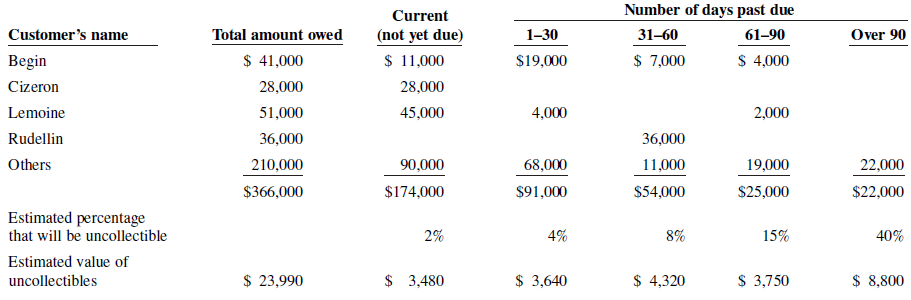

The following is an aging schedule for a companys accounts receivable as at December 31, 2019: On

Question:

The following is an aging schedule for a company’s accounts receivable as at December 31, 2019:

On December 31, 2019, the unadjusted balance in the Allowance for Doubtful Accounts (prior to the aging analysis) was a credit of $6,230.

Required

a. Journalize the adjusting entry for bad debts on December 31, 2019.

b. Journalize the following selected events and transactions in 2020:

i. On April 17, a $1,450 customer account that originated in 2020 is judged uncollectible.

ii. On September 1, a $1,450 cheque is received from the customer whose account was written off as uncollectible on April 17.

c. Journalize the adjusting entry for bad debts on December 31, 2020, assuming that the unadjusted balance in Allowance for Doubtful Accounts at that time is a debit of $4,520 and an aging schedule indicates that the estimated value of uncollectibles is $28,620.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Aging Schedule

Aging schedule is an accounting table that shows a company’s account receivables. It is an summarized presentation of accounts receivable into a separate time brackets that the rank received based upon the days due or the days past due. Generally...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley