Answered step by step

Verified Expert Solution

Question

1 Approved Answer

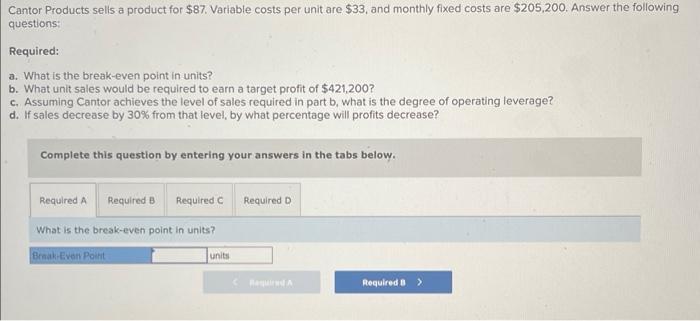

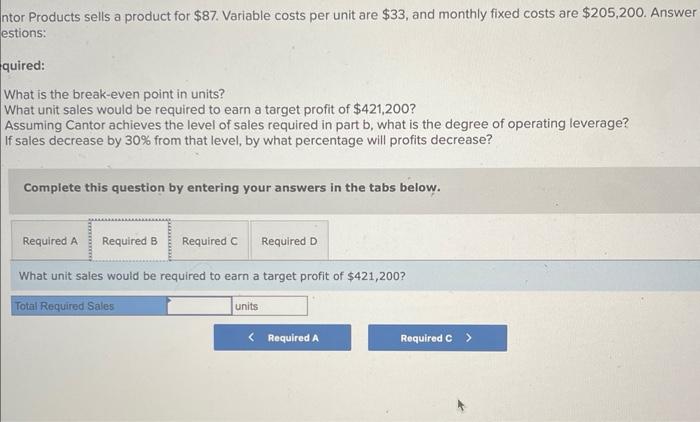

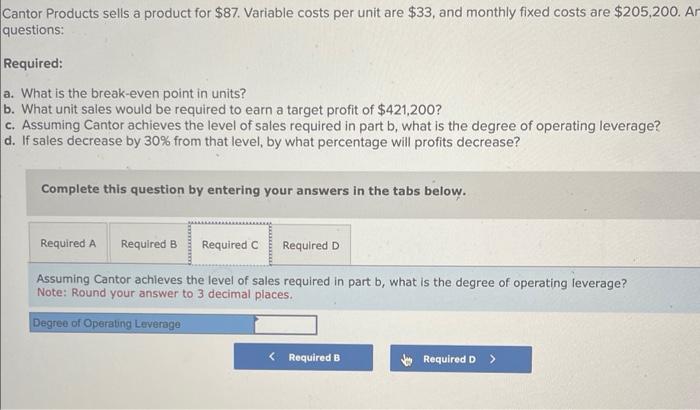

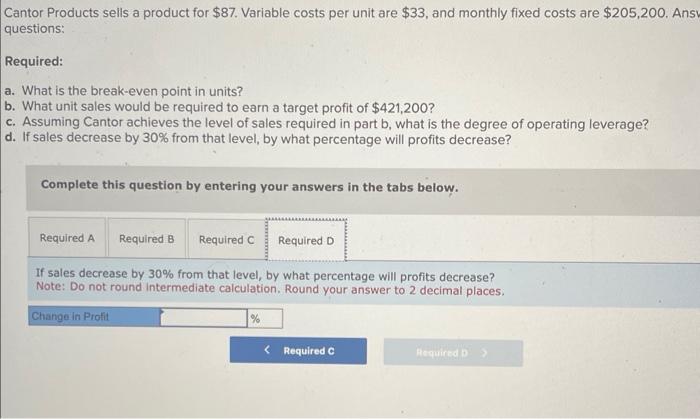

Cantor Products sells a product for $87. Variable costs per unit are $33, and monthly fixed costs are $205,200. Answer the following questions: Required:

Cantor Products sells a product for $87. Variable costs per unit are $33, and monthly fixed costs are $205,200. Answer the following questions: Required: a. What is the break-even point in units? b. What unit sales would be required to earn a target profit of $421,200? c. Assuming Cantor achieves the level of sales required in part b, what is the degree of operating leverage? d. If sales decrease by 30% from that level, by what percentage will profits decrease? Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the break-even point in units? Break-Even Point units Required D Required A Required B > ntor Products sells a product for $87. Variable costs per unit are $33, and monthly fixed costs are $205,200. Answer estions: quired: What is the break-even point in units? What unit sales would be required to earn a target profit of $421,200? Assuming Cantor achieves the level of sales required in part b, what is the degree of operating leverage? If sales decrease by 30% from that level, by what percentage will profits decrease? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D What unit sales would be required to earn a target profit of $421,200? Total Required Sales units < Required A Required C > Cantor Products sells a product for $87. Variable costs per unit are $33, and monthly fixed costs are $205,200. Ar questions: Required: a. What is the break-even point in units? b. What unit sales would be required to earn a target profit of $421,200? c. Assuming Cantor achieves the level of sales required in part b, what is the degree of operating leverage? d. If sales decrease by 30% from that level, by what percentage will profits decrease? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Assuming Cantor achieves the level of sales required in part b, what is the degree of operating leverage? Note: Round your answer to 3 decimal places. Degree of Operating Leverage < Required B Required D > Cantor Products sells a product for $87. Variable costs per unit are $33, and monthly fixed costs are $205,200. Ansv questions: Required: a. What is the break-even point in units? b. What unit sales would be required to earn a target profit of $421,200? c. Assuming Cantor achieves the level of sales required in part b, what is the degree of operating leverage? d. If sales decrease by 30% from that level, by what percentage will profits decrease? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D If sales decrease by 30% from that level, by what percentage will profits decrease? Note: Do not round Intermediate calculation. Round your answer to 2 decimal places. Change in Profit < Required C Required D

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Lets address the questions one by one a What is the breakeven point in units To calculate the breakeven point in units we use the formula Breakeven po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started