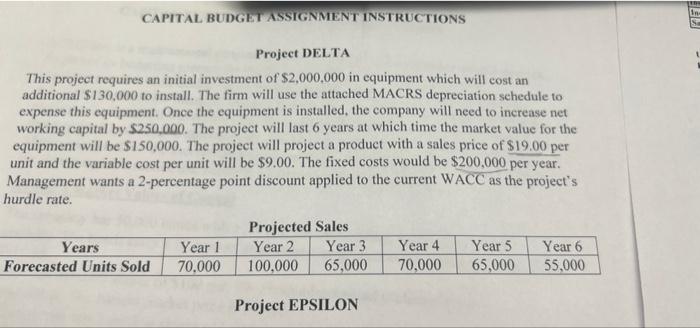

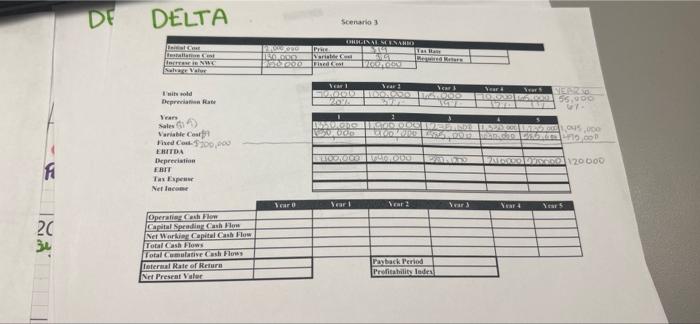

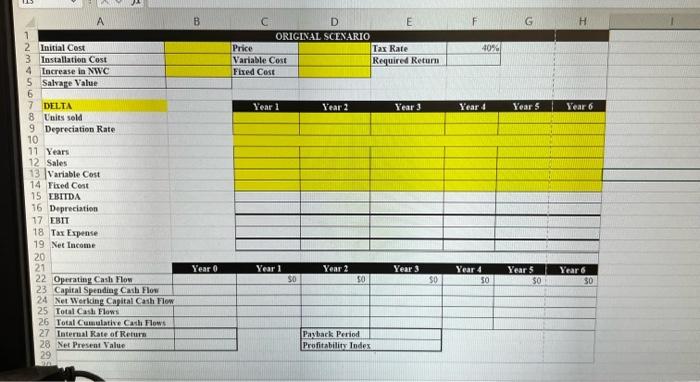

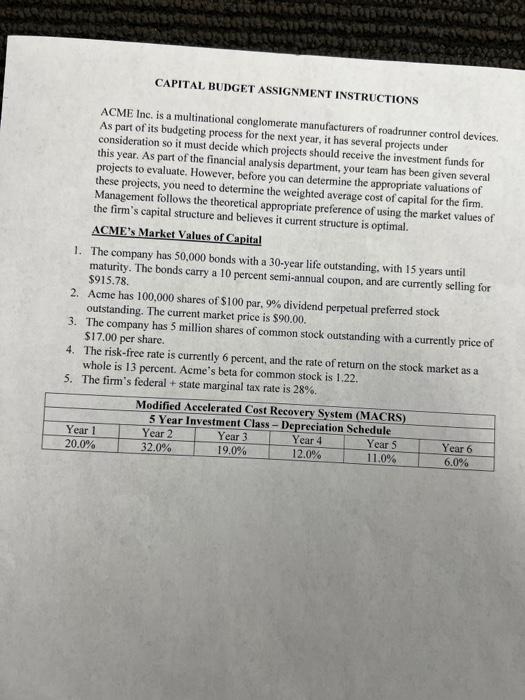

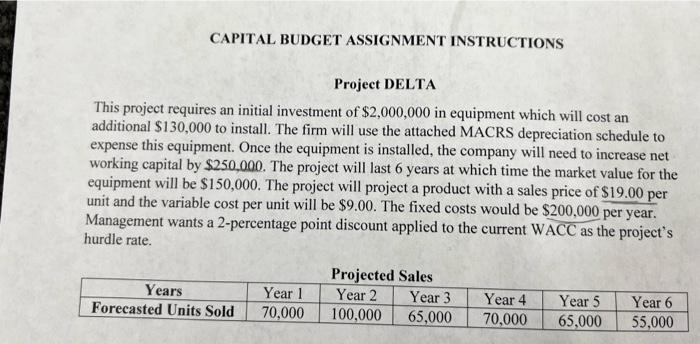

CAPITAL BUDGET ASSIGNMENT INSTRUCTIONS Project DELTA This project requires an initial investment of $2,000,000 in equipment which will cost an additional $130,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $250,000. The project will last 6 years at which time the market value for the equipment will be $150,000. The project will project a product with a sales price of $19.00 per unit and the variable cost per unit will be $9.00. The fixed costs would be $200,000 per year. Management wants a 2-percentage point discount applied to the current WACC as the project's hurdle rate. Projected Sales Years Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Forecasted Units Sold 70,000 100,000 65,000 70,000 65,000 55,000 Project EPSILON DF DELTA Scenarios fest EINE Salas Vaher ILOS BSTRATO CHINESENAND 11 ola War d! WY Vai Ver Ver Tirol Deprem Ver BET35.900 Sale 2 BESAR 5.000 LEGENDS Ver Variable Costa FeC200,00 ERITDA Depreciation FRIT Tas Epe Nella BROCADE DE HERRER DE 20 000 fi Vaar Year 4 Years 20 34 Operating how Capital Speediarah How Net Working Capital Cash Flow Total Cash Flow Total Cumulative Cash Flows Caterial Rate of Return Nint Preset Valor Payback period traliatile lutel B F G H D E ORIGINAL SCENARIO Price Tax Rate Variable Cost Required Return Fixed Cost 40% Year 1 Year 2 Year 3 Yeard Year 5 Year 6 A 1 2 Initial Cast 3 Installation Cost 4 Increase in NWC 5 Salvage Value 6 7 DELTA 8 Units sold 9 Depreciation Rate 10 11 Years 12 Sales 13 Variable Cost 14 Fixed Cost 15 EBITDA 16 Depreciation 17 EBIT 18 Tax Espense 19 Net Income 20 21 22 Operating Cash Flow 23 Capital Spending Cala Flow 24 Net Working Capital Cash Flow 25 Total Cash Flows 26 Total Cative Cash Flows 27 Internal Rate of Returs 28 Net Present Value 29 Year 0 Year 1 Year 2 Year 3 Year 4 50 Year 5 50 Year 6 30 $0 50 50 Payback Period Profitability Index CAPITAL BUDGET ASSIGNMENT INSTRUCTIONS ACME Inc. is a multinational conglomerate manufacturers of roadrunner control devices. As part of its budgeting process for the next year, it has several projects under consideration so it must decide which projects should receive the investment funds for this year. As part of the financial analysis department, your team has been given several projects to evaluate. However, before you can determine the appropriate valuations of these projects, you need to determine the weighted average cost of capital for the firm. Management follows the theoretical appropriate preference of using the market values of the firm's capital structure and believes it current structure is optimal. ACME's Market Values of Capital 1. The company has 50,000 bonds with a 30-year life outstanding, with 15 years until maturity. The bonds carry a 10 percent semi-annual coupon, and are currently selling for $915.78 2. Acme has 100,000 shares of $100 par, 9% dividend perpetual preferred stock outstanding. The current market price is $90.00. 3. The company has 5 million shares of common stock outstanding with a currently price of $17.00 per share. 4. The risk-free rate is currently 6 percent, and the rate of return on the stock market as a whole is 13 percent. Acme's beta for common stock is 1.22. 5. The firm's federal + state marginal tax rate is 28%. Modified Accelerated Cost Recovery System (MACRS) 5 Year Investment Class - Depreciation Schedule Year 1 Year 2 Year 3 Year 4 Years Year 6 20.0% 32.0% 19.0% 12.0% 11.0% 6.0% CAPITAL BUDGET ASSIGNMENT INSTRUCTIONS Project DELTA This project requires an initial investment of $2,000,000 in equipment which will cost an additional $130,000 to install. The firm will use the attached MACRS depreciation schedule to expense this equipment. Once the equipment is installed, the company will need to increase net working capital by $250,000. The project will last 6 years at which time the market value for the equipment will be $150,000. The project will project a product with a sales price of $19.00 per unit and the variable cost per unit will be $9.00. The fixed costs would be $200,000 per year. Management wants a 2-percentage point discount applied to the current WACC as the project's hurdle rate. Projected Sales Years Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Forecasted Units Sold 70,000 100,000 65,000 70,000 65,000 55,000