Answered step by step

Verified Expert Solution

Question

1 Approved Answer

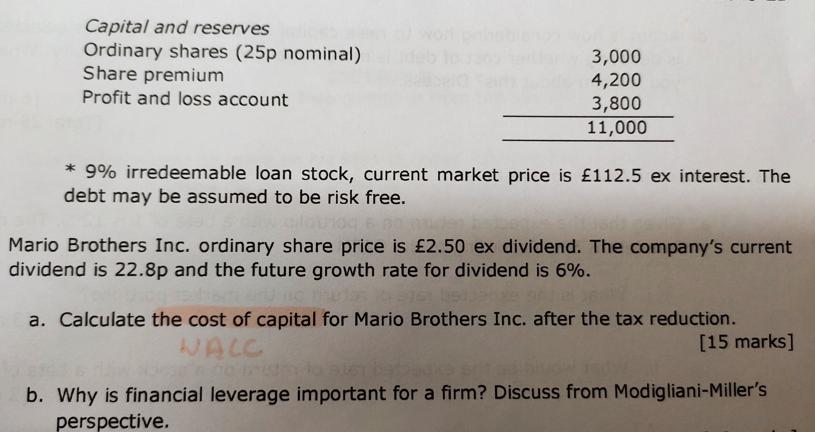

Capital and reserves Ordinary shares (25p nominal) Share premium Profit and loss account 3,000 de 4,200 3,800 11,000 * 9% irredeemable loan stock, current

Capital and reserves Ordinary shares (25p nominal) Share premium Profit and loss account 3,000 de 4,200 3,800 11,000 * 9% irredeemable loan stock, current market price is 112.5 ex interest. The debt may be assumed to be risk free. Mario Brothers Inc. ordinary share price is 2.50 ex dividend. The company's current dividend is 22.8p and the future growth rate for dividend is 6%. thuda a. Calculate the cost of capital for Mario Brothers Inc. after the tax reduction. WALC [15 marks] b. Why is financial leverage important for a firm? Discuss from Modigliani-Miller's perspective.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of the Cost of Capital for Mario Brothers Inc after tax reduction To calculate the cost of capital for Mario Brothers Inc we first need to determine the cost of equity and the cost of de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started