Answered step by step

Verified Expert Solution

Question

1 Approved Answer

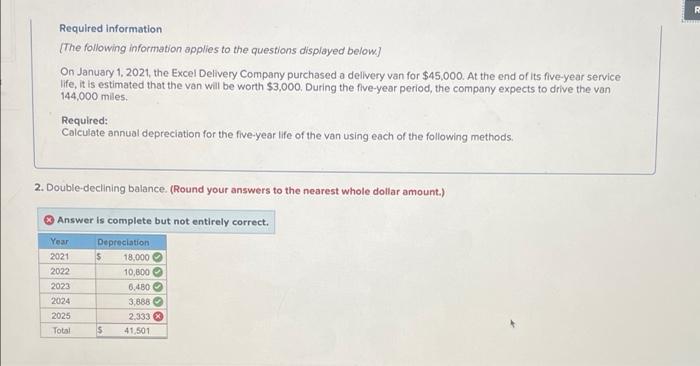

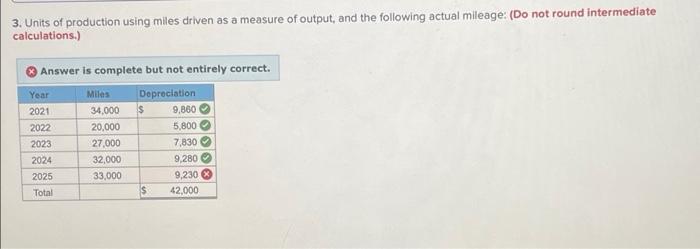

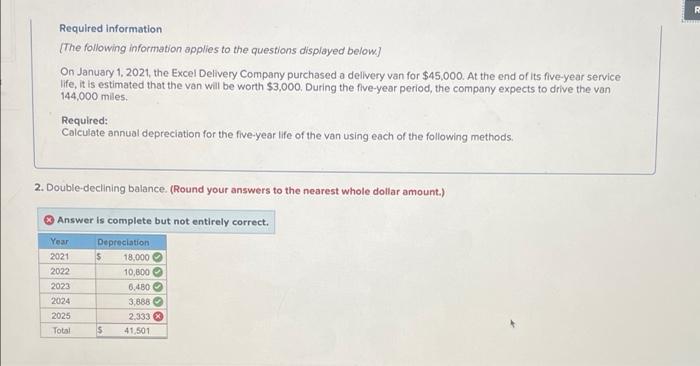

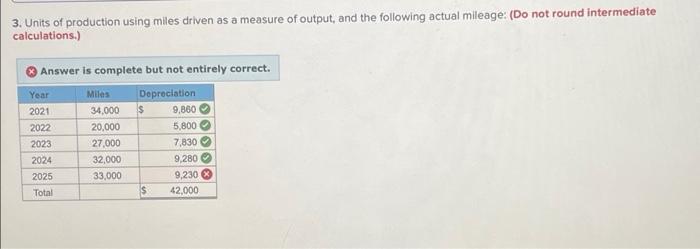

cant figure out the ones that has an X by it! 11 1 Required information [The following information applies to the questions displayed below] 2.

cant figure out the ones that has an X by it!

11 1 Required information [The following information applies to the questions displayed below] 2. Double-declining balance. (Round your answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Depreciation 18,000 10,800 6,480 3,888 2,333 41,501 On January 1, 2021, the Excel Delivery Company purchased a delivery van for $45,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 144,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. L Year 2021 $ 2022 2023 2024 2025 Total $ R Suma 3. Units of production using miles driven as a measure of output, and the following actual mileage: (Do not round intermediate calculations.) Answer is complete but not entirely correct. Depreciation 9,860 5,800 7,830 Year 2021 2022 2023 2024 2025 Total MNMM Miles 34,000 $ 20,000 27,000 32,000 33,000 9,280 9,230 $ 42,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started