Question

(Capital Asset Pricing Model) Johnson Manufacturing, Inc., is considering several investments. The rate on Treasury bills is currently 6.5 percent, and the expected return

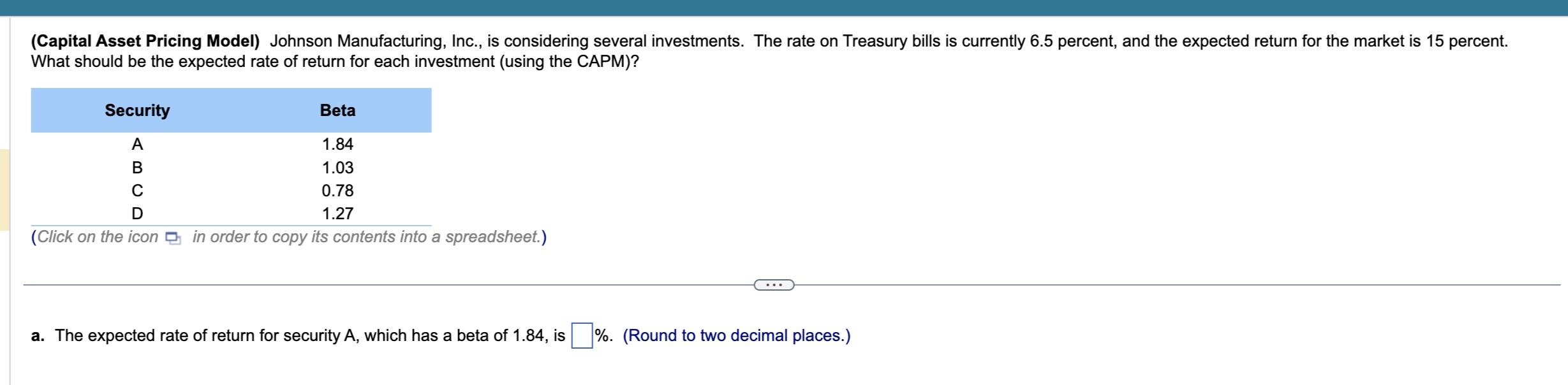

(Capital Asset Pricing Model) Johnson Manufacturing, Inc., is considering several investments. The rate on Treasury bills is currently 6.5 percent, and the expected return for the market is 15 percent. What should be the expected rate of return for each investment (using the CAPM)? Security A B C D (Click on the icon in order to copy its contents into a spreadsheet.) Beta 1.84 1.03 0.78 1.27 a. The expected rate of return for security A, which has a beta of 1.84, is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected rate of return for each investment using the Capital Asset Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur Keown, John Martin

12th edition

133423824, 978-0133423822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App