Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Candy Company has approached you to help decide what type of inventory system it should use (perpetual vs. periodic) and what cost flow assumption

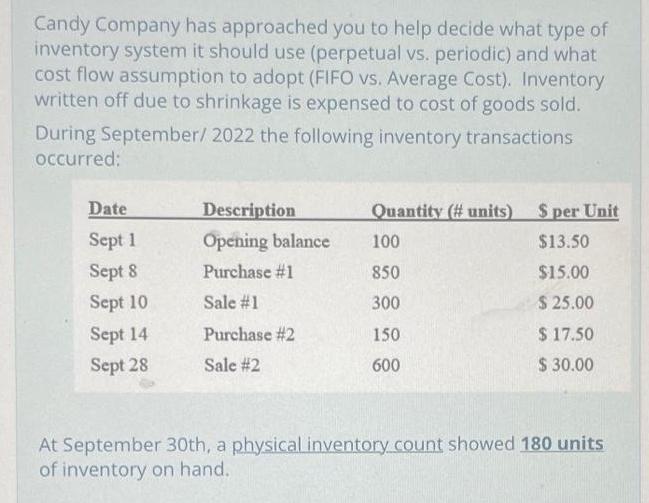

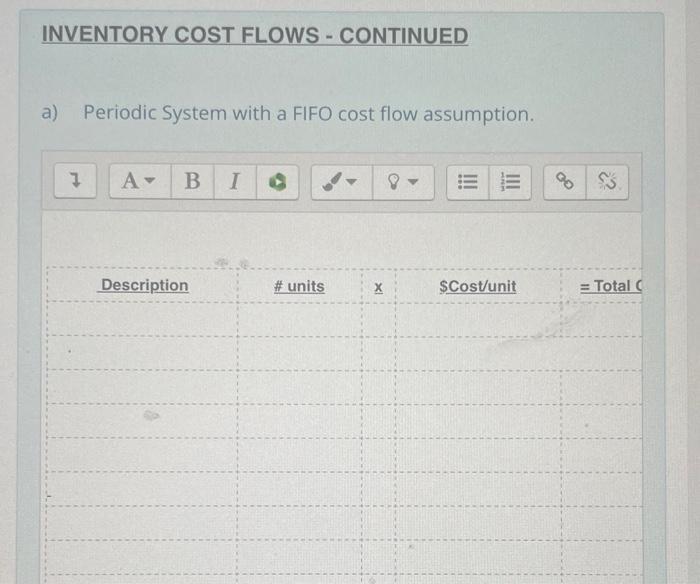

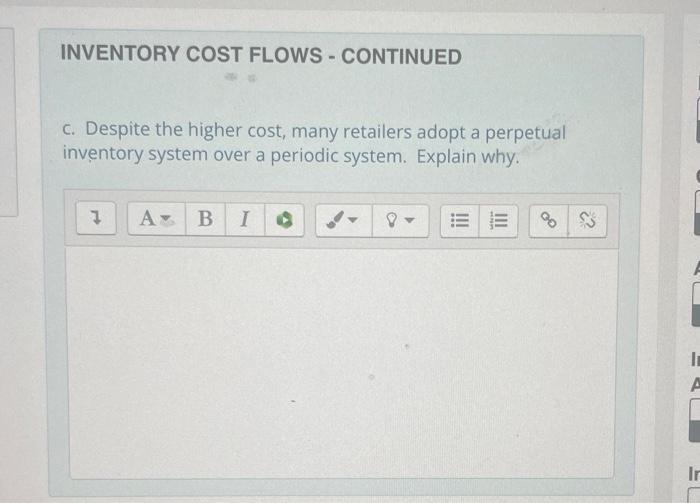

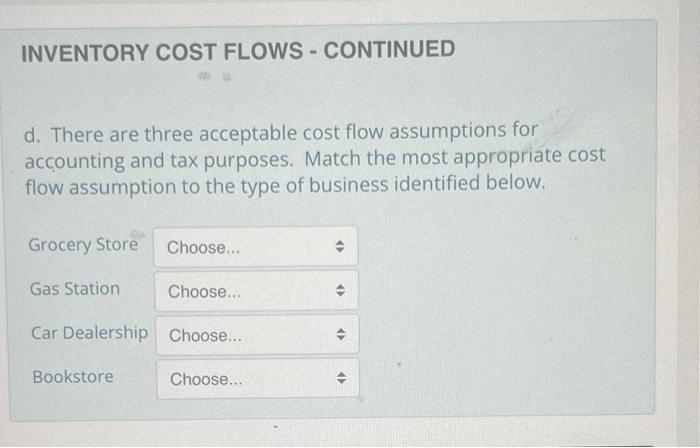

Candy Company has approached you to help decide what type of inventory system it should use (perpetual vs. periodic) and what cost flow assumption to adopt (FIFO vs. Average Cost). Inventory written off due to shrinkage is expensed to cost of goods sold. During September/ 2022 the following inventory transactions occurred: Date Sept 1 Sept 8 Sept 10 Sept 14 Sept 28 Description Opening balance Purchase #1 Sale #1 Purchase #2 Sale #2 Quantity (#units) 100 850 300 150 600 $ per Unit $13.50 $15.00 $ 25.00 $17.50 $30.00 At September 30th, a physical inventory count showed 180 units of inventory on hand. INVENTORY COST FLOWS - CONTINUED a) 1 Periodic System with a FIFO cost flow assumption. A B I Description # units X EE $Cost/unit S3 Total C INVENTORY COST FLOWS - CONTINUED b) Perpetual System with a moving weighted average cost flow assumption. (Note: Calculate all per unit costs to 4 decimal places.) 1 A B I # units X III $Cost/unit % 3 = Total C INVENTORY COST FLOWS - CONTINUED c. Despite the higher cost, many retailers adopt a perpetual inventory system over a periodic system. Explain why. 1 A B I ||| 0 I A Ir INVENTORY COST FLOWS - CONTINUED d. There are three acceptable cost flow assumptions for accounting and tax purposes. Match the most appropriate cost flow assumption to the type of business identified below. Grocery Store Gas Station Choose... Bookstore Choose... Car Dealership Choose... Choose... ( O "

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started