Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In early 20x5 the Miami company signed a contract for construction of an industrial park to be completed in three years. At the time.

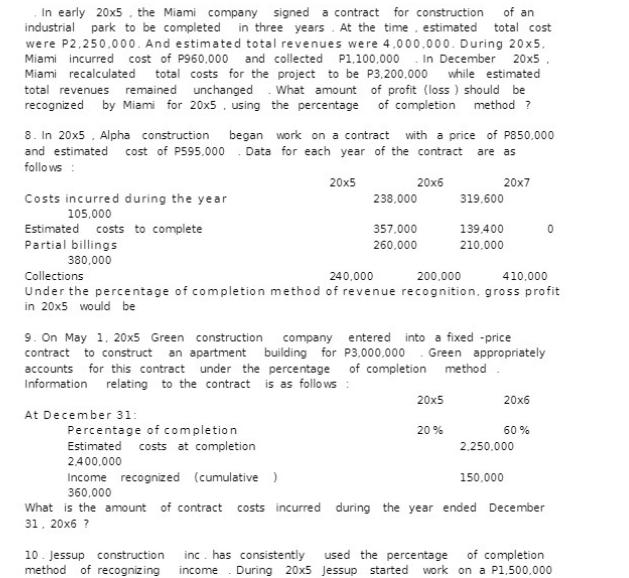

In early 20x5 the Miami company signed a contract for construction of an industrial park to be completed in three years. At the time. estimated total cost were P2,250.000. And estimated total revenues were 4.000.000. During 20x5, Miami incurred cost of P960,000 and collected P1,100,000 In December 20x5 Miami recalculated total costs for the project to be P3,200.000 while estimated total revenues remained unchanged. What amount of profit (loss) should be recognized by Miami for 20x5, using the percentage of completion method ? 8. In 20x5 Alpha construction began work on a contract with a price of P850.000 and estimated cost of P595.000 Data for each year of the contract are as follows: 20x6 20x7 Costs incurred during the year 105.000 Estimated costs to complete Partial billings 380,000 20x5 At December 31: 238,000 Percentage of completion Estimated costs at completion 2,400,000 357.000 260,000 Collections 240,000 200,000 410,000 Under the percentage of completion method of revenue recognition, gross profit in 20x5 would be 9. On May 1, 20x5 Green construction company entered into a fixed -price contract to construct an apartment building for P3,000,000 Green appropriately accounts for this contract under the percentage of completion method Information relating to the contract is as follows: 319,600 139,400 210.000 20x5 20% 20x6 60% 2.250.000 0 Income recognized (cumulative ) 360,000 What is the amount of contract costs incurred during the year ended December 31, 20x6 ? 150,000 10 Jessup construction inc. has consistently used the percentage of completion method of recognizing income. During 20x5 Jessup started work on a P1,500,000

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze each of the provided scenarios Miami Company The profit or loss recognized under the percentageofcompletion method is based on the propor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started