Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canadian Taxation course: 1- Should the total cost of actual move, including cost of moving personal possessions be deducted? Yes/No? Amount? 2- Should cleaning fees

Canadian Taxation course:

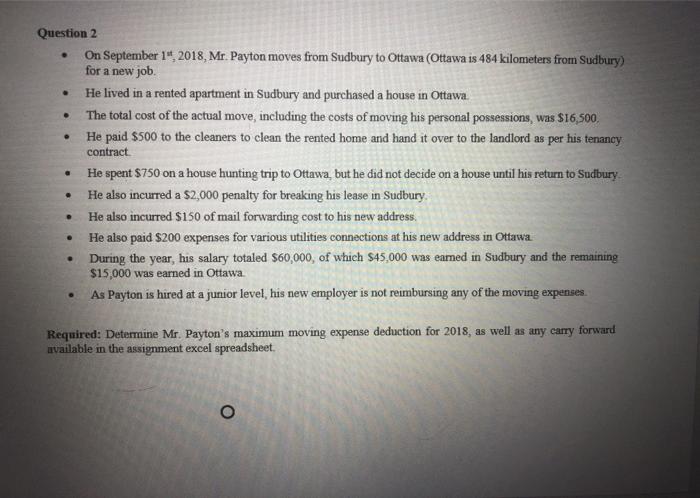

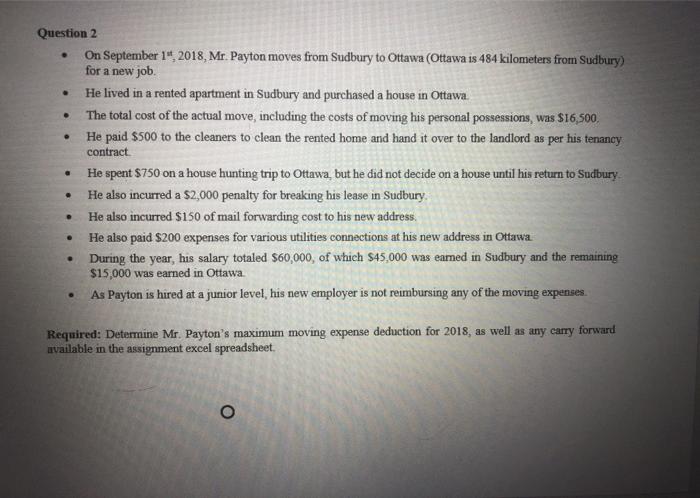

. Question 2 On September 1", 2018, Mr. Payton moves from Sudbury to Ottawa Ottawa is 484 kilometers from Sudbury) for a new job. He lived in a rented apartment in Sudbury and purchased a house in Ottawa The total cost of the actual move, including the costs of moving his personal possessions, was $16.500 He paid $500 to the cleaners to clean the rented home and hand it over to the landlord as per his tenancy contract He spent $750 on a house hunting trip to Ottawa, but he did not decide on a house until his return to Sudbury He also incurred a $2,000 penalty for breaking his lease in Sudbury. He also incurred $150 of mail forwarding cost to his new address. He also paid $200 expenses for various utilities connections at his new address in Ottawa During the year, his salary totaled $60,000, of which $45.000 was eamed in Sudbury and the remaining $15,000 was earned in Ottawa As Payton is hired at a junior level, his new employer is not reimbursing any of the moving expenses. . . Required: Determine Mr. Payton's maximum moving expense deduction for 2018, as well as any carry forward available in the assignment excel spreadsheet. O

1- Should the total cost of actual move, including cost of moving personal possessions be deducted? Yes/No? Amount?

2- Should cleaning fees be deducted? Yes/No? Amount?

3- Should house hunting trip expense be deducted? Yes/No? Amount?

4- Should lease breaking penalty be deducted? Yes/No? Amount?

5- Should mail forwarding fees be deducted? Yes/No? Amount?

6- Should utlities connections fees be deducted? Yes/No? Amount?

- Show your calculations of maximum moving expense deduction:

- Total deductible moving expense:

- Amount of Carry Forward, if any (if no carry forward enter 0)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started