Answered step by step

Verified Expert Solution

Question

1 Approved Answer

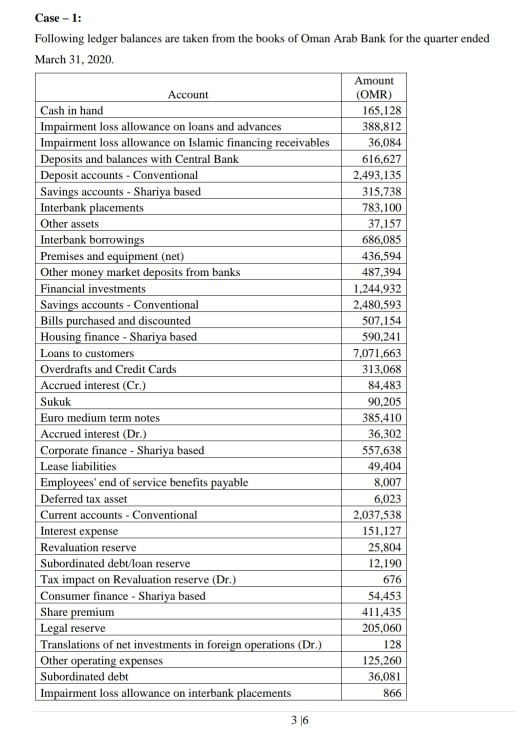

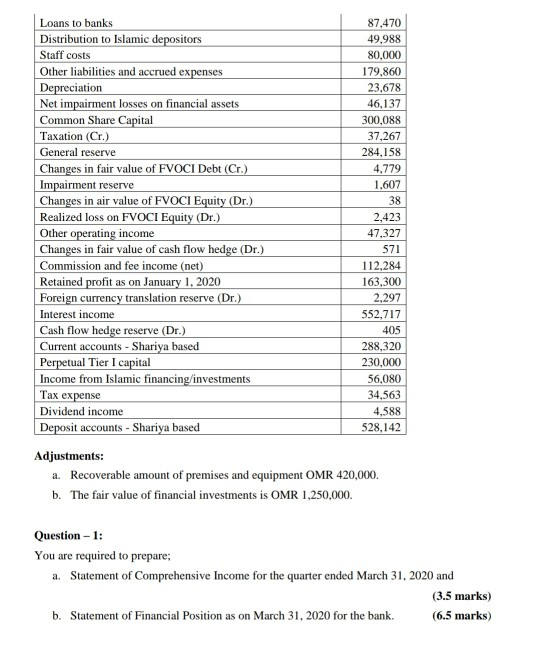

Canceled Case-1: Following ledger balances are taken from the books of Oman Arab Bank for the quarter ended March 31, 2020. Amount Account (OMR) Cash

Canceled

Case-1: Following ledger balances are taken from the books of Oman Arab Bank for the quarter ended March 31, 2020. Amount Account (OMR) Cash in hand 165,128 Impairment loss allowance on loans and advances 388,812 Impairment loss allowance on Islamic financing receivables 36,084 Deposits and balances with Central Bank 616,627 Deposit accounts - Conventional 2,493.135 Savings accounts - Shariya based 315,738 Interbank placements 783,100 Other assets 37.157 Interbank borrowings 686,085 Premises and equipment (net) 436,594 Other money market deposits from banks 487,394 Financial investments 1,244.932 Savings accounts - Conventional 2.480,593 Bills purchased and discounted 507,154 Housing finance - Shariya based 590.241 Loans to customers 7,071,663 Overdrafts and Credit Cards 313,068 Accrued interest (Cr.) 84,483 Sukuk 90.205 Euro medium term notes 385,410 Accrued interest (Dr.) 36,302 Corporate finance - Shariya based 557,638 Lease liabilities 49,404 Employees' end of service benefits payable 8,007 Deferred tax asset 6,023 Current accounts - Conventional 2,037,538 Interest expense 151,127 Revaluation reserve 25,804 Subordinated debt/loan reserve 12,190 Tax impact on Revaluation reserve (Dr.) 676 Consumer finance - Shariya based 54,453 Share premium 411.435 Legal reserve 205,060 Translations of net investments in foreign operations (Dr.) 128 Other operating expenses 125.260 Subordinated debt 36,081 Impairment loss allowance on interbank placements 866 36 Loans to banks 87,470 Distribution to Islamic depositors 49,988 Staff costs 80,000 Other liabilities and accrued expenses 179,860 Depreciation 23,678 Net impairment losses on financial assets 46,137 Common Share Capital 300,088 Taxation (Cr.) 37,267 General reserve 284,158 Changes in fair value of FVOCI Debt (Cr.) 4.779 Impairment reserve 1.607 Changes in air value of FVOCI Equity (Dr.) 38 Realized loss on FVOCI Equity (Dr.) 2,423 Other operating income 47,327 Changes in fair value of cash flow hedge (Dr.) 571 Commission and fee income (net) 112,284 Retained profit as on January 1, 2020 163,300 Foreign currency translation reserve (Dr.) 2,297 Interest income 552,717 Cash flow hedge reserve (Dr.) 405 Current accounts - Shariya based 288,320 Perpetual Tier I capital 230,000 Income from Islamic financing/investments 56,080 Tax expense 34,563 Dividend income 4,588 Deposit accounts - Shariya based 528,142 Adjustments: a. Recoverable amount of premises and equipment OMR 420,000. b. The fair value of financial investments is OMR 1,250,000. Question - 1: You are required to prepare; a. Statement of Comprehensive Income for the quarter ended March 31, 2020 and (3.5 marks) b. Statement of Financial Position as on March 31, 2020 for the bank. (6.5 marks) Case-1: Following ledger balances are taken from the books of Oman Arab Bank for the quarter ended March 31, 2020. Amount Account (OMR) Cash in hand 165,128 Impairment loss allowance on loans and advances 388,812 Impairment loss allowance on Islamic financing receivables 36,084 Deposits and balances with Central Bank 616,627 Deposit accounts - Conventional 2,493.135 Savings accounts - Shariya based 315,738 Interbank placements 783,100 Other assets 37.157 Interbank borrowings 686,085 Premises and equipment (net) 436,594 Other money market deposits from banks 487,394 Financial investments 1,244.932 Savings accounts - Conventional 2.480,593 Bills purchased and discounted 507,154 Housing finance - Shariya based 590.241 Loans to customers 7,071,663 Overdrafts and Credit Cards 313,068 Accrued interest (Cr.) 84,483 Sukuk 90.205 Euro medium term notes 385,410 Accrued interest (Dr.) 36,302 Corporate finance - Shariya based 557,638 Lease liabilities 49,404 Employees' end of service benefits payable 8,007 Deferred tax asset 6,023 Current accounts - Conventional 2,037,538 Interest expense 151,127 Revaluation reserve 25,804 Subordinated debt/loan reserve 12,190 Tax impact on Revaluation reserve (Dr.) 676 Consumer finance - Shariya based 54,453 Share premium 411.435 Legal reserve 205,060 Translations of net investments in foreign operations (Dr.) 128 Other operating expenses 125.260 Subordinated debt 36,081 Impairment loss allowance on interbank placements 866 36 Loans to banks 87,470 Distribution to Islamic depositors 49,988 Staff costs 80,000 Other liabilities and accrued expenses 179,860 Depreciation 23,678 Net impairment losses on financial assets 46,137 Common Share Capital 300,088 Taxation (Cr.) 37,267 General reserve 284,158 Changes in fair value of FVOCI Debt (Cr.) 4.779 Impairment reserve 1.607 Changes in air value of FVOCI Equity (Dr.) 38 Realized loss on FVOCI Equity (Dr.) 2,423 Other operating income 47,327 Changes in fair value of cash flow hedge (Dr.) 571 Commission and fee income (net) 112,284 Retained profit as on January 1, 2020 163,300 Foreign currency translation reserve (Dr.) 2,297 Interest income 552,717 Cash flow hedge reserve (Dr.) 405 Current accounts - Shariya based 288,320 Perpetual Tier I capital 230,000 Income from Islamic financing/investments 56,080 Tax expense 34,563 Dividend income 4,588 Deposit accounts - Shariya based 528,142 Adjustments: a. Recoverable amount of premises and equipment OMR 420,000. b. The fair value of financial investments is OMR 1,250,000. Question - 1: You are required to prepare; a. Statement of Comprehensive Income for the quarter ended March 31, 2020 and (3.5 marks) b. Statement of Financial Position as on March 31, 2020 for the bank. (6.5 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started