Answered step by step

Verified Expert Solution

Question

1 Approved Answer

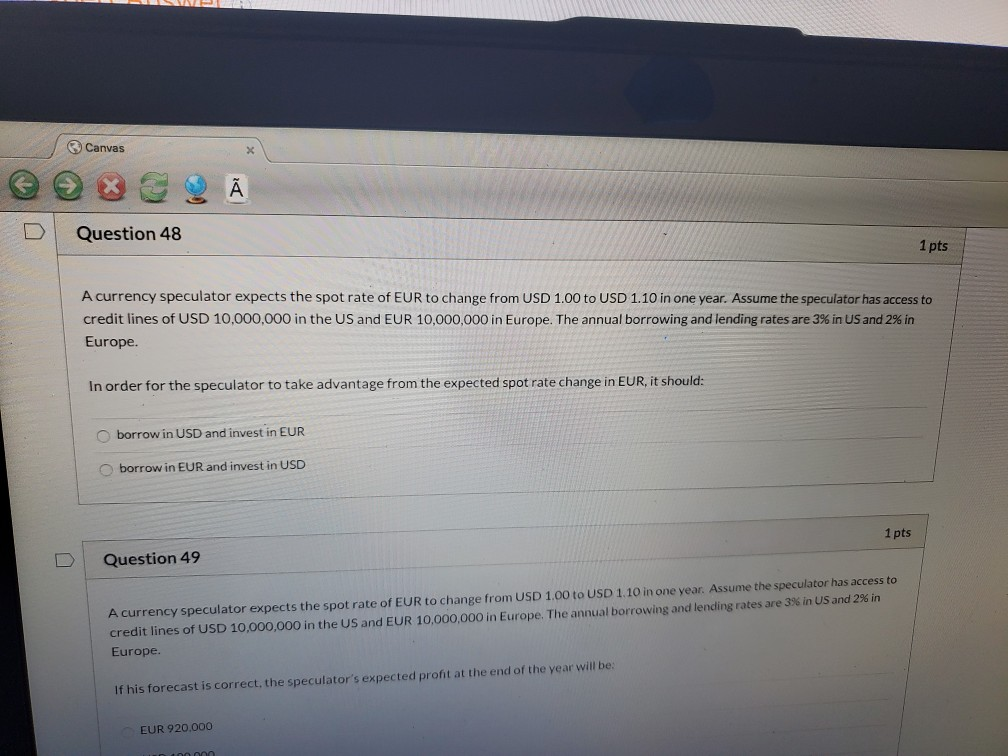

Canvas A U Question 48 1 pts A currency speculator expects the spot rate of EUR to change from USD 1.00 to USD 1.10 in

Canvas A U Question 48 1 pts A currency speculator expects the spot rate of EUR to change from USD 1.00 to USD 1.10 in one year. Assume the speculator has access to credit lines of USD 10,000,000 in the US and EUR 10,000,000 in Europe. The annual borrowing and lending rates are 3% in US and 2% in Europe. In order for the speculator to take advantage from the expected spot rate change in EUR, it should: borrow in USD and invest in EUR borrow in EUR and invest in USD 1 pts Question 49 A currency speculator expects the spot rate of EUR to change from USD 1.00 to USD 1.10 in one year. Assume the speculator has access to credit lines of USD 10,000,000 in the US and EUR 10,000,000 in Europe. The annual borrowing and lending rates are 396 in US and 2% in Europe. If his forecast is correct, the speculator's expected proht at the end of the year will be: EUR 920.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started