Answered step by step

Verified Expert Solution

Question

1 Approved Answer

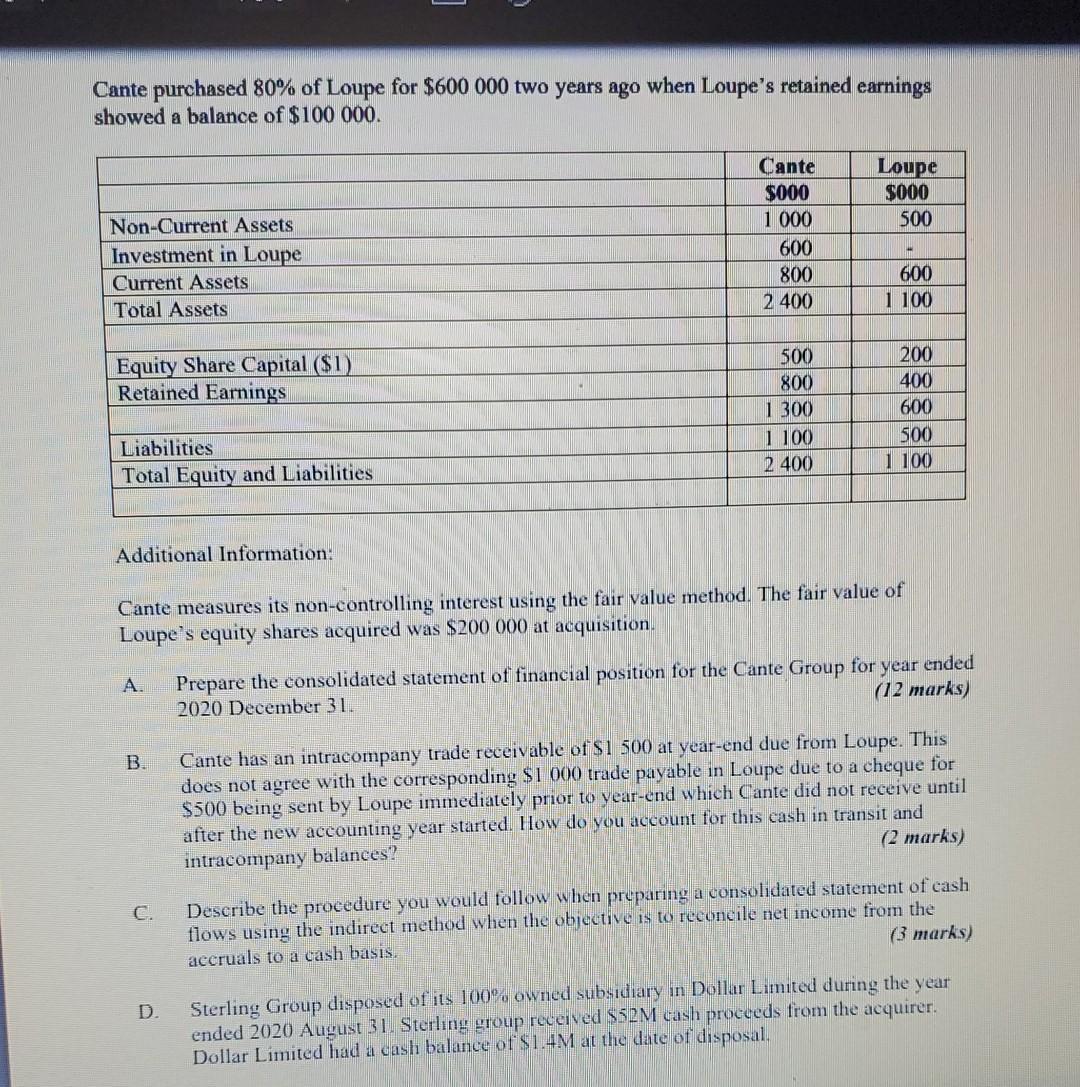

Cante purchased 80% of Loupe for $600 000 two years ago when Loupe's retained earnings showed a balance of $100 000. Cante Loupe SO0

Cante purchased 80% of Loupe for $600 000 two years ago when Loupe's retained earnings showed a balance of $100 000. Cante Loupe SO0 500 SO00 1 000 600 800 Non-Current Assets Investment in Loupe 600 1 100 Current Assets 2 400 Total Assets 500 800 1 300 1 100 2 400 200 400 600 Equity Share Capital ($1) Retained Earnings 500 Liabilities 1 100 Total Equity and Liabilities Additional Information: Cante measures its non-controlling interest using the fair value method. The fair value of Loupe's equity shares acquired was $200 000 at acquisition. Prepare the consolidated statement of financial position for the Cante Group for year ended (12 marks) A. 2020 December 31. Cante has an intracompany trade receivable of S1 500 at year-end due from Loupe. This does not agree with the corresponding $1 000 trade payable in Loupe due to a cheque for $500 being sent by Loupe immediately prior to year-end which Cante did not receive until after the new accounting year started. How do you account for this cash in transit and intracompany balances? (2 marks) flows using the indirect method when the objective is to reconcile net income from the (3 marks) C. Describe the procedure you would follow when preparing a consolidated statement of cash accruals to a cash basis. ended 2020 August 31. Sterling group received $52M cash proceeds from the acquirer. Dollar Limited had a cash balance of S1.4M at the date of disposal, D. Sterling Group disposed of its 100% owned subsidiary in Dollar Limited during the year B.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started