Question

Candidate Review #2 Consider the non-constant dividend price valuations prepared by Bob-o and Tim. Both candidates have prepared a valuation based on the following information:

Candidate Review #2

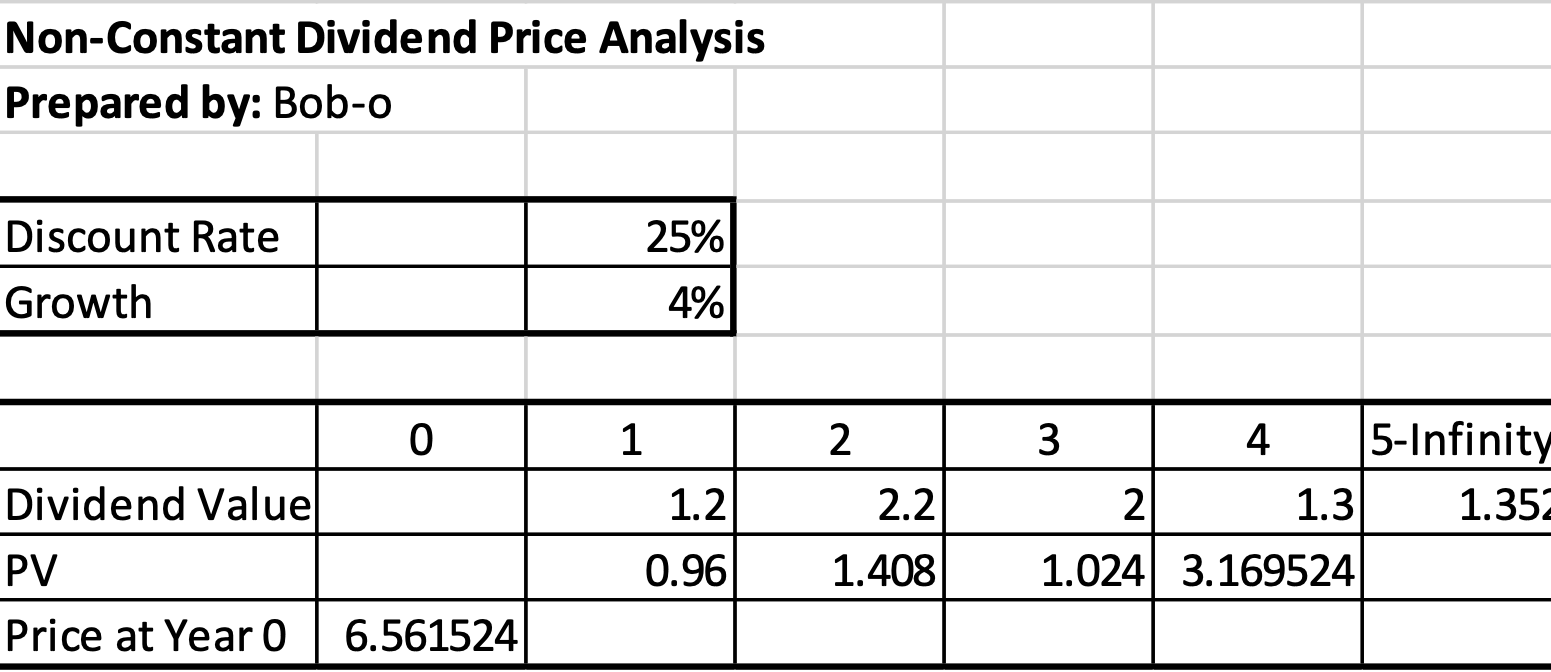

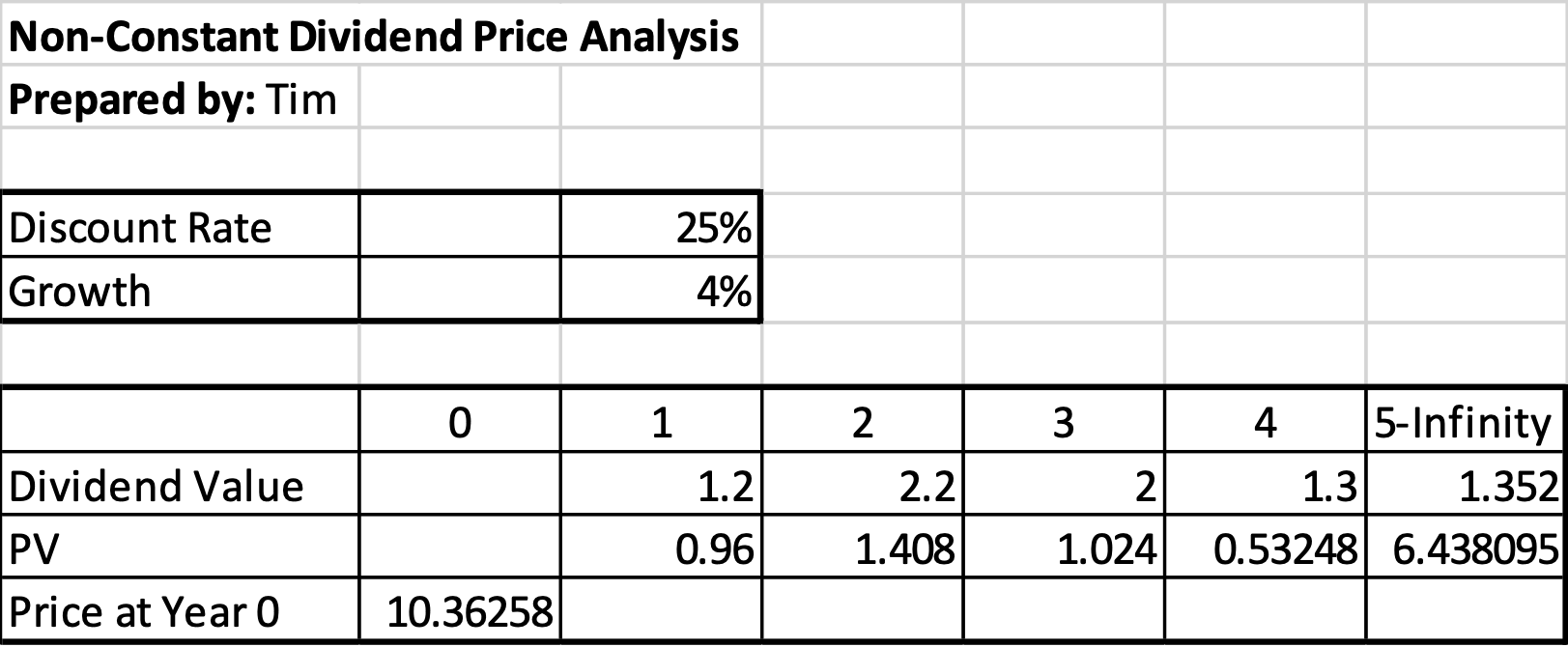

Consider the non-constant dividend price valuations prepared by Bob-o and Tim. Both candidates have prepared a valuation based on the following information:

The firm will pay the following dividends:

Year 1: $1.20

Year 2: $2.20

Year 3: $2.00

Year 4: $1.30

After year four, the firm anticipates that dividends will grow at 4% forever. Comparable firms have a required rate of return of 25%.

It is our goal to use this analysis to determine if we should acquire the firm who will pay these dividends. The stock is currently trading at $8 per share.

It is your job as the manager to determine if any errors exist in the valuations prepared by each candidate. Please fill out the associated question sheet for both Bob-os and Tims valuations.

Your final submission should include the following:

A feedback sheet for Bob-o

A feedback sheet for Tim

Your corrected valuation prepared in excel

Your recommendation on who should be hired and justification for that decision based on your feedback sheets

Feedback for Bob-o

What mistake(s) (if any) did this candidate make?

Why is this mistake incorrect?

What is the ultimate impact of the mistake on the business both in terms of the outcome of the analysis, but also in terms of other outcomes? (For example, if the decision results in underfunding the business how might that impact operations of the business?)

Feedback for Tim

What mistake(s) (if any) did this candidate make?

Why is this mistake incorrect?

What is the ultimate impact of the mistake on the business both in terms of the outcome of the analysis, but also in terms of other outcomes? (For example, if the decision results in underfunding the business how might that impact operations of the business?)

Your recommendation

Who should we hire (circle one)?

Bob-o Tim

In three or four sentences defend your selection?

Non-Constant Dividend Price Analysis Prepared by: Bob-o \begin{tabular}{|l|r|r|} \hline Discount Rate & & 25% \\ \hline Growth & & 4% \\ \hline \end{tabular} \begin{tabular}{|l|c|r|r|r|r|r} \hline & \multicolumn{1}{|c|}{0} & \multicolumn{1}{c|}{1} & \multicolumn{1}{c|}{2} & \multicolumn{1}{c|}{3} & \multicolumn{1}{c|}{4} & 5-Infinity \\ \hline Dividend Value & & 1.2 & 2.2 & 2 & 1.3 & 1.35 \\ \hline PV & & 0.96 & 1.408 & 1.024 & 3.169524 & \\ \hline Price at Year 0 & 6.561524 & & & & & \\ \hline \end{tabular} Non-Constant Dividend Price Analysis Prepared by: Tim \begin{tabular}{|l|r|r|} \hline Discount Rate & & 25% \\ \hline Growth & & 4% \\ \hline \end{tabular} \begin{tabular}{|l|c|r|r|r|r|r|} \hline & \multicolumn{1}{|c|}{0} & \multicolumn{1}{c|}{1} & \multicolumn{1}{c|}{2} & \multicolumn{1}{c|}{3} & \multicolumn{1}{c|}{4} & 5-Infinity \\ \hline Dividend Value & & 1.2 & 2.2 & 2 & 1.3 & 1.352 \\ \hline PV & & 0.96 & 1.408 & 1.024 & 0.53248 & 6.438095 \\ \hline Price at Year 0 & 10.36258 & & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started