Answered step by step

Verified Expert Solution

Question

1 Approved Answer

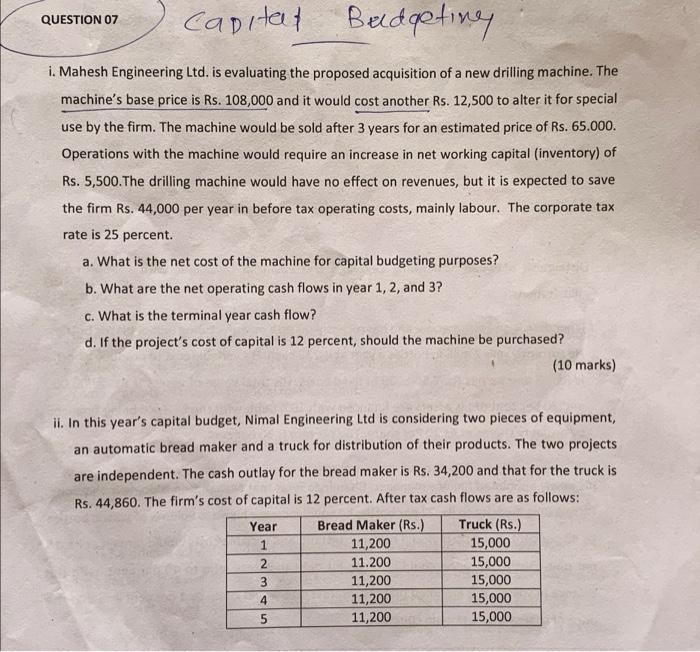

Capital Budgeting i. Mahesh Engineering Ltd. is evaluating the proposed acquisition of a new drilling machine. The machine's base price is Rs. 108,000 and it

Capital Budgeting i. Mahesh Engineering Ltd. is evaluating the proposed acquisition of a new drilling machine. The machine's base price is Rs. 108,000 and it would cost another Rs. 12,500 to alter it for special use by the firm. The machine would be sold after 3 years for an estimated price of Rs. 65.000. Operations with the machine would require an increase in net working capital (inventory) of Rs. 5,500. The drilling machine would have no effect on revenues, but it is expected to save the firm Rs. 44,000 per year in before tax operating costs, mainly labour. The corporate tax rate is 25 percent. a. What is the net cost of the machine for capital budgeting purposes? b. What are the net operating cash flows in year 1, 2, and 3? c. What is the terminal year cash flow? d. If the project's cost of capital is 12 percent, should the machine be purchased? QUESTION 07 ii. In this year's capital budget, Nimal Engineering Ltd is considering two pieces of equipment, an automatic bread maker and a truck for distribution of their products. The two projects are independent. The cash outlay for the bread maker is Rs. 34,200 and that for the truck is Rs. 44,860. The firm's cost of capital is 12 percent. After tax cash flows are as follows: Bread Maker (Rs.) Truck (Rs.) 11,200 15,000 11.200 15,000 11,200 15,000 11,200 15,000 11,200 15,000 Year 1 2 23 3 (10 marks) 4 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started