Answered step by step

Verified Expert Solution

Question

1 Approved Answer

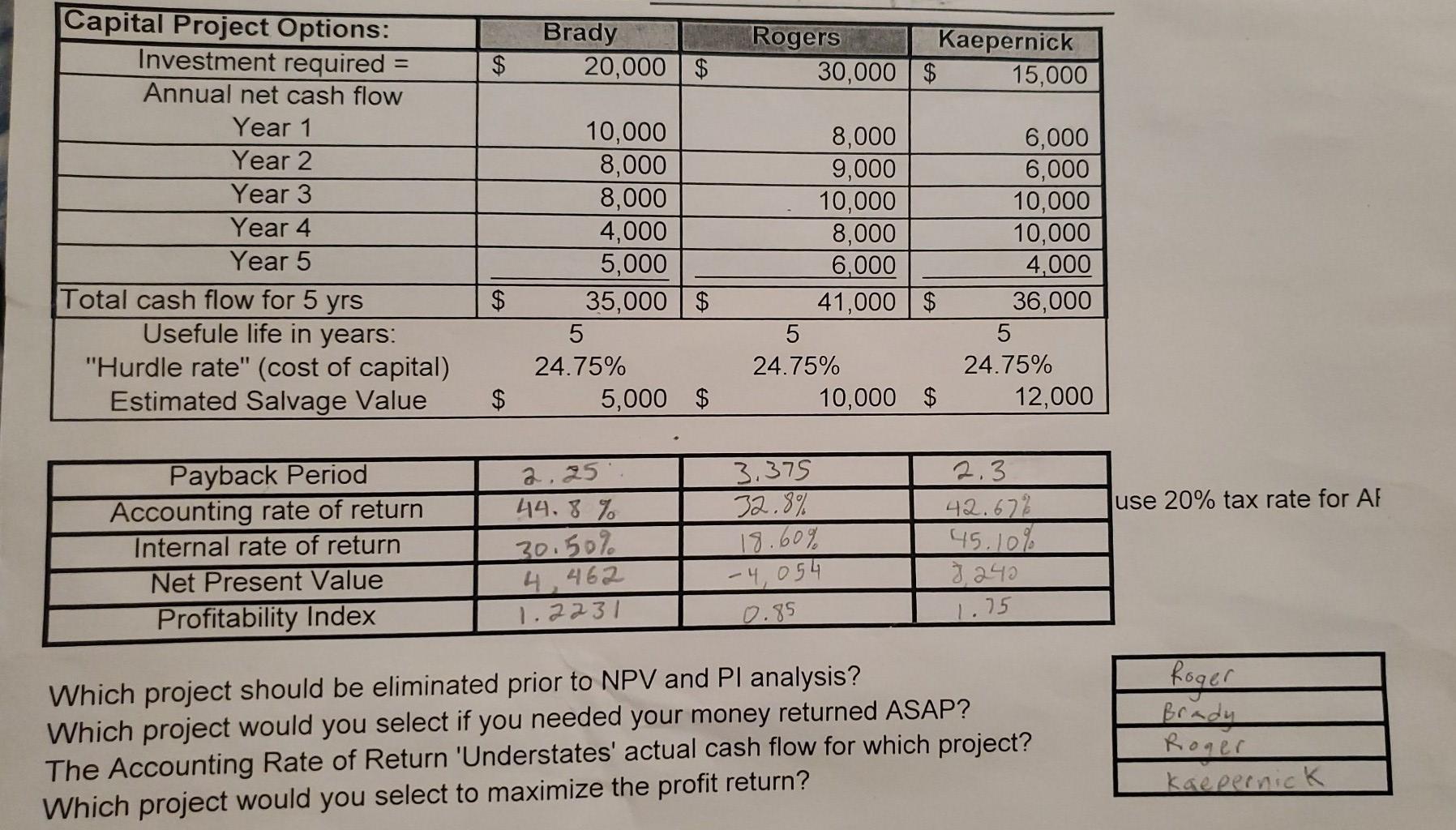

Capital Budgeting: Brady Rogers Kaepernick. Can you help solve these questions? Every post shows different answers and doesn't show work. Thank you! Brady 20,000 $

Capital Budgeting: Brady Rogers Kaepernick.

Can you help solve these questions? Every post shows different answers and doesn't show work. Thank you!

Brady 20,000 $ $ Rogers Kaepernick 30,000 $ 15,000 Capital Project Options: Investment required = Annual net cash flow Year 1 Year 2 Year 3 Year 4 Year 5 Total cash flow for 5 yrs Usefule life in years: "Hurdle rate" (cost of capital) Estimated Salvage Value 10,000 8,000 8,000 4,000 5,000 35,000 $ 5 24.75% 5,000 $ 8,000 9,000 10,000 8,000 6,000 41,000 $ 5 24.75% 10,000 $ 6,000 6,000 10,000 10,000 4,000 36,000 5 24.75% 12,000 $ $ a. 25 44.8% Payback Period Accounting rate of return Internal rate of return Net Present Value Profitability Index 3.375 32.8% 18.60% use 20% tax rate for AF 2.3 42.67% 45.10% 3,240 30.50% 4,462 1.2231 - 4,054 0.85 1.75 Which project should be eliminated prior to NPV and Pl analysis? Which project would you select if you needed your money returned ASAP? The Accounting Rate of Return 'Understates' actual cash flow for which project? Which project would you select to maximize the profit return? Roger Brady Roger kaepernickStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started