Capital budgeting

Can you answer the Second Stage? Considering: 1.NSD is NPV

2.Marginal ASM is MWACC

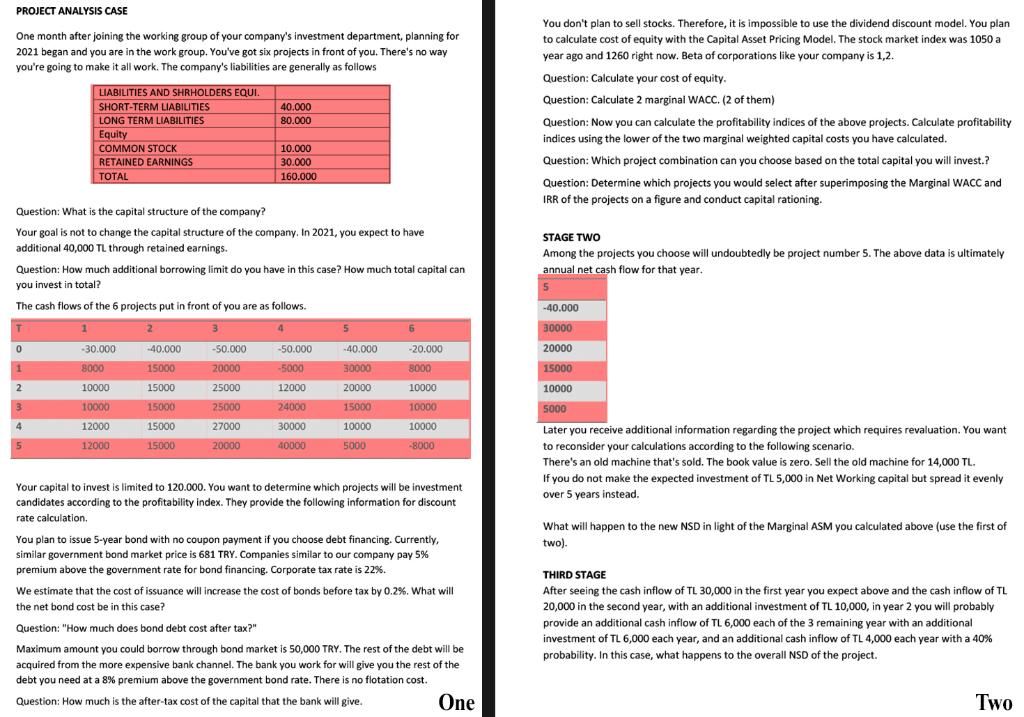

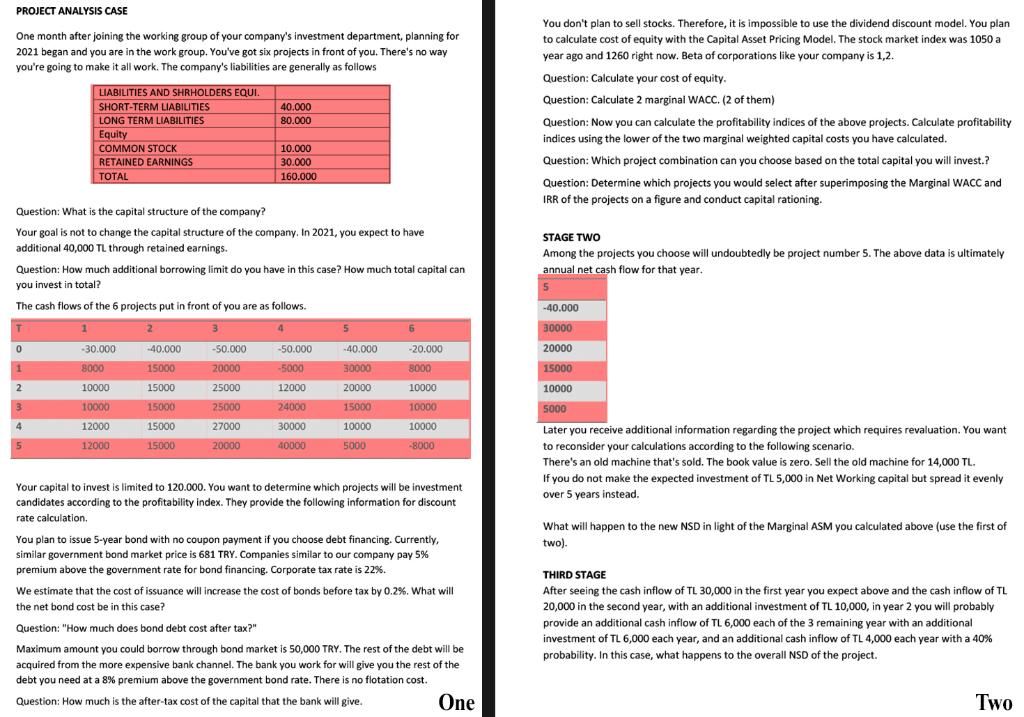

PROJECT ANALYSIS CASE One month after joining the working group of your company's investment department planning for 2021 began and you are in the work group. You've got six projects in front of you. There's no way you're going to make it all work. The company's liabilities are generally as follows LIABILITIES AND SHRHOLDERS EQUI. SHORT-TERM LIABILITIES 40.000 LONG TERM LIABILITIES 80.000 Equity COMMON STOCK 10.000 RETAINED EARNINGS 30.000 TOTAL 160.000 You don't plan to sell stocks. Therefore, it is impossible to use the dividend discount model. You plan to calculate cost of equity with the Capital Asset Pricing Model. The stock market index was 1050 a year ago and 1260 right now. Beta of corporations like your company is 1,2. Question: Calculate your cost of equity. Question: Calculate 2 marginal WACC. (2 of them) Question: Now you can calculate the profitability indices of the above projects. Calculate profitability indices using the lower of the two marginal weighted capital costs you have calculated. Question: Which project combination can you choose based on the total capital you will invest.? Question: Determine which projects you would select after superimposing the Marginal WACC and IRR of the projects on a figure and conduct capital rationing. Question: What is the capital structure of the company? Your goal is not to change the capital structure of the company. In 2021, you expect to have additional 40,000 TL through retained earnings. Question: How much additional borrowing limit do you have in this case? How much total capital can you invest in total? The cash flows of the projects put in front of you are as follows. STAGE TWO Among the projects you choose will undoubtedly be project number 5. The above data is ultimately annual net cash flow for that year. 5 -40.000 30000 6 0 -50.000 -40.000 -40.000 15000 1 -30.000 8000 10000 10000 2. 15000 -50.000 20000 25000 25000 27000 20000 3 -20.000 8000 10000 10000 10000 -8000 -5000 12000 24000 30000 40000 15000 30000 20000 15000 10000 5000 4 12000 12000 15000 15000 20000 15000 10000 5000 Later you receive additional information regarding the project which requires revaluation. You want to reconsider your calculations according to the following scenario. There's an old machine that's sold. The book value is zero. Sell the old machine for 14,000 TL. If you do not make the expected investment of TL 5,000 in Net Working capital but spread it evenly over 5 years instead. 5 What will happen to the new NSD in light of the Marginal ASM you calculated above (use the first of ( two). Your capital to invest is limited to 120.000. You want to determine which projects will be investment candidates according to the profitability index. They provide the following information for discount rate calculation. You plan to issue 5-year bond with no coupon payment if you choose debt financing. Currently, similar government bond market price is 681 TRY. Companies similar to our company pay 5% premium above the government rate for bond financing. Corporate tax rate is 22%. We estimate that the cost of issuance will increase the cost of bonds before tax by 0.2%. What will . the net bond cost be in this case? ? Question: "How much does bond debt cost after tax?" Maximum amount you could borrow through bond market is 50,000 TRY. The rest of the debt will be acquired from the more expensive bank channel. The bank you work for will give you the rest of the debt you need at a 8% premium above the government bond rate. There is no flotation cost. Question: How much is the after-tax cost of the capital that the bank will give. One THIRD STAGE After seeing the cash inflow of TL 30,000 in the first year you expect above and the cash inflow of TL 20,000 in the second year, with an additional investment of TL 10,000, in year 2 you will probably provide an additional cash inflow of TL 6,000 each of the 3 remaining year with an additional investment of TL 6,000 each year, and an additional cash inflow of TL 4,000 each year with a 40% probability. In this case, what happens to the overall NSD of the project. Two PROJECT ANALYSIS CASE One month after joining the working group of your company's investment department planning for 2021 began and you are in the work group. You've got six projects in front of you. There's no way you're going to make it all work. The company's liabilities are generally as follows LIABILITIES AND SHRHOLDERS EQUI. SHORT-TERM LIABILITIES 40.000 LONG TERM LIABILITIES 80.000 Equity COMMON STOCK 10.000 RETAINED EARNINGS 30.000 TOTAL 160.000 You don't plan to sell stocks. Therefore, it is impossible to use the dividend discount model. You plan to calculate cost of equity with the Capital Asset Pricing Model. The stock market index was 1050 a year ago and 1260 right now. Beta of corporations like your company is 1,2. Question: Calculate your cost of equity. Question: Calculate 2 marginal WACC. (2 of them) Question: Now you can calculate the profitability indices of the above projects. Calculate profitability indices using the lower of the two marginal weighted capital costs you have calculated. Question: Which project combination can you choose based on the total capital you will invest.? Question: Determine which projects you would select after superimposing the Marginal WACC and IRR of the projects on a figure and conduct capital rationing. Question: What is the capital structure of the company? Your goal is not to change the capital structure of the company. In 2021, you expect to have additional 40,000 TL through retained earnings. Question: How much additional borrowing limit do you have in this case? How much total capital can you invest in total? The cash flows of the projects put in front of you are as follows. STAGE TWO Among the projects you choose will undoubtedly be project number 5. The above data is ultimately annual net cash flow for that year. 5 -40.000 30000 6 0 -50.000 -40.000 -40.000 15000 1 -30.000 8000 10000 10000 2. 15000 -50.000 20000 25000 25000 27000 20000 3 -20.000 8000 10000 10000 10000 -8000 -5000 12000 24000 30000 40000 15000 30000 20000 15000 10000 5000 4 12000 12000 15000 15000 20000 15000 10000 5000 Later you receive additional information regarding the project which requires revaluation. You want to reconsider your calculations according to the following scenario. There's an old machine that's sold. The book value is zero. Sell the old machine for 14,000 TL. If you do not make the expected investment of TL 5,000 in Net Working capital but spread it evenly over 5 years instead. 5 What will happen to the new NSD in light of the Marginal ASM you calculated above (use the first of ( two). Your capital to invest is limited to 120.000. You want to determine which projects will be investment candidates according to the profitability index. They provide the following information for discount rate calculation. You plan to issue 5-year bond with no coupon payment if you choose debt financing. Currently, similar government bond market price is 681 TRY. Companies similar to our company pay 5% premium above the government rate for bond financing. Corporate tax rate is 22%. We estimate that the cost of issuance will increase the cost of bonds before tax by 0.2%. What will . the net bond cost be in this case? ? Question: "How much does bond debt cost after tax?" Maximum amount you could borrow through bond market is 50,000 TRY. The rest of the debt will be acquired from the more expensive bank channel. The bank you work for will give you the rest of the debt you need at a 8% premium above the government bond rate. There is no flotation cost. Question: How much is the after-tax cost of the capital that the bank will give. One THIRD STAGE After seeing the cash inflow of TL 30,000 in the first year you expect above and the cash inflow of TL 20,000 in the second year, with an additional investment of TL 10,000, in year 2 you will probably provide an additional cash inflow of TL 6,000 each of the 3 remaining year with an additional investment of TL 6,000 each year, and an additional cash inflow of TL 4,000 each year with a 40% probability. In this case, what happens to the overall NSD of the project. Two