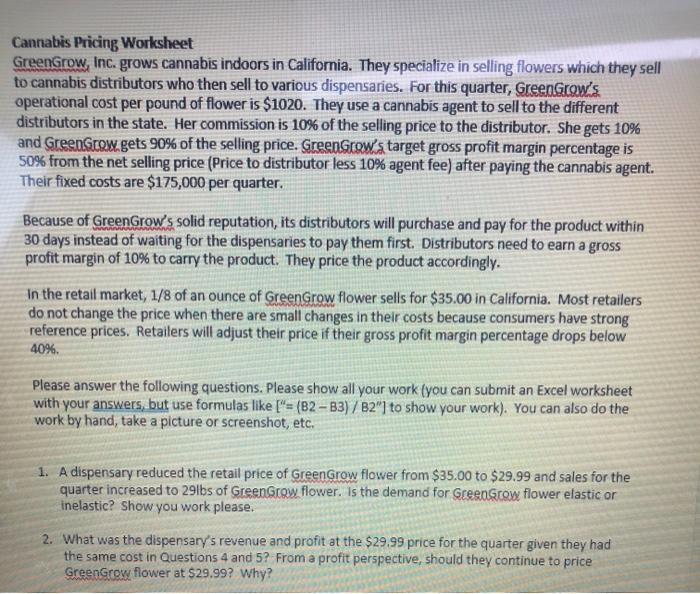

Cannabis Pricing Worksheet GreenGrow, Inc. grows cannabis indoors in California. They specialize in selling flowers which they sell to cannabis distributors who then sell to various dispensaries. For this quarter, GreenGrow's operational cost per pound of flower is $1020. They use a cannabis agent to sell to the different distributors in the state. Her commission is 10% of the selling price to the distributor. She gets 10% and GreenGrow.gets 90% of the selling price. GreenGrow's target gross profit margin percentage is 50% from the net selling price (Price to distributor less 10% agent fee) after paying the cannabis agent. Their fixed costs are $175,000 per quarter. Because of GreenGrow's solid reputation, its distributors will purchase and pay for the product within 30 days instead of waiting for the dispensaries to pay them first. Distributors need to earn a gross profit margin of 10% to carry the product. They price the product accordingly. In the retail market, 1/8 of an ounce of GreenGrow flower sells for $35.00 in California. Most retailers do not change the price when there are small changes in their costs because consumers have strong reference prices. Retailers will adjust their price if their gross profit margin percentage drops below 40%. Please answer the following questions. Please show all your work (you can submit an Excel worksheet with your answers, but use formulas like ["=(B2-83) / B2" to show your work). You can also do the work by hand, take a picture or screenshot, etc. 1. A dispensary reduced the retail price of GreenGrow flower from $35.00 to $29.99 and sales for the quarter increased to 291bs of GreenGrow flower. Is the demand for GreenGrow flower elastic or inelastic? show you work please. 2. What was the dispensary's revenue and profit at the $29.99 price for the quarter given they had the same cost in Questions 4 and 5? From a profit perspective, should they continue to price GreenGrow flower at $29.99? Why? Cannabis Pricing Worksheet GreenGrow, Inc. grows cannabis indoors in California. They specialize in selling flowers which they sell to cannabis distributors who then sell to various dispensaries. For this quarter, GreenGrow's operational cost per pound of flower is $1020. They use a cannabis agent to sell to the different distributors in the state. Her commission is 10% of the selling price to the distributor. She gets 10% and GreenGrow.gets 90% of the selling price. GreenGrow's target gross profit margin percentage is 50% from the net selling price (Price to distributor less 10% agent fee) after paying the cannabis agent. Their fixed costs are $175,000 per quarter. Because of GreenGrow's solid reputation, its distributors will purchase and pay for the product within 30 days instead of waiting for the dispensaries to pay them first. Distributors need to earn a gross profit margin of 10% to carry the product. They price the product accordingly. In the retail market, 1/8 of an ounce of GreenGrow flower sells for $35.00 in California. Most retailers do not change the price when there are small changes in their costs because consumers have strong reference prices. Retailers will adjust their price if their gross profit margin percentage drops below 40%. Please answer the following questions. Please show all your work (you can submit an Excel worksheet with your answers, but use formulas like ["=(B2-83) / B2" to show your work). You can also do the work by hand, take a picture or screenshot, etc. 1. A dispensary reduced the retail price of GreenGrow flower from $35.00 to $29.99 and sales for the quarter increased to 291bs of GreenGrow flower. Is the demand for GreenGrow flower elastic or inelastic? show you work please. 2. What was the dispensary's revenue and profit at the $29.99 price for the quarter given they had the same cost in Questions 4 and 5? From a profit perspective, should they continue to price GreenGrow flower at $29.99? Why