Answered step by step

Verified Expert Solution

Question

1 Approved Answer

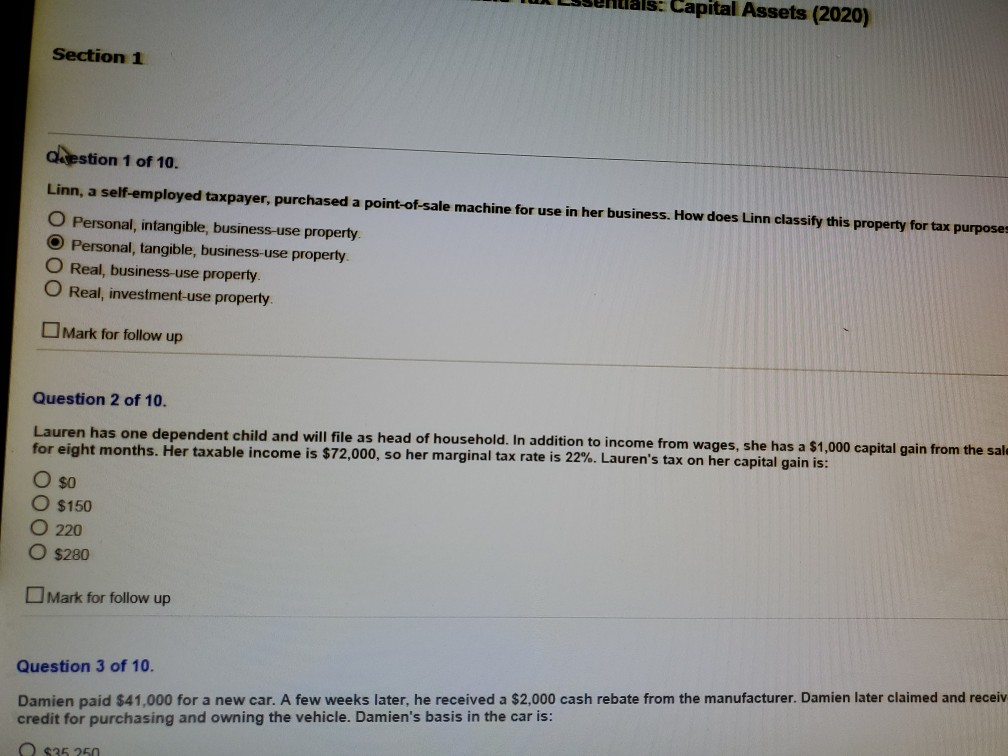

Capital Assets (2020) Section 1 Question 1 of 10. Linn, a self-employed taxpayer, purchased a point-of-sale machine for use in her business. How does Linn

Capital Assets (2020) Section 1 Question 1 of 10. Linn, a self-employed taxpayer, purchased a point-of-sale machine for use in her business. How does Linn classify this property for tax purposes O Personal, intangible, business-use property O Personal, tangible, business-use property. O Real, business-use property O Real, investment-use property Mark for follow up Question 2 of 10. Lauren has one dependent child and will file as head of household. In addition to income from wages, she has a $1,000 capital gain from the sale for eight months. Her taxable income is $72,000, so her marginal tax rate is 22%. Lauren's tax on her gain is: O $0 O $150 O 220 O $280 Mark for follow up Question 3 of 10. Damien paid $41,000 for a new car. A few weeks later, he received a $2,000 cash rebate from the manufacturer. Damien later claimed and receiv credit for purchasing and owning the vehicle. Damien's basis in the car is: O $35 250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started