Canadian tax

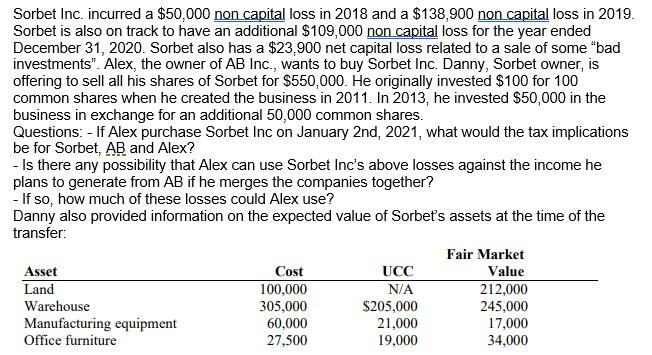

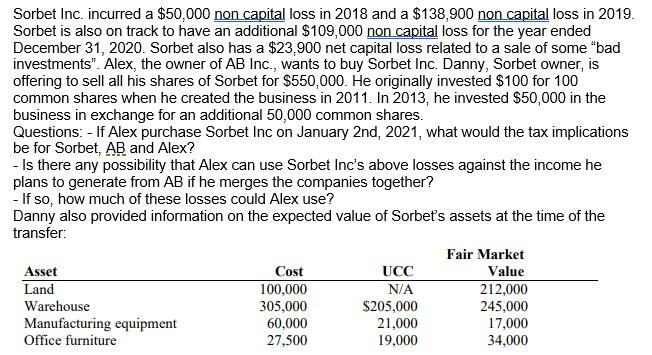

Sorbet Inc. incurred a $50,000 non capital loss in 2018 and a $138,900 non capital loss in 2019. Sorbet is also on track to have an additional $109,000 non capital loss for the year ended December 31, 2020. Sorbet also has a $23,900 net capital loss related to a sale of some "bad investments". Alex, the owner of AB Inc., wants to buy Sorbet Inc. Danny, Sorbet owner, is offering to sell all his shares of Sorbet for $550,000. He originally invested $100 for 100 common shares when he created the business in 2011. In 2013, he invested $50,000 in the business in exchange for an additional 50,000 common shares. Questions - If Alex purchase Sorbet Inc on January 2nd, 2021, what would the tax implications be for Sorbet, AB and Alex? - Is there any possibility that Alex can use Sorbet Inc's above losses against the income he plans to generate from AB if he merges the companies together? - If so, how much of these losses could Alex use? Danny also provided information on the expected value of Sorbet's assets at the time of the transfer: Fair Market Asset Cost UCC Value Land 100,000 N/A 212,000 Warehouse 305,000 $205,000 245,000 Manufacturing equipment 60,000 21,000 17,000 Office furniture 27,500 19,000 34,000 Sorbet Inc. incurred a $50,000 non capital loss in 2018 and a $138,900 non capital loss in 2019. Sorbet is also on track to have an additional $109,000 non capital loss for the year ended December 31, 2020. Sorbet also has a $23,900 net capital loss related to a sale of some "bad investments". Alex, the owner of AB Inc., wants to buy Sorbet Inc. Danny, Sorbet owner, is offering to sell all his shares of Sorbet for $550,000. He originally invested $100 for 100 common shares when he created the business in 2011. In 2013, he invested $50,000 in the business in exchange for an additional 50,000 common shares. Questions - If Alex purchase Sorbet Inc on January 2nd, 2021, what would the tax implications be for Sorbet, AB and Alex? - Is there any possibility that Alex can use Sorbet Inc's above losses against the income he plans to generate from AB if he merges the companies together? - If so, how much of these losses could Alex use? Danny also provided information on the expected value of Sorbet's assets at the time of the transfer: Fair Market Asset Cost UCC Value Land 100,000 N/A 212,000 Warehouse 305,000 $205,000 245,000 Manufacturing equipment 60,000 21,000 17,000 Office furniture 27,500 19,000 34,000