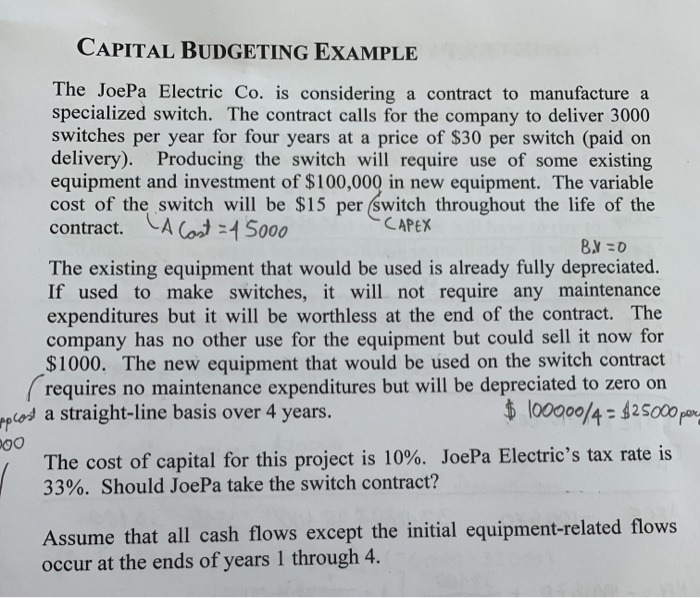

CAPITAL BUDGETING EXAMPLE itches per yoducing the $100,000 in nn throughou The JoePa Electric Co. is considering a contract to manufacture a specialized switch. The contract calls for the company to deliver 3000 switches per year for four years at a price of $30 per switch (paid on delivery). Producing the switch will require use of some existing equipment and investment of $100,000 in new equipment. The variable cost of the switch will be $15 per (switch throughout the life of the contract. CA Cost = 45000 -CAPEX Brzo The existing equipment that would be used is already fully depreciated. If used to make switches, it will not require any maintenance expenditures but it will be worthless at the end of the contract. The company has no other use for the equipment but could sell it now for $1000. The new equipment that would be used on the switch contract requires no maintenance expenditures but will be depreciated to zero on los a straight-line basis over 4 years. $ 100000/4 - $25000 per moo The cost of capital for this project is 10%. JoePa Electric's tax rate is 33%. Should JoePa take the switch contract? Assume that all cash flows except the initial equipment-related flows occur at the ends of years 1 through 4. CAPITAL BUDGETING EXAMPLE itches per yoducing the $100,000 in nn throughou The JoePa Electric Co. is considering a contract to manufacture a specialized switch. The contract calls for the company to deliver 3000 switches per year for four years at a price of $30 per switch (paid on delivery). Producing the switch will require use of some existing equipment and investment of $100,000 in new equipment. The variable cost of the switch will be $15 per (switch throughout the life of the contract. CA Cost = 45000 -CAPEX Brzo The existing equipment that would be used is already fully depreciated. If used to make switches, it will not require any maintenance expenditures but it will be worthless at the end of the contract. The company has no other use for the equipment but could sell it now for $1000. The new equipment that would be used on the switch contract requires no maintenance expenditures but will be depreciated to zero on los a straight-line basis over 4 years. $ 100000/4 - $25000 per moo The cost of capital for this project is 10%. JoePa Electric's tax rate is 33%. Should JoePa take the switch contract? Assume that all cash flows except the initial equipment-related flows occur at the ends of years 1 through 4