Answered step by step

Verified Expert Solution

Question

1 Approved Answer

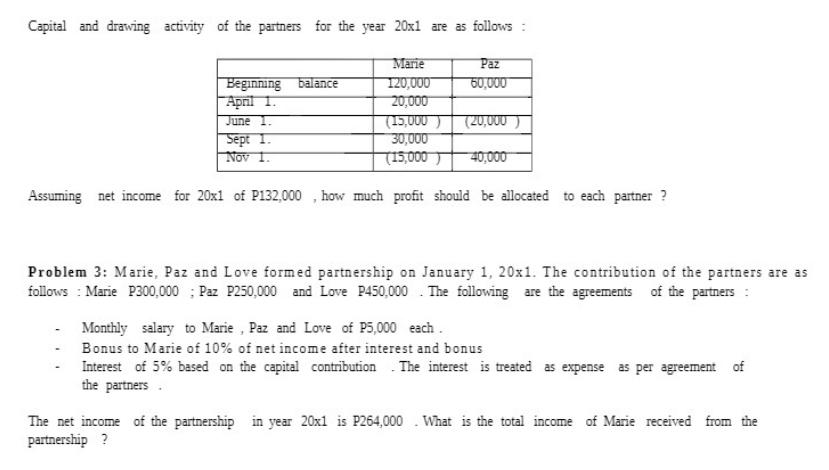

Capital and drawing activity of the partners for the year 20x1 are as follows: Beginning balance April 1. June 1. Sept 1. Nov 1.

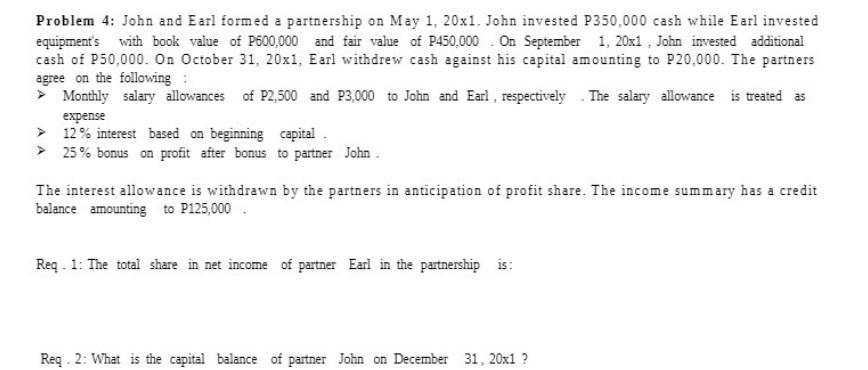

Capital and drawing activity of the partners for the year 20x1 are as follows: Beginning balance April 1. June 1. Sept 1. Nov 1. Assuming net income for 20x1 of P132,000 . Marie 120,000 20,000 (15,000) 30,000 (15,000) Paz 60,000 (20,000) 40,000 how much profit should be allocated to each partner? Problem 3: Marie, Paz and Love formed partnership on January 1, 20x1. The contribution of the partners are as follows: Marie P300,000 Paz P250,000 and Love P450,000. The following are the agreements of the partners: Monthly salary to Marie, Paz and Love of P5,000 each. Bonus to Marie of 10% of net income after interest and bonus Interest of 5% based on the capital contribution The interest is treated as expense as per agreement of the partners. The net income of the partnership in year 20x1 is P264,000. What is the total income of Marie received from the partnership ? Problem 4: John and Earl formed a partnership on May 1, 20x1. John invested P350,000 cash while Earl invested equipment's with book value of P600,000 and fair value of P450,000 On September 1, 20x1, John invested additional cash of P50,000. On October 31, 20x1, Earl withdrew cash against his capital amounting to P20,000. The partners agree on the following: Monthly salary allowances of P2,500 and P3,000 to John and Earl, respectively. The salary allowance is treated as expense > 12% interest based on beginning capital. 25% bonus on profit after bonus to partner John. The interest allowance is withdrawn by the partners in anticipation of profit share. The income summary has a credit balance amounting to P125,000. Req. 1: The total share in net income of partner Earl in the partnership is: Req. 2: What is the capital balance of partner John on December 31, 20x1 ?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve the problems step by step Problem 1 Given the capital and drawing activity of the partner...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started