Answered step by step

Verified Expert Solution

Question

1 Approved Answer

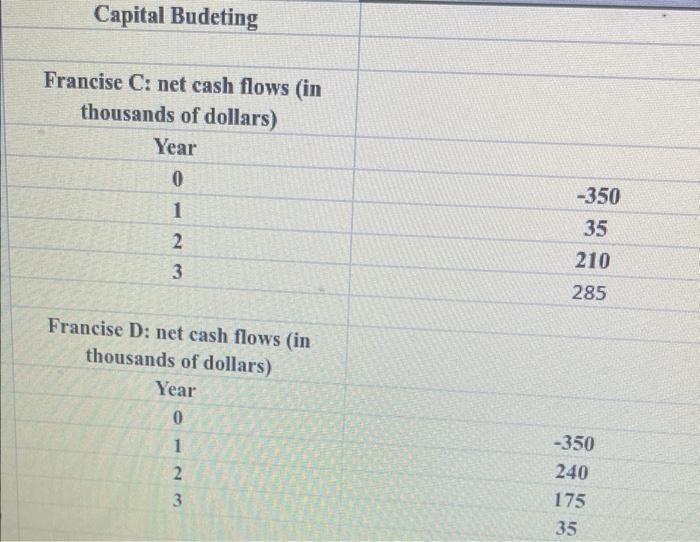

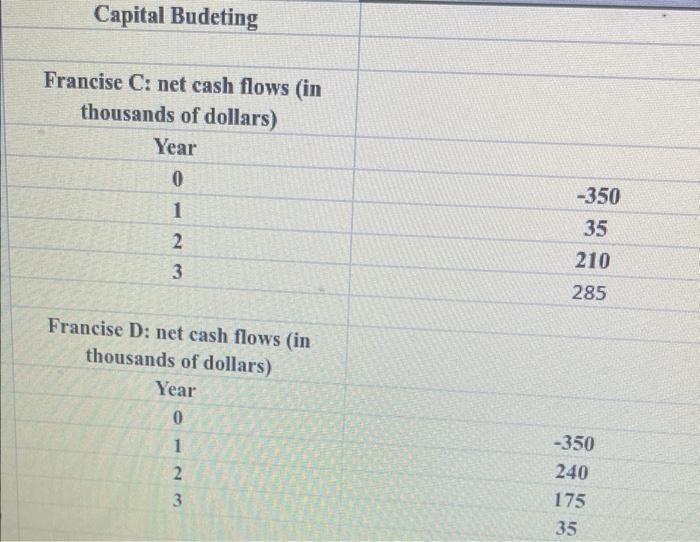

Capital Budeting Francise C: net cash flows (in thousands of dollars) begin{tabular}{cc} Year & 0 & 350 hline 1 & 35 hline

Capital Budeting Francise C: net cash flows (in thousands of dollars) \begin{tabular}{cc} Year & \\ 0 & 350 \\ \hline 1 & 35 \\ \hline 2 & 210 \\ \hline 3 & 285 \\ \hline \end{tabular} Francise D: net cash flows (in thousands of dollars) Year012335024017535 8. Look at your NPV profile graph without referring to the actual NPVs and IRRs. Which franchise or franchises should be accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any cost of capital less than 23.6% ? 9. Define the term modified IRR (MIRR). Find the MIRRs for Franchises C and D

Capital Budeting Francise C: net cash flows (in thousands of dollars) \begin{tabular}{cc} Year & \\ 0 & 350 \\ \hline 1 & 35 \\ \hline 2 & 210 \\ \hline 3 & 285 \\ \hline \end{tabular} Francise D: net cash flows (in thousands of dollars) Year012335024017535 8. Look at your NPV profile graph without referring to the actual NPVs and IRRs. Which franchise or franchises should be accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any cost of capital less than 23.6% ? 9. Define the term modified IRR (MIRR). Find the MIRRs for Franchises C and D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started