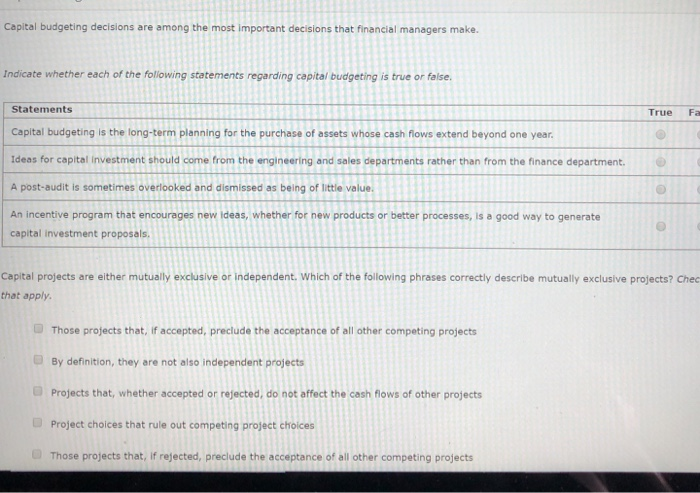

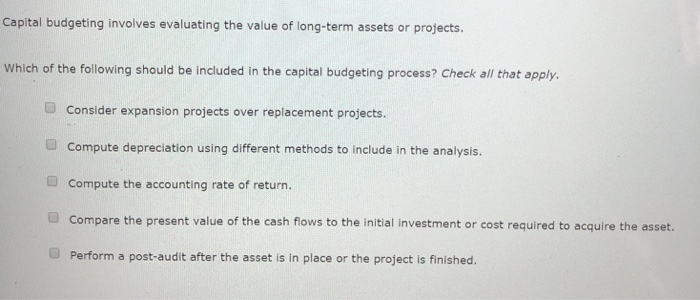

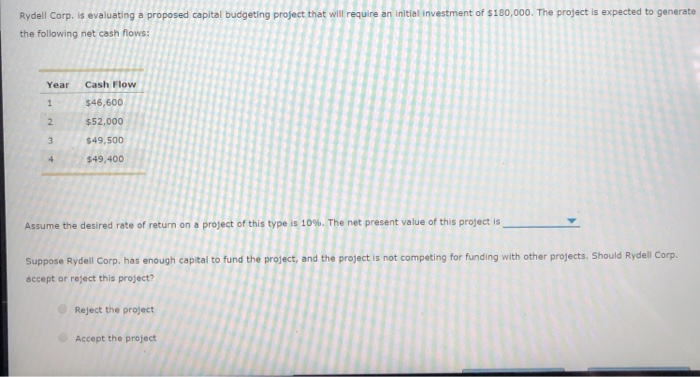

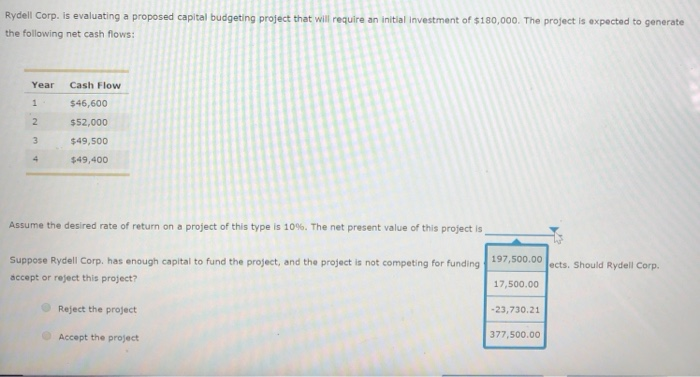

Capital budgeting decisions are among the most important decisions that financial managers make. Indicate whether each of the folowing statements regarding capital budgeting is true or false Statements Capital budgeting is the long-term planning for the purchase of assets whose cash flows extend beyond one year Ideas for capital investment should come from the engineering and sales departments rather than from the finance department A post-audit is sometimes overlooked and dismissed as being of little value. An incentive program that encourages new ideas, whether for new products or better processes, is a good way to generate capital investment proposals True Fa Capital projects are either mutually exclusive or independent. Which of the following phrases correctly describe mutually exclusive projects? Ched that apply Those projects that, if accepted, preclude the acceptance of all other competing projects By definition, they are not also independent projects Projects that, whether accepted or rejected, do not affect the cash flows of other projects Project choices that rule out competing project choices Those projects that, if rejected, preclude the acceptance of all other competing projects Capital budgeting involves evaluating the value of long-term assets or projects. Which of the following should be included in the capital budgeting process? Check all that apply. O Consider expansion projects over replacement projects. compute depreciation using different methods to include in the analysis. Compute the accounting rate of return. Compare the present value of the cash flows to the initial investment or cost required to acquire the asset. Perform a post-audit after the asset is in place or the project is finished Rydell Corp. is evaluating a proposed capital budgeting project that will require an initial investment of $180,000. The project is expected to generate the following net cash flows: Year Cash Flow 1$46,600 2 3 4 $49,400 $52,000 $49,500 Assume the desired rate of return on a project of this type is 10%. The net present value of this project i Suppose Rydell Corp, has enough capital to fund the project, and the project is not competing for funding with other projects, Should Rydell Corp. accept or reject this project? Reject the project Accept the project Rydell Corp,. is evaluating a proposed capital budgeting project that will require an initial Investment of $180,000. The project is expected to generate the following net cash flows: Year Cash Flow 1 $46,600 $52,000 3 $49,500 $49,400 Assume the desired rate of return on project of this type is 10%. The net present value of this project is Suppose Rydell Corp, has enough capital to fund the project, and the project is not competing for funding accept or reject this project? Reject the project Accept the project 197,500.00 ects. Should Rydell Corp 17,500.00 23,730.21 377,500.00