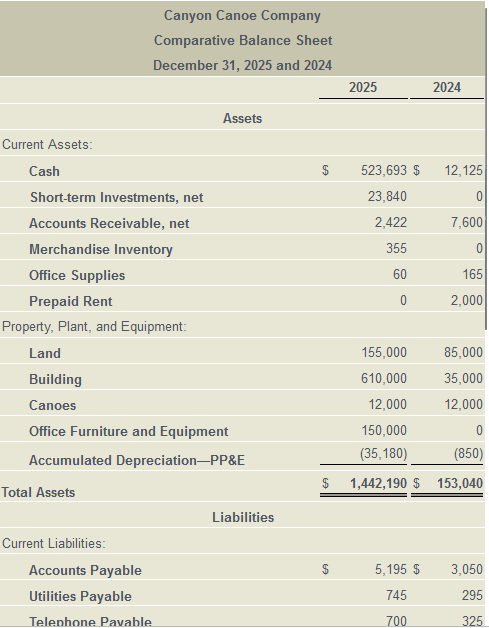

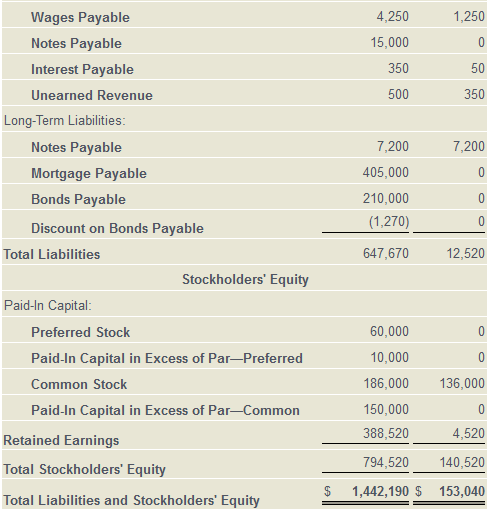

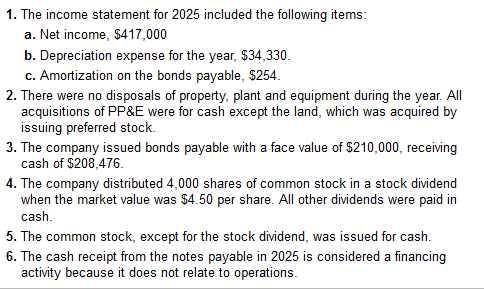

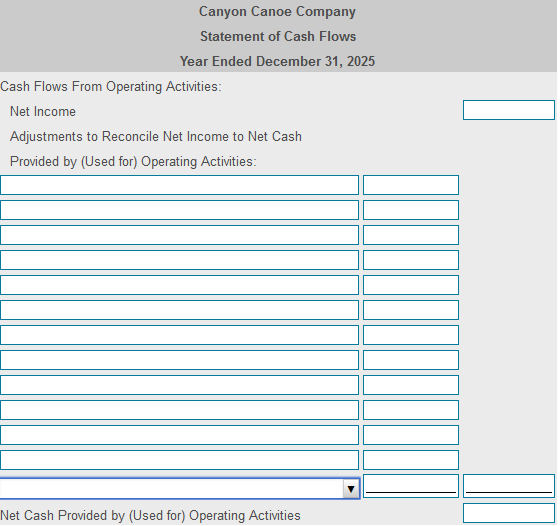

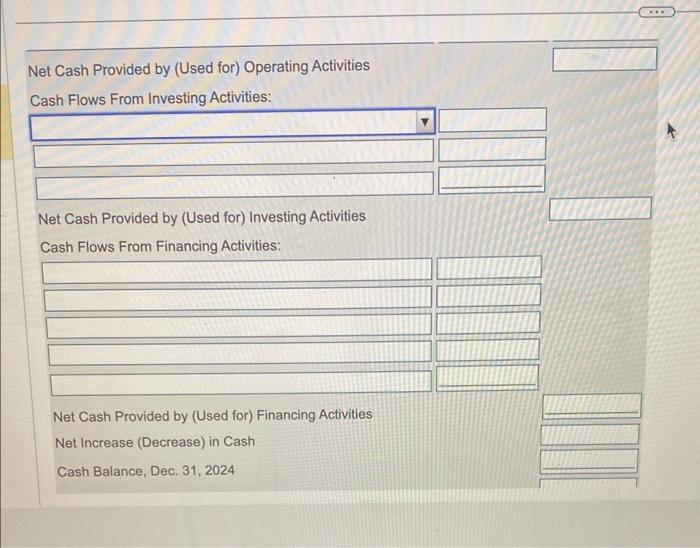

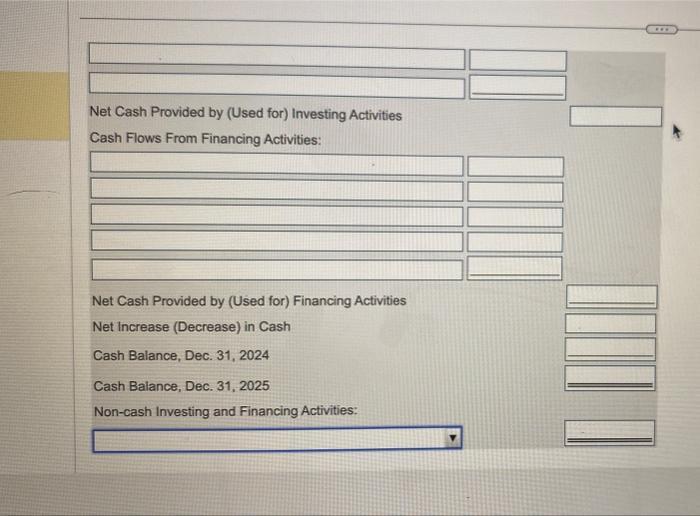

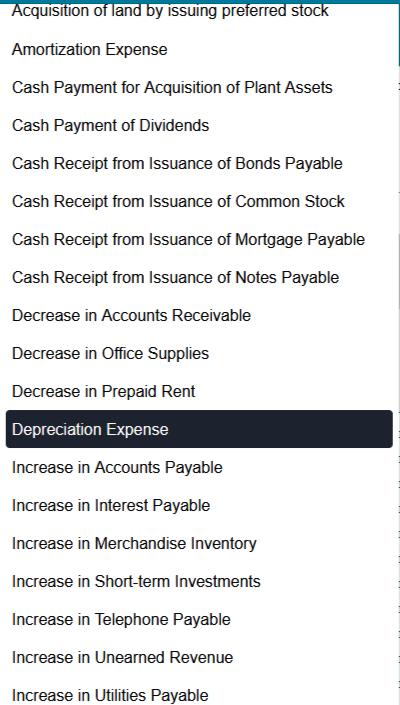

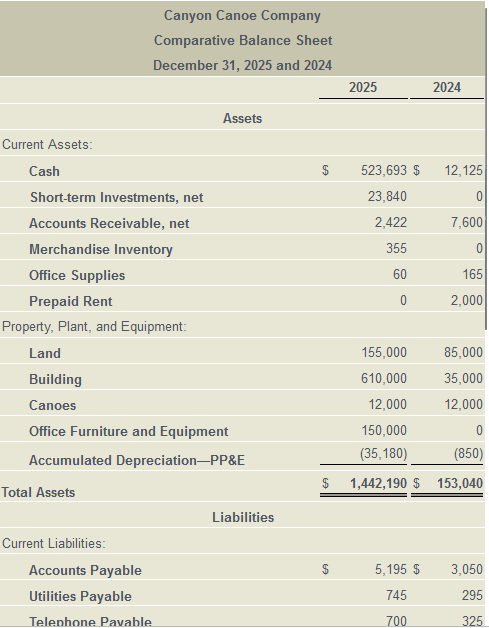

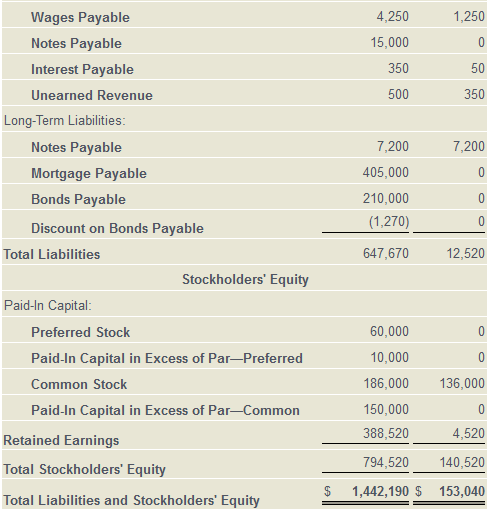

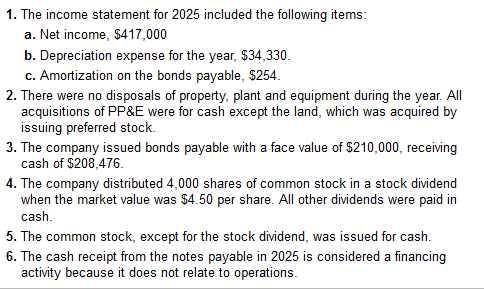

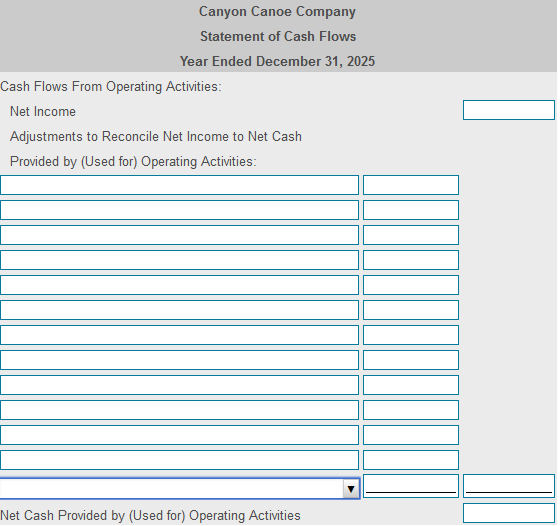

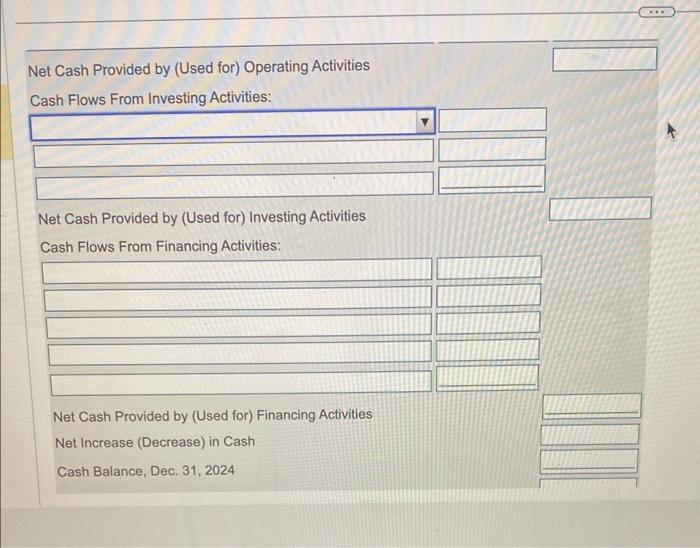

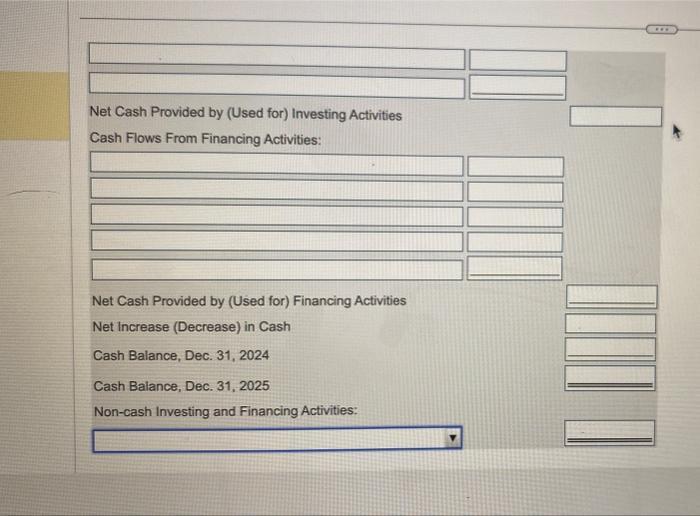

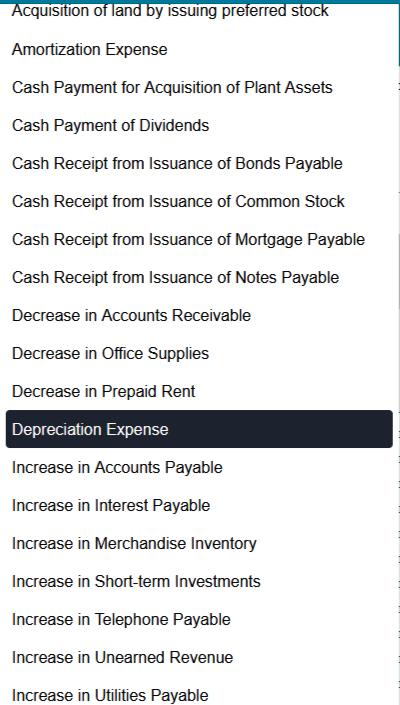

Canyon Canoe Company Comparative Balance Sheet December 31, 2025 and 2024 20252024 Assets Current Assets: Liabilities Current Liabilities: Accounts Payable Utilities Payable Telenhone. Pavable 700325 1. The income statement for 2025 included the following items: a. Net income, $417,000 b. Depreciation expense for the year, $34,330. c. Amortization on the bonds payable, $254. 2. There were no disposals of property, plant and equipment during the year. All acquisitions of PP\&E were for cash except the land, which was acquired by issuing preferred stock. 3. The company issued bonds payable with a face value of $210,000, receiving cash of $208,476. 4. The company distributed 4,000 shares of common stock in a stock dividend when the market value was $4.50 per share. All other dividends were paid in cash. 5. The common stock, except for the stock dividend, was issued for cash. 6. The cash receipt from the notes payable in 2025 is considered a financing activity because it does not relate to operations. Canyon Canoe Company Statement of Cash Flows Year Ended December 31, 2025 Cash Flows From Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Net Cash Provided by (Used for) Operating Activities Cash Flows From Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows From Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, Dec. 31, 2024 Net Cash Provided by (Used for) Investing Activities Cash Flows From Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, Dec. 31, 2024 Cash Balance, Dec. 31, 2025 Non-cash Investing and Financing Activities: Acquisition of land by issuing preferred stock Amortization Expense Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Receipt from Issuance of Bonds Payable Cash Receipt from Issuance of Common Stock Cash Receipt from Issuance of Mortgage Payable Cash Receipt from Issuance of Notes Payable Decrease in Accounts Receivable Decrease in Office Supplies Decrease in Prepaid Rent Depreciation Expense Increase in Accounts Payable Increase in Interest Payable Increase in Merchandise Inventory Increase in Short-term Investments Increase in Telephone Payable Increase in Unearned Revenue Increase in Utilities Payable