Answered step by step

Verified Expert Solution

Question

1 Approved Answer

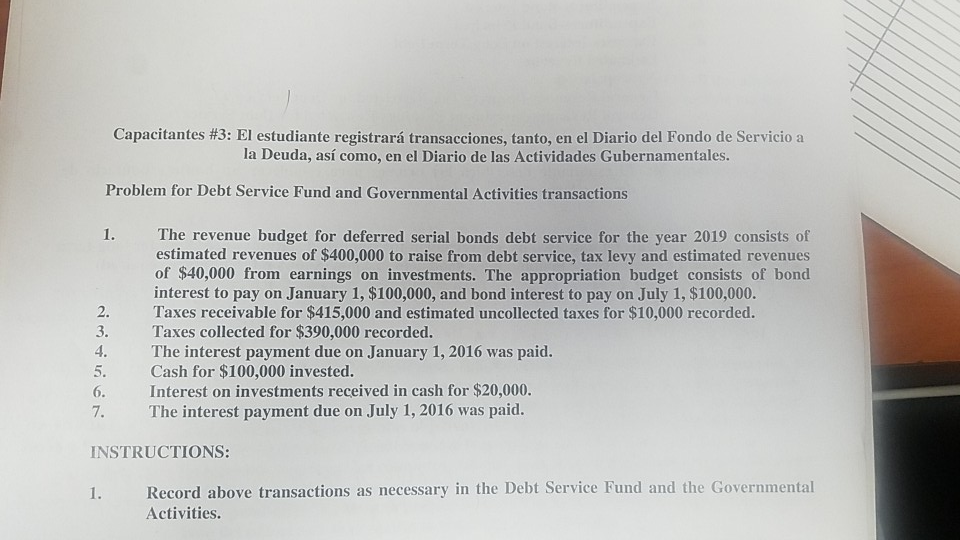

capacitantes #3: El estudiante registrar transacciones, tanto, en el Diario del Fondo de Servicio a la Deuda, as como, en el Diario de las Actividades

capacitantes #3: El estudiante registrar transacciones, tanto, en el Diario del Fondo de Servicio a la Deuda, as como, en el Diario de las Actividades Gubernamentales. Problem for Debt Service Fund and Governmental Activities transactions The revenue budget for deferred serial bonds debt service for the year 2019 consists of estimated revenues of $400,000 to raise from debt service, tax levy and estimated revenues of $40,000 from earnings on investments. The appropriation budget consists of bond interest to pay on January 1, $100,000, and bond interest to pay on July 1, $100,000. Taxes receivable for $415,000 and estimated uncollected taxes for $10,000 recorded. Taxes collected for $390,000 recorded. The interest payment due on January 1, 2016 was paid 1. 2. 3. 5. Cash for $100,000 invested. 6. Interest on investments received in cash for $20,000. 7. The interest payment due on July 1, 2016 was paid. INSTRUCTIONS: Record above transactions as necessary in the Debt Service Fund and the Governmental Activities. 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started