptable methods would be the best alternative; and in those Cases where instalments are required, indicate the dates on which the payments ow s TQ 911 lo dbs9 1o1 baiups helup woil? adt obulani bioda owens uYbiag d uen ans nlst no0 atsie bluoria uoy noiesup.zidingnewens.ai will be due. SobiWmist dewanaad ameldo1 nmngieak Assignment Problem Two-3 (Individual Tax Instalments) For the three taxation years ending December 31, 2016, 2017, and 2018, assume that Bronson James had the following actual and estimated amounts of federal and provincial Tax Payable withheld by his employer: om mol8,946 m (etnomiatao 476ublviba 2018 (Estimated sni 810 dinsosd anibne 159 99d sd o In order to illustrate the calculation of required instalments, consider the following three independent cases. In each case, Bronson's combined federal/provincial Tax Payable is 2016 2017 9,672 provided. 0.0 Case 1 (bCase 2 8ros Year Case 3 $7,843w 1yolS 8,116u 12,862 14,327 Tos ai 000,ar2 aros ni 00er 2016 $13,146 wollol 12,842 13,676 2017 13,846 13,542 2018 (Estimated) Required: For each of the three Cases: indicate whether instalments are required for the 2018 taxation year; in those Cases where instalments are required, calculate the amount of the instalments that would be required under each of the three acceptable methods; in those cases where instalments are required, indicate which of the three acceptable methods would be the best alternative; and in those Cases where instalments are required, indicate the dates on which the payments ow s TQ 911 lo dbs9 1o1 baiups helup woil? adt obulani bioda owens uYbiag d uen ans nlst no0 atsie bluoria uoy noiesup.zidingnewens.ai will be due. SobiWmist dewanaad Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started