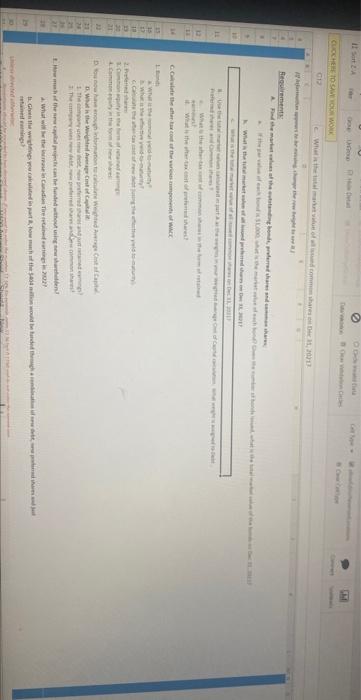

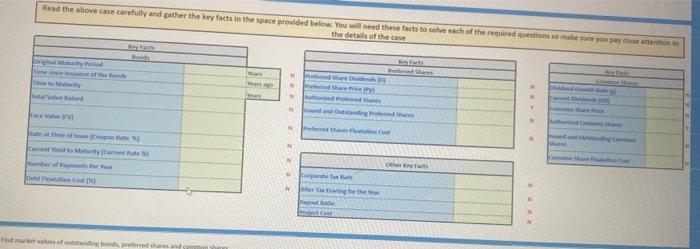

Canadian Tire Corporation, Uimited (Canadian Tire) is a family of companies that includes a retail segnent and a financial sevices division. among others. The retail business is led by Canadian Tire, which was founded in 1922 and provides Canadians with products for ife in Canada across its Livine. Playing. Fixing, Automotive and Seasonal categories. As noted in the Annual Report, the company was involved in a number of strategic inittatives in 2021, including: 1 Leadingedze technology initiattives such as their - innovation centre in Waterloo, - Cloud computing centre in Winnipeg, and - Mobile wallet project. 2. They have also made significant investments (and will continue to do so) in productivity initatives, streamlining the organizational structure and making a number of bold stratezic marketing moves across each of our brends In all the company spent $404.0 million in 2021 on these initatives. These initatives required a mult-year commitment on the part of the Board of Directors as well as the senior management of Canadian Tire. As a result, the company plans to spend the same amount in 2022 on special projects. The company issued 2.6 million bonds, with a face value of $1,000 each. The bonds have a coupon rate of 10.0%, were issued at par and are payable semi-annually. The bonds have a 25 year maturity and were issued sox years ago. The superior credit ratings being assoclated with the company have had a positive effect on the Yield-to-Maturity rates for Canadian Tire's debt. A $1,000 Canadian Tire bond has a nominal vield to maturity of 6.00% (an effective vieid to maturity of 6.09% ). As of December 31, 2021 the authorized capital of Canadian Tire consisted of 20milion preferred shares issued and outstanding and 75 million common shares issued and outstanding. The outstanding Common Shares and Preferred Shares of CTC are listed on the Toronto Stock Exchange ("T5X") and are traded under the symbols CTC and CTC . . respectively. Preferred shares traded in a relatively narrow range in 2021 closing the year at $80.81 per share. Common shares traded in a higher range, closing 2021 at $100.85 per share. Canadian Tire has consistently maintained a growth in the common share dividend of 49 per year and they anticipate continuing that trend into the future. The dividend paid at the end of 2021 was 55.721 per share. The holders of Preferred Shares are entitied to receive a preferential non-cumulative dividend at the rate of 51.00 every calendar quarter Fiecouinthent: firmit A. What it the ouming vird be metyern" 2. firtetint thann the details of the case Canadian Tire Corporation, Uimited (Canadian Tire) is a family of companies that includes a retail segnent and a financial sevices division. among others. The retail business is led by Canadian Tire, which was founded in 1922 and provides Canadians with products for ife in Canada across its Livine. Playing. Fixing, Automotive and Seasonal categories. As noted in the Annual Report, the company was involved in a number of strategic inittatives in 2021, including: 1 Leadingedze technology initiattives such as their - innovation centre in Waterloo, - Cloud computing centre in Winnipeg, and - Mobile wallet project. 2. They have also made significant investments (and will continue to do so) in productivity initatives, streamlining the organizational structure and making a number of bold stratezic marketing moves across each of our brends In all the company spent $404.0 million in 2021 on these initatives. These initatives required a mult-year commitment on the part of the Board of Directors as well as the senior management of Canadian Tire. As a result, the company plans to spend the same amount in 2022 on special projects. The company issued 2.6 million bonds, with a face value of $1,000 each. The bonds have a coupon rate of 10.0%, were issued at par and are payable semi-annually. The bonds have a 25 year maturity and were issued sox years ago. The superior credit ratings being assoclated with the company have had a positive effect on the Yield-to-Maturity rates for Canadian Tire's debt. A $1,000 Canadian Tire bond has a nominal vield to maturity of 6.00% (an effective vieid to maturity of 6.09% ). As of December 31, 2021 the authorized capital of Canadian Tire consisted of 20milion preferred shares issued and outstanding and 75 million common shares issued and outstanding. The outstanding Common Shares and Preferred Shares of CTC are listed on the Toronto Stock Exchange ("T5X") and are traded under the symbols CTC and CTC . . respectively. Preferred shares traded in a relatively narrow range in 2021 closing the year at $80.81 per share. Common shares traded in a higher range, closing 2021 at $100.85 per share. Canadian Tire has consistently maintained a growth in the common share dividend of 49 per year and they anticipate continuing that trend into the future. The dividend paid at the end of 2021 was 55.721 per share. The holders of Preferred Shares are entitied to receive a preferential non-cumulative dividend at the rate of 51.00 every calendar quarter Fiecouinthent: firmit A. What it the ouming vird be metyern" 2. firtetint thann the details of the case