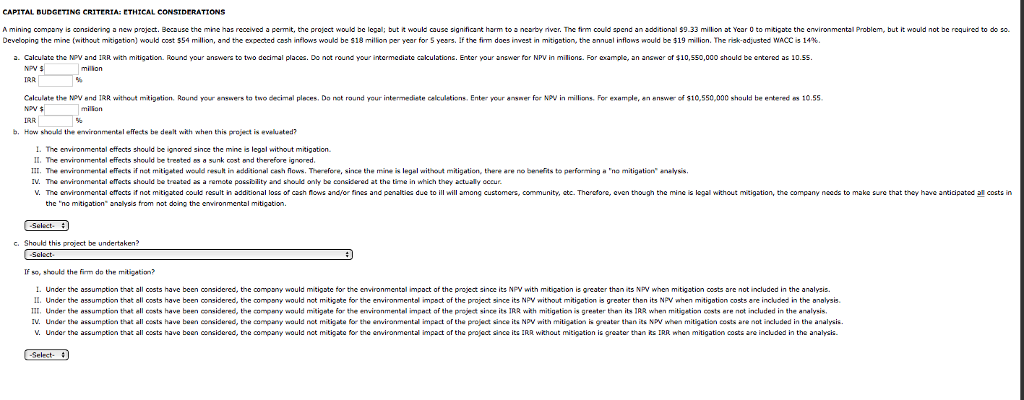

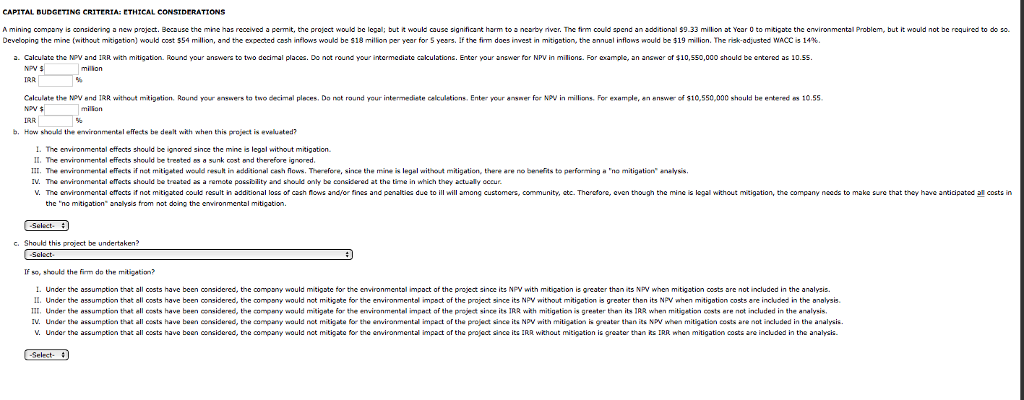

CAPITAL BUDGETING CRITERIA: CTHICAL CONSTDERATIONS A mining company is considering new pro ect. Because the mi e nas received ? pe it tne pro cct would be legal; but would cause significant harm too nco tr n cr. ? e r could spend ?nadditional S9.33 mil on at Year 0 to mitigate the environmental Problem, but it would not be equired to do so Developing the mine ithout mit gation would cost $54 m lion, and the expected cash flows would be sl milion per year for S yers. If the fr does n vest in mit gobo te annual inflows ould be 319 million The sk adl sted wa C 15 1496 a calculate the M , and IRR with mitigation. Round you anc e s to two decimal places Do not ound your intermediate calculations. Enter your a s or for NPV in milions For example an ans er of?10,550,000 should be entered as 10.55 TRA Calculate the t end IRR without m kigotion. Round your ons ers to todeer al places. Do not round Your int emmediete calculations. Enter youra sner for NPV in millians. For example, "nenswer of 10,550,000 should be entered 10.55 b. How should the ewiranmentel effects be dealt with when this project is evaluated? L. The enwironmental effects should be ignored since the mine is legl without mitigation 11. The environmental effects should be trested 55 ? sunk cost ond therefore ignored. J. The ewironmental effects if not miti?ated would result in additianal cash flows. Therefore, since the mine is legal without mitigation, there are no benefits to performing a "no mitigation" aneysis 1 The environmental errect? should be treated as a remote posslity and should aily be considered at the time in which they actually occur. e al? nmental e ects if not miti ated could esult ?dditional locs of cash flows and er fines and penalties due to ill the "no mtigation analysis from not doing the environmental mitigation ill among customers, community, t c. The a or en hough the mine is egal without mitigation, the company needs to make s re that they have anti pate a costs in c. Should this project be undertaken? If so, should the firm do the mitigation? . Uncer the assumption that all ccsts have been considered, the campsmy would mitigote for the enwironmental impact of the praject since its NPV with mitigation is greater than its NPV when mitigation costs are not included in the analysis. 11. Under the assumption t at all costs have been oonsidered the comp5 would not mitigate or the environmental impot of the p oject s nce 'ts NPV without itigation grester then its N w en m tigation costsare included the analysts. Under the assumptio that all costs have been c midere the compe ? v ould r igete ??? r the en ronmental impact of the pre ect sr ce its IRR with mitigation is greeter thon its IRR when miti etion o sts ere not included in the analysis v. under the assumption that all costs have been a sidered the co paty ould not miti9aa fr the ?? v iranmental impact of the pro ea since its NpY ?th miti ation is eater than its NpN hen miti ation costs r? not included in the analysis. under the assumption that all costs have been considered the company ould not mitigate for the en ironmental impact of the pro ect since its IRR without mitigation i??reater than its IRR hen mitigation costs are included in the analysis. Select