Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canbuild Materials Ltd. is a family-run do-it-yourself building materials company located on Pelee Island, Ontario. The company produces high-quality building materials for the do-it-yourselfers.

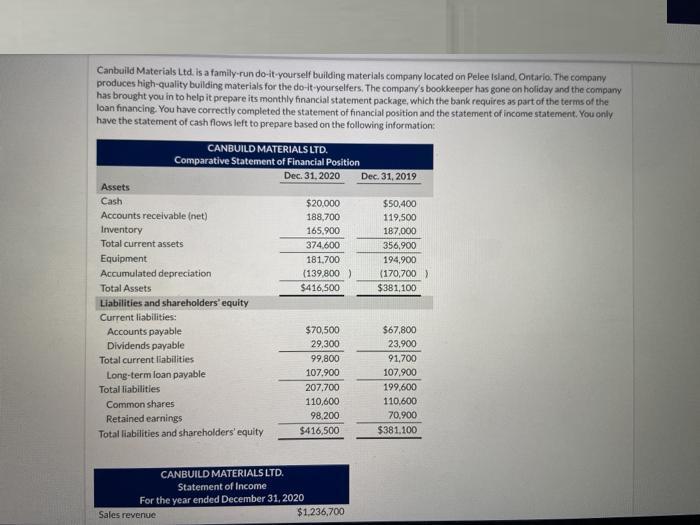

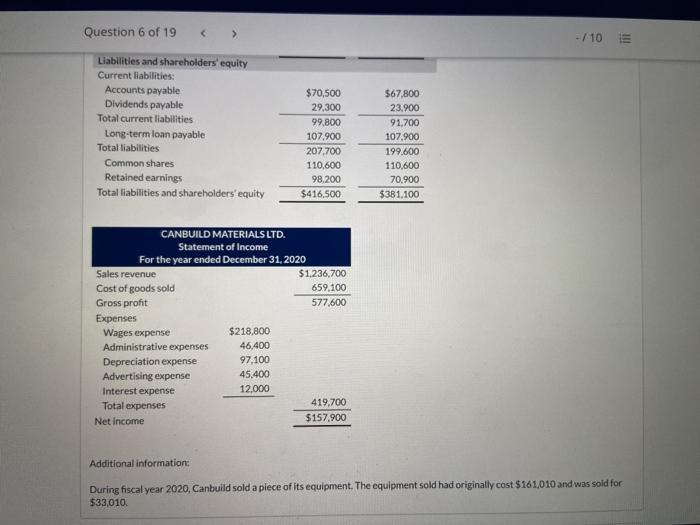

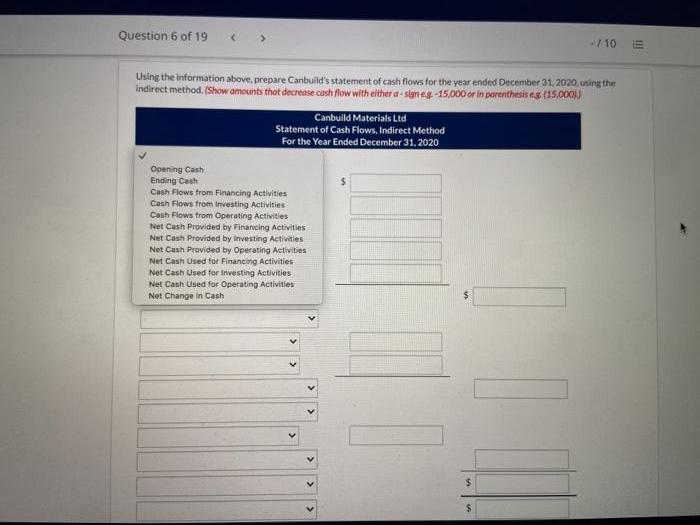

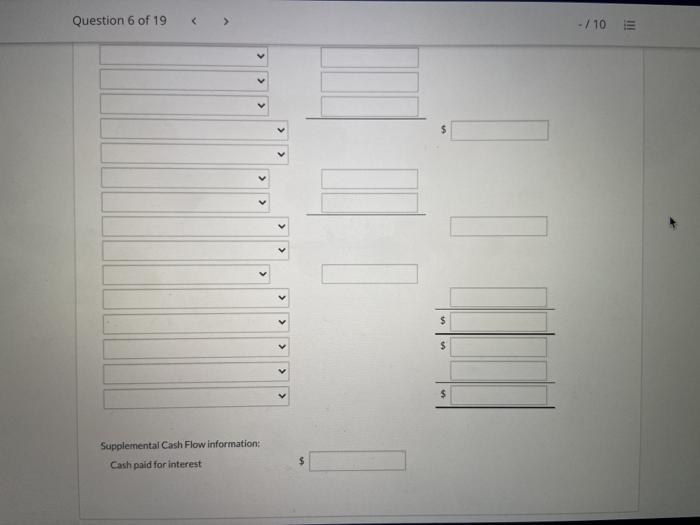

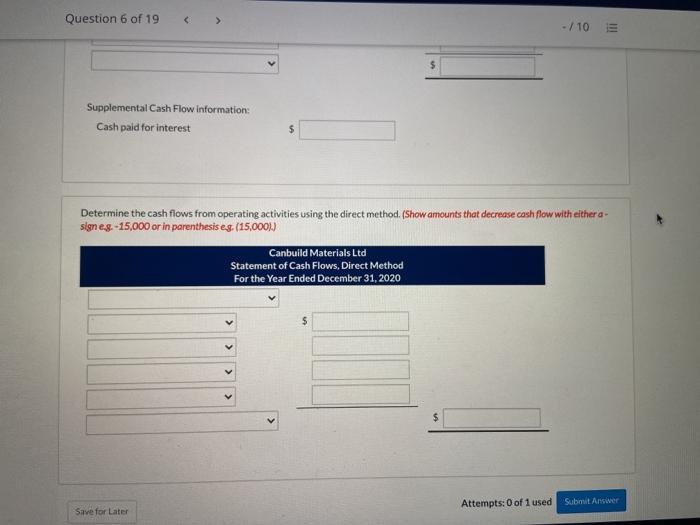

Canbuild Materials Ltd. is a family-run do-it-yourself building materials company located on Pelee Island, Ontario. The company produces high-quality building materials for the do-it-yourselfers. The company's bookkeeper has gone on holiday and the company has brought you in to help it prepare its monthly financial statement package, which the bank requires as part of the terms of the loan financing. You have correctly completed the statement of financial position and the statement of income statement. You only have the statement of cash flows left to prepare based on the following information: Assets Cash CANBUILD MATERIALS LTD. Comparative Statement of Financial Position Dec. 31, 2020 Accounts receivable (net) Inventory Total current assets Equipment Accumulated depreciation Total Assets Liabilities and shareholders' equity Current liabilities: Accounts payable Dividends payable Total current liabilities Long-term loan payable Total liabilities Common shares Retained earnings Total liabilities and shareholders' equity Sales revenue $20,000 188,700 165,900 374,600 181,700 (139,800 ) $416,500 CANBUILD MATERIALS LTD. Statement of Income For the year ended December 31, 2020 $70,500 29,300 99,800 107,900 207,700 110,600 98,200 $416,500 $1,236,700 Dec. 31, 2019 $50,400 119,500 187,000 356,900 194,900 (170,700) $381,100 $67,800 23,900 91,700 107,900 199,600 110,600 70,900 $381,100 Question 6 of 19 Liabilities and shareholders' equity Current liabilities: Accounts payable Dividends payable Total current liabilities Long-term loan payable Total liabilities Common shares Retained earnings Total liabilities and shareholders' equity CANBUILD MATERIALS LTD. Statement of Income For the year ended December 31, 2020 Sales revenue Cost of goods sold Gross profit Expenses Wages expense Administrative expenses Depreciation expense Advertising expense Interest expense Total expenses Net income $218,800 46,400 97,100 45,400 12,000 $70,500 29,300 99,800 107,900 207,700 110,600 98,200 $416,500 $1,236,700. 659,100 577,600 419,700 $157,900 $67,800 23,900 91,700 107,900 199.600 110,600 70.900 $381,100 -/10 Additional information: During fiscal year 2020, Canbuild sold a piece of its equipment. The equipment sold had originally cost $161,010 and was sold for $33,010. Question 6 of 19 Using the information above, prepare Canbuild's statement of cash flows for the year ended December 31, 2020, using the Indirect method. (Show amounts that decrease cash flow with either a-sign eg-15,000 or in parenthesis es (15,0001) Opening Cash Ending Cash Canbuild Materials Ltd Statement of Cash Flows, Indirect Method For the Year Ended December 31, 2020 Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used for Financing Activities Net Cash Used for Investing Activities Net Cash Used for Operating Activities Net Change in Cash -/10 $ !!! E Question 6 of 19 < > Supplemental Cash Flow information: Cash paid for interest > > 11 $ $ -/10 Question 6 of 19 < > Supplemental Cash Flow information: Cash paid for interest Save for Later Determine the cash flows from operating activities using the direct method. (Show amounts that decrease cash flow with either a- sign e.g.-15,000 or in parenthesis e.g. (15,000)) Canbuild Materials Ltd Statement of Cash Flows, Direct Method For the Year Ended December 31, 2020 > -/10 > !!! Attempts: 0 of 1 used Submit Ansiver

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Worki...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started