Answered step by step

Verified Expert Solution

Question

1 Approved Answer

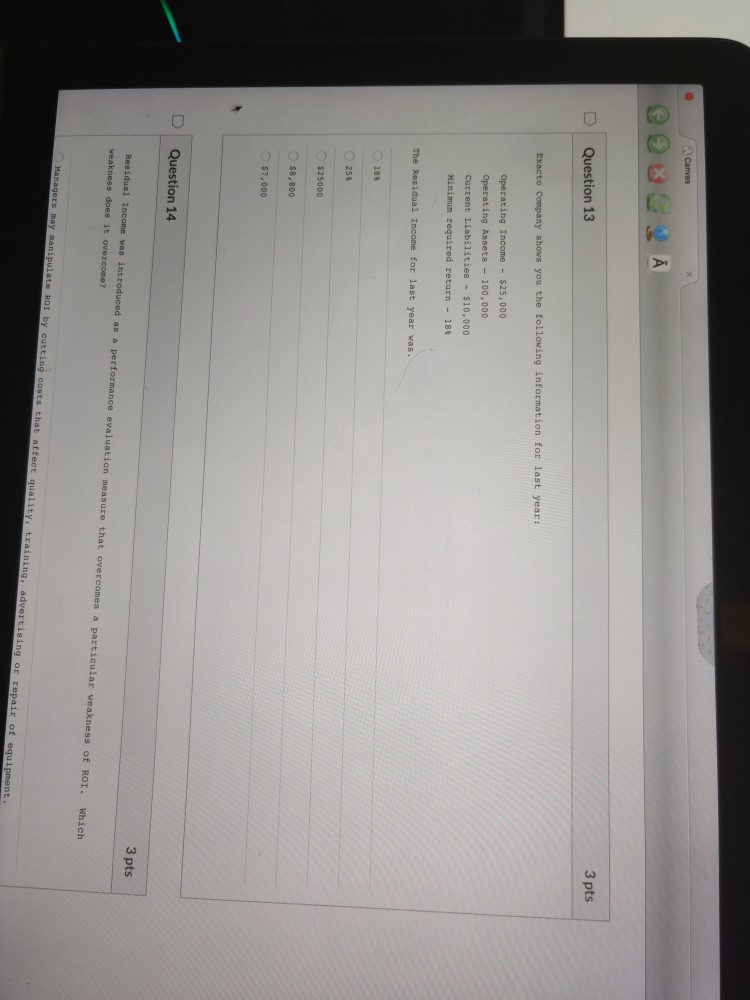

Canvas Question 13 3 pts Exacto Company shows you the following information for last year: Operating Income - $25,000 Operating Assets - 100,000 Current Liabilities

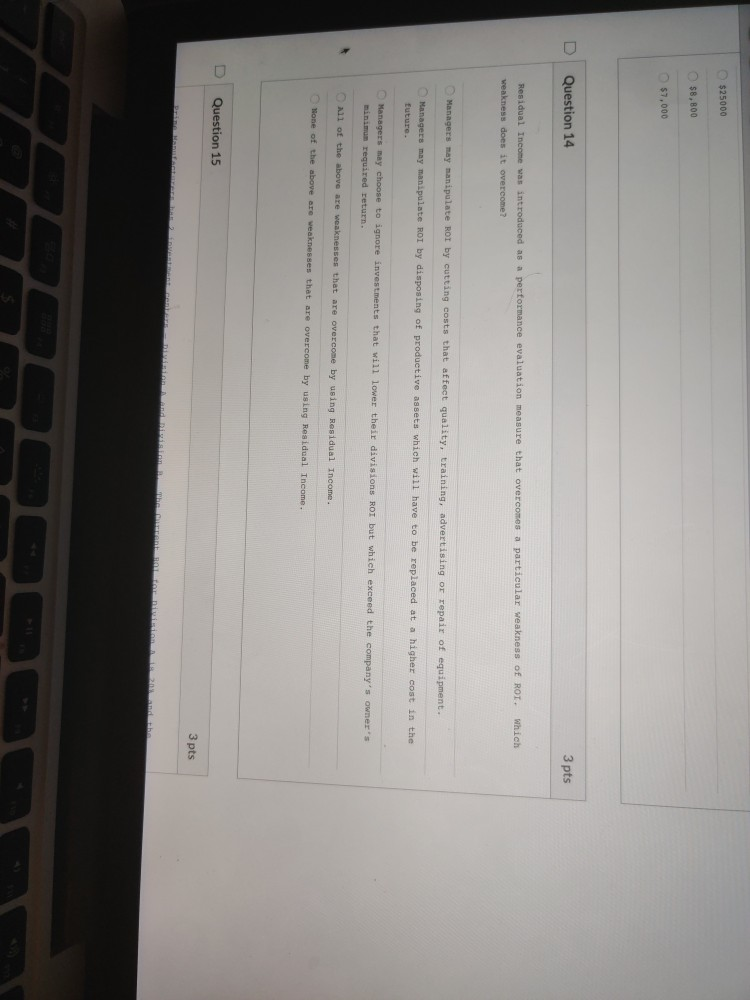

Canvas Question 13 3 pts Exacto Company shows you the following information for last year: Operating Income - $25,000 Operating Assets - 100,000 Current Liabilities - $10,000 Minimum required return - 188 The Residual Income for last year was. 189 256 $25000 $8,800 $7,000 D Question 14 3 pts Residual Income was introduced as a performance evaluation measure that overcomes a particular weakness of ROI. weakness does it overcome? Which Managers may manipulate ROI by cutting costs that affect quality, training, advertising or repair of equipment. $25000 $8,800 $7,000 Question 14 3 pts Residual Income was introduced as a performance evaluation measure that overcomes a particular weakness of ROI. weakness does it overcome? Which Managers may manipulate ROI by cutting costs that affect quality, training, advertising or repair of equipment. Managers may manipulate ROI by disposing of productive assets which will have to be replaced at a higher cost in the future. Managers may choose to ignore investments that will lower their divisions ROI but which exceed the company's owner's minimum required return. All of the above are weaknesses that are overcome by using Residual Income. None of the above are weaknesses that are overcome by using Residual Income. Question 15 3 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started