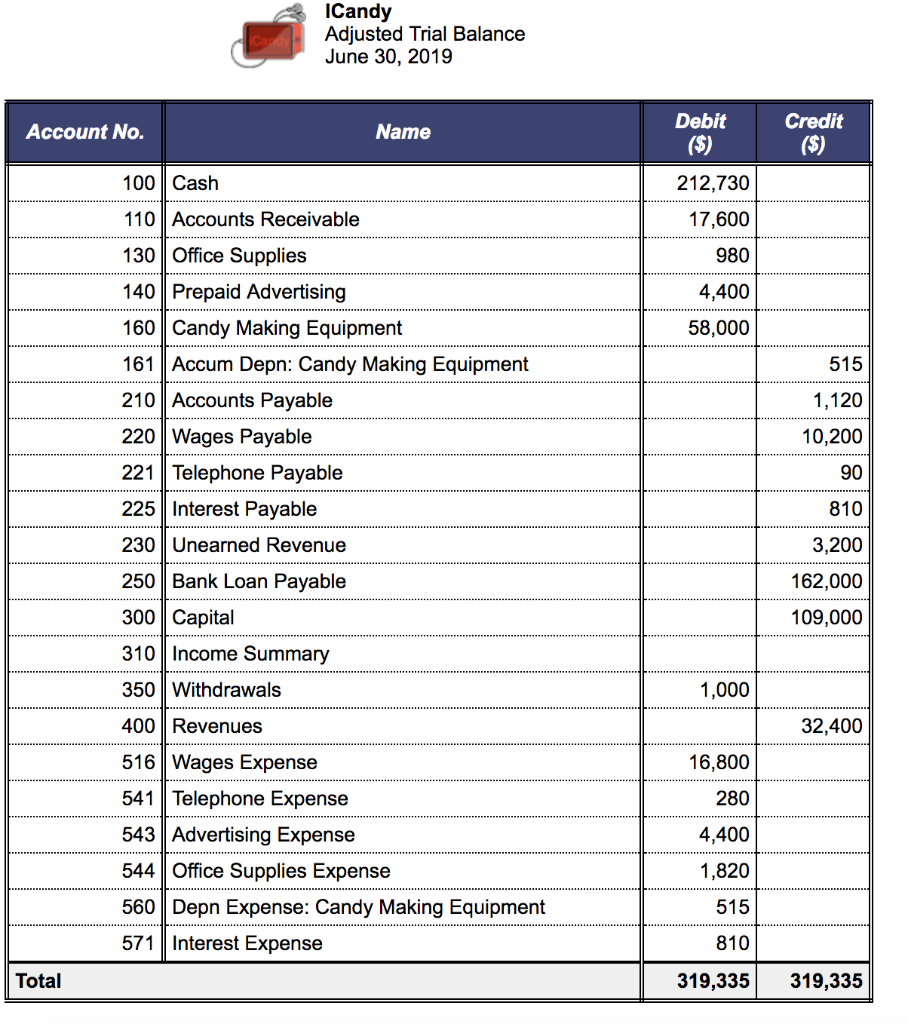

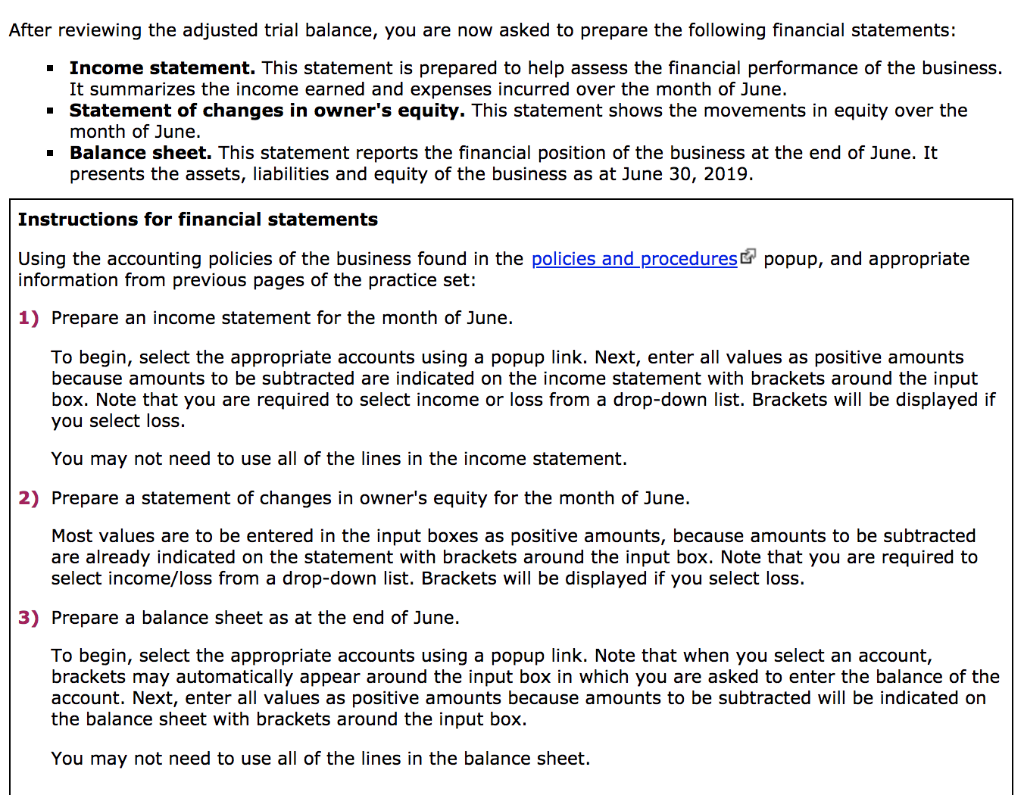

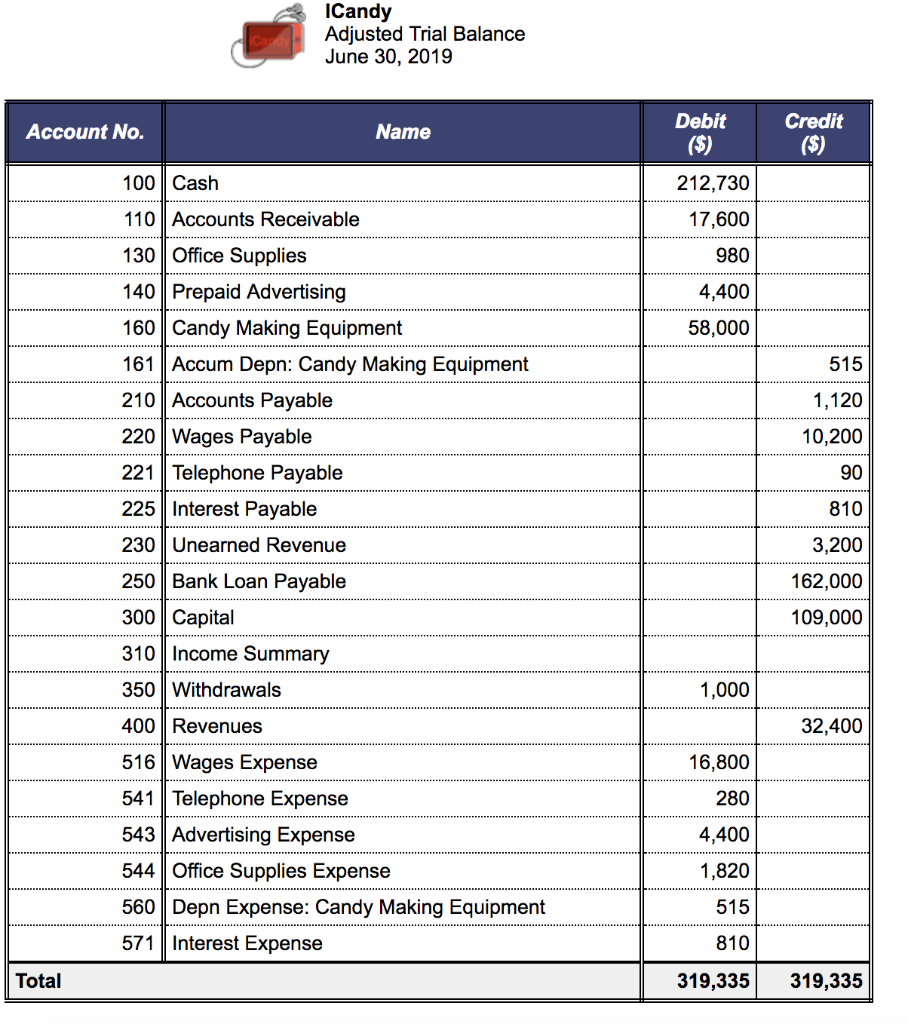

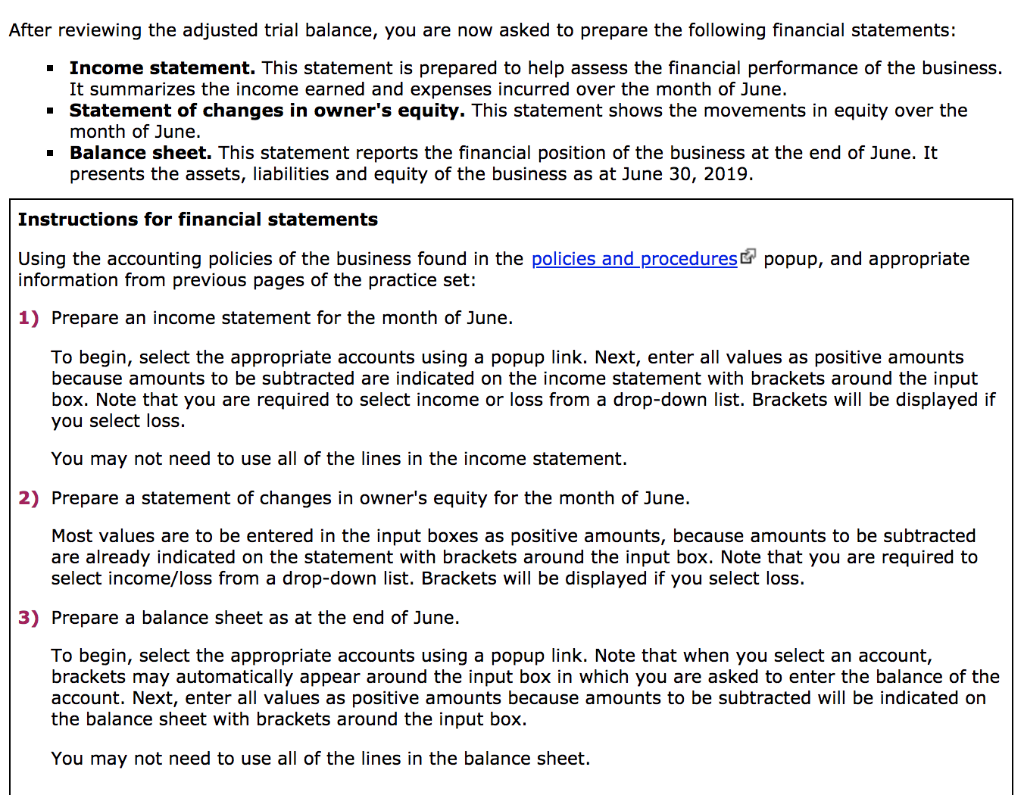

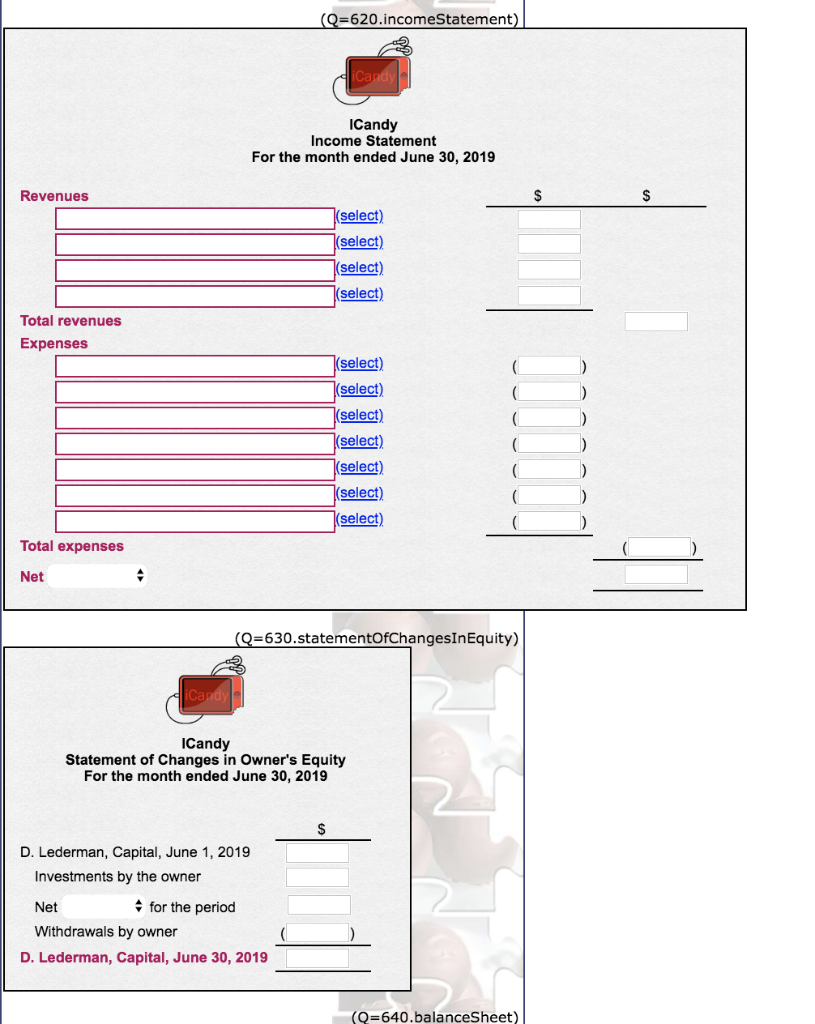

Candy Adiusted Trial Balance June 30, 2019 Debit Credit Account No. Name 100 Cash 110Accounts Receivable 13 Office Supplies 140 Prepaid Advertising 160 Candy Making Equipment 161 Accum Depn: Candy Making Equipment 210 Accounts Payable 220 Wages Payable 221 Telephone Payable 225 Interest Payable 230 Unearned Revenue 250 Bank Loan Payable 300 Capital 310 Income Summary 350 Withdrawals 400 Revenues 516 Wages Expense 541 | Telephone Expense 543 Advertising Expense 544 Office Supplies Expense 560 Depn Expense: Candy Making Equipment 571|Interest Expense 212,730 17,600 980 4,400 58,000 515 1,120 10,200 90 810 3,200 162,000 109,000 1,000 32,400 16,800 280 4,400 1,820 515 810 Total 319,335319,335 After reviewing the adjusted trial balance, you are now asked to prepare the following financial statements: - Income statement. This statement is prepared to help assess the financial performance of the business - Statement of changes in owner's equity. This statement shows the movements in equity over the - Balance sheet. This statement reports the financial position of the business at the end of June. It It summarizes the income earned and expenses incurred over the month of June month of June. presents the assets, liabilities and equity of the business as at June 30, 2019 Instructions for financial statements Using the accounting policies of the business found in the policies and procedures& popup, and appropriate information from previous pages of the practice set 1) Prepare an income statement for the month of June. To begin, select the appropriate accounts using a popup link. Next, enter all values as positive amounts because amounts to be subtracted are indicated on the income statement with brackets around the input box. Note that you are required to select income or loss from a drop-down list. Brackets will be displayed if you select loss You may not need to use all of the lines in the income statement. 2) Prepare a statement of changes in owner's equity for the month of June Most values are to be entered in the input boxes as positive amounts, because amounts to be subtracted are already indicated on the statement with brackets around the input box. Note that you are required to select income/loss from a drop-down list. Brackets will be displayed if you select loss 3) Prepare a balance sheet as at the end of June To begin, select the appropriate accounts using a popup link. Note that when you select an account, brackets may automatically appear around the input box in which you are asked to enter the balance of the account. Next, enter all values as positive amounts because amounts to be subtracted will be indicated on the balance sheet with brackets around the input box You may not need to use all of the lines in the balance sheet 620.incomeStatement iCa Candy Income Statement For the month ended June 30, 2019 Revenues select) select) select) select) Total revenues Expenses select) select) Total expenses Net 630.statementOfChangesInEquity) iCa Candy Statement of Changes in Owner's Equity For the month ended June 30, 2019 D. Lederman, Capital, June 1, 2019 Investments by the owner Net Withdrawals by owner for the period D. Lederman, Capital, June 30, 2019 (Q 640.balanceSheet) Candy Balance Sheet June 30, 2019 Assets Current assets select) se select) select) Total current assets Property, plant and equipment se select) se Total property, plant and equipment Total assets Liabilities Current liabilities select) (select) select) select) select) Total current liabilities Long-term liabilities select) select) select) select) select) select) Total liabilities Equity select) select) select) select) Total liabilities and equity Candy Adiusted Trial Balance June 30, 2019 Debit Credit Account No. Name 100 Cash 110Accounts Receivable 13 Office Supplies 140 Prepaid Advertising 160 Candy Making Equipment 161 Accum Depn: Candy Making Equipment 210 Accounts Payable 220 Wages Payable 221 Telephone Payable 225 Interest Payable 230 Unearned Revenue 250 Bank Loan Payable 300 Capital 310 Income Summary 350 Withdrawals 400 Revenues 516 Wages Expense 541 | Telephone Expense 543 Advertising Expense 544 Office Supplies Expense 560 Depn Expense: Candy Making Equipment 571|Interest Expense 212,730 17,600 980 4,400 58,000 515 1,120 10,200 90 810 3,200 162,000 109,000 1,000 32,400 16,800 280 4,400 1,820 515 810 Total 319,335319,335 After reviewing the adjusted trial balance, you are now asked to prepare the following financial statements: - Income statement. This statement is prepared to help assess the financial performance of the business - Statement of changes in owner's equity. This statement shows the movements in equity over the - Balance sheet. This statement reports the financial position of the business at the end of June. It It summarizes the income earned and expenses incurred over the month of June month of June. presents the assets, liabilities and equity of the business as at June 30, 2019 Instructions for financial statements Using the accounting policies of the business found in the policies and procedures& popup, and appropriate information from previous pages of the practice set 1) Prepare an income statement for the month of June. To begin, select the appropriate accounts using a popup link. Next, enter all values as positive amounts because amounts to be subtracted are indicated on the income statement with brackets around the input box. Note that you are required to select income or loss from a drop-down list. Brackets will be displayed if you select loss You may not need to use all of the lines in the income statement. 2) Prepare a statement of changes in owner's equity for the month of June Most values are to be entered in the input boxes as positive amounts, because amounts to be subtracted are already indicated on the statement with brackets around the input box. Note that you are required to select income/loss from a drop-down list. Brackets will be displayed if you select loss 3) Prepare a balance sheet as at the end of June To begin, select the appropriate accounts using a popup link. Note that when you select an account, brackets may automatically appear around the input box in which you are asked to enter the balance of the account. Next, enter all values as positive amounts because amounts to be subtracted will be indicated on the balance sheet with brackets around the input box You may not need to use all of the lines in the balance sheet 620.incomeStatement iCa Candy Income Statement For the month ended June 30, 2019 Revenues select) select) select) select) Total revenues Expenses select) select) Total expenses Net 630.statementOfChangesInEquity) iCa Candy Statement of Changes in Owner's Equity For the month ended June 30, 2019 D. Lederman, Capital, June 1, 2019 Investments by the owner Net Withdrawals by owner for the period D. Lederman, Capital, June 30, 2019 (Q 640.balanceSheet) Candy Balance Sheet June 30, 2019 Assets Current assets select) se select) select) Total current assets Property, plant and equipment se select) se Total property, plant and equipment Total assets Liabilities Current liabilities select) (select) select) select) select) Total current liabilities Long-term liabilities select) select) select) select) select) select) Total liabilities Equity select) select) select) select) Total liabilities and equity